Table of Contents

The owner of Sports Direct has bought luxury goods websites from THG.

The deal is part of a broader alliance that brings together two of the biggest names in retail.

Frasers Group, where Sports Direct founder Mike Ashley is the largest shareholder with 73 per cent, acquired Coggles, AllSole and Mybag from online platform THG, where founder and chief executive Matt Molding has a 23 per cent stake. hundred.

Coggles sells high-end fashion, including Ralph Lauren and Coach, while AllSole and Mybag specialize in designer shoes and bags, respectively.

A wider partnership also means THG’s protein powders will be sold in Sports Direct stores and Frasers will use THG’s technology in certain parts of its business.

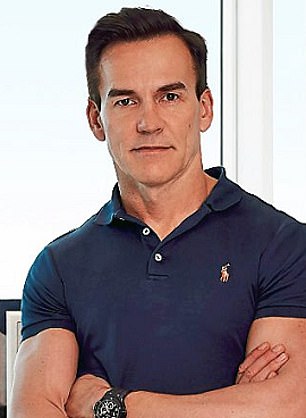

Union: Frasers, where Mike Ashley (left) is the main shareholder, acquired Coggles, AllSole and Mybag from THG, where founder Matt Molding (right) has a 23% stake.

There has even been speculation that this could pave the way for Ashley to buy a stake in THG, formerly known as The Hut Group, in the future.

Frasers chief executive Michael Murray, Ashley’s son-in-law, said it was “just the start of an exciting partnership”. Molding called Frasers Group a “force in luxury fashion”.

Ashley and Molding are two of the country’s best-known retail magnates and are no strangers to controversy.

Ashley, 59, a ruthless procurement specialist, is known for his clashes in the city and once held a management meeting in a pub where he drank 12 pints and vomited into a fireplace.

Moulding, 52, is prone to taking to social media to launch various broadsides against journalists, hedge fund managers and the London stock market.

The businessman has accused “small groups” of coming together to “try to damage UK companies and their share prices”.

THG’s value has fallen 92 percent since its IPO in 2021, although shares rose 1.5 percent yesterday. Frasers shares gained 39 per cent and have more than tripled in the last five years.

Dan Coatsworth, investment analyst at AJ Bell, said: “Moulding and Ashley may seem like great rivals as they are both people with big personalities and even bigger ideas.

‘But the collaboration between two of retail’s most notable figures is a sign of the times. Cooperation is the name of the game.”

He said it was “surprising” that Frasers had not taken a stake in THG yet, before adding: “Maybe it’s just a matter of time.”

- THG Chairman Charles Allen was re-elected with 90 percent shareholder support despite opposition from investor Kelso Group.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

eToro

eToro

Stock Investment: Community of over 30 million

Trade 212

Trade 212

Free stock trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you