The Dolphins have become the first NRL team to adopt a medical cannabis company as a sponsor, with the expansion club to sport Alternaleaf branding on the front of their jersey this season.

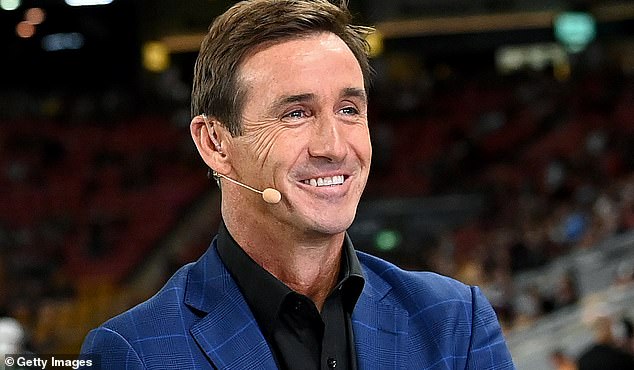

And it comes after NRL immortal Andrew Johns previously called on the federal government to fund research into the use of medicinal cannabis to treat concussions and head trauma in sport.

Dolphins coach Wayne Bennett has long supported the NRL’s illicit drugs policy and the sport’s current anti-doping and drug use approach, making the partnership seem unusual on the surface.

But the sponsorship deal is not a green light for players to start using marijuana recreationally.

NRL expansion club The Dolphins will become the league’s first team to be sponsored by a medical cannabis company.

The legalized marijuana industry has been growing steadily in Australia, with athletes turning to non-mind-altering CBD products to treat a variety of symptoms (file image)

Medical marijuana focuses primarily on the use of cannabidiol-containing products, which are non-smokable, do not produce a high, and provide a variety of health benefits to athletes, including a potential treatment for concussion symptoms.

These products do not contain tetrahydrocannabinol, which is the active ingredient in cannabis strains that get the consumer high.

The effects of blows to the head on past and current players, including the onset of the deadly brain disease chronic traumatic encephalopathy, are a huge problem for code and other contact sports around the world.

The World Anti-Doping Agency (WADA) removed CBD from its list of prohibited substances in 2017 and the Australian Sports Anti-Doping Authority (ASADA) followed suit.

CBD contains plant compounds called cannabinoids capable of interacting with the human endocannabinoid system (ECS) and providing benefits including appetite control, pain response, sleep patterns, and response to inflammation.

Dolphins coach Wayne Bennett has actively spoken out against recreational and performance-enhancing drugs in the past.

THC, the active ingredient in recreational marijuana, is still prohibited and all CBD products must contain no more than 0.02 percent so that users do not experience mind-altering effects.

Athletes can consume prescription cannabis with a higher THC reading, but would need an exemption from WADA and ASADA.

Some famous athletes who have used CBD during their career include heavyweight champion Mike Tyson, UFC fighter Nate Diaz, NBA star Klay Thompson, and American soccer star Megan Rapinoe.

NRL superstar Johns also turned to the product after suffering epileptic episodes while retired. Since Levin Health referred him to CBD, he has not had any seizures since.

“It’s been life-changing,” Johns said in 2023.

“I haven’t felt this kind of clarity, nor has my body felt this good in many years. I am seizure free.

‘I still take traditional medicine, but I also take CBD oil, which I spoke to my professor about and he was totally on board.

Andrew Johns has not suffered seizures from blows to the head since he began using medical marijuana.

AFL coach Damien Hardwick suffers pain from his playing days and uses medicinal cannabis to treat inflammation.

Wallaby Drew Mitchell developed anxiety during his retirement and has been using medicinal cannabis to get his life back.

Johns sits on Levin Health’s advisory board, alongside other sporting greats including basketball player Lauren Jackson, AFL coaches Alastair Clarkson and Damien Hardwick, jockey Damien Oliver and hockey champion Jenn Morris.

The company filed a presentation with the federal Senate calling for exploring the use of cannabinoids as a treatment option for concussion in sports.

Several other prominent names in the sport have also been associated with the use of CBD.

Former three-time premiership-winning Richmond coach Hardwick uses medicinal cannabis to manage pain from his football career, while former Wallaby Drew Mitchell uses it to treat anxiety.

Dolphins chief executive Terry Reader said Alternaleaf was a good fit for the NRL’s newest brand.

“We are very happy to partner with a company like Alternaleaf that has a strong commitment to health and well-being,” he said.

“We welcome Alternaleaf to the Dolphins sponsorship family and look forward to working with them to help them continue to grow their brand across the Australian healthcare landscape.”