Despite the economic problems that many European countries continue to face, some companies based across Europe are thriving like never before.

It is one of the main reasons why the European small business investment fund is supported by quite good performance figures.

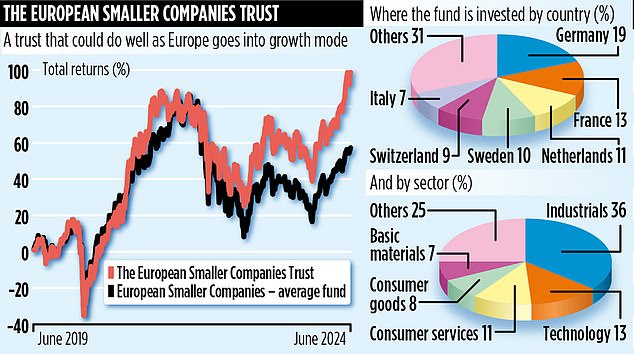

Over the past year, it has posted overall returns of just over 23 percent, while over the past five years it has posted a 95 percent gain. Trusts with a similar investment mandate have lagged somewhat behind.

Along with two colleagues from investment house Janus Henderson, Ollie Beckett runs the £739m trust which is listed on the London Stock Exchange.

He says: ‘There is a lot of political noise going around in Western Europe following the European Union elections and President Macron’s decision to hold early elections in France. And yes, economic growth is desperately needed.

‘But the truth is that there are many European companies that are doing good work on the world stage. They are selling their products in the United States, China and India, and because of this they are doing well. These are the companies we like: companies more dependent on global markets than European ones.’

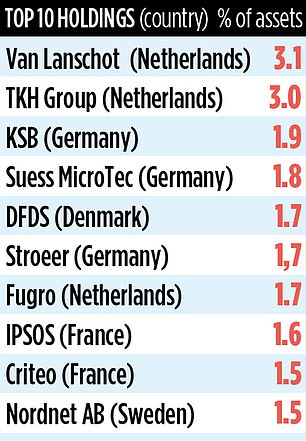

A quick look at the trust’s largest holdings confirms this approach. For example, German pump manufacturer KSB sells a wide range of industrial pumps in China and India, while Suss MicroTec (also German) supplies components to giants such as TSMC and Samsung.

“The German economy may look like a disaster right now,” says Beckett, “but these companies are enjoying huge growth in sales abroad.”

The trust has a diverse portfolio of 131 holdings. The largest position (3.1 percent of the trust’s assets) is in the Dutch private banking group Van Lanschot Kempen.

“As a general rule, we don’t invest more than five percent of the fund’s assets in any stock,” Beckett says. ‘In the smaller company space, diversity pays off, not high-conviction investing. As an investment manager, you will be wrong about about 44 percent of your stock picks.

‘Then investors are made money from the remaining 56 percent. The key is to gain confidence in these winners, build positions and trade them. This way you will make profits for your shareholders.’

To demonstrate this, “winners” such as Van Lanschot, KSB and Suss MicroTec (the top ten holding companies) have been in the portfolio for nine, 13 and 12 years respectively.

By contrast, the trust dumped several companies last year, including Swedish media company Viaplay and Swiss manufacturer Meyer Burger, as Beckett said they turned out to be “the wrong” investments. Recent purchases include a stake in Swedish printed circuit board maker NCAB.

Beckett says his focus is always on buying undervalued companies. ‘We are constantly looking for companies whose share price does not reflect their true value. This may be because a company has underperformed due to poor management or because the market does not appreciate the value of the business.’ Beckett says the diversity of stock markets and companies in Europe offers opportunities to discover gems. “These are markets for stock pickers,” he adds.

The trust has ongoing annual charges of 0.65 per cent. Its market symbol is ESCT and its stock identification code is BMCF868. Investment trusts with a similar mandate are European Assets, JPMorgan European Discovery and Montanaro European Smaller Companies.

- Beckett runs the fund along with Rory Stokes and Julia Scheufler.