NASA and the European Space Agency are rushing to land on the Moon’s hitherto unexplored southern hemisphere in search of water.

In the modern space race, finding water on the Moon could reduce space mission costs by providing hydration, oxygen and much-needed rocket fuel.

NASA hopes to build a permanent, sustainable presence at the Moon’s south pole, with the Lunar Gateway space station serving as a launch pad between Earth and the Moon.

NASA plans to launch a space mission later this year and plans to land in the south polar region of the Moon by 2026.

The European Space Agency intends to launch its Airline 6 rocket to the Moon in mid-2024.

Russia, China, India and Japan also plan to send astronauts to the southern region of the Moon in 2026.

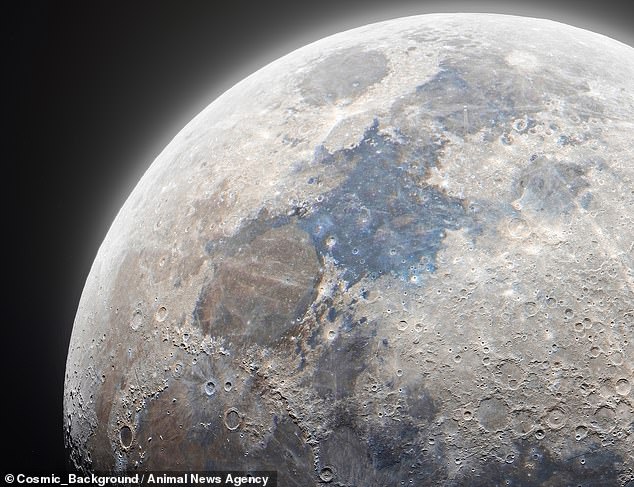

Astronomers believe the southern region of the Moon could contain billions of gallons of water.

It will take about a week for Odysseus to reach the lunar surface after it detaches from the Falcon 9 rocket.

When astronauts landed on the moon in 1969 in their quest to defeat the Soviet Union during the Cold War, there was nothing to indicate that the moon contained billions of gallons of water.

But in 2009, NASA made the surprising discovery that water could be present on the Moon after it intentionally crashed a rocket into one of the Moon’s craters, releasing a plume of material called hydroxyl, which is an important indicator of the presence of water. .

Astronomers missed the telltale signs of water because crews have historically landed at the Moon’s equator, where daytime temperatures reach 120 degrees Celsius (248 degrees Fahrenheit).

But temperatures at the north and south poles drop to -230 degrees Celsius (-382 degrees Fahrenheit), which is low enough for water molecules to accumulate as ice over billions of years.

The possibility of water on the lunar surface could prove incredibly beneficial to long-term plans to build a human presence on the Moon.

NASA hopes to eventually increase human presence on the Moon and will send astronauts to the Lunar Gateway space station (Lunar Gateway image)

NASA intends to eventually build the Lunar Gateway space station that can serve as a launch pad for astronauts to travel to and from Earth.

If there is water on the Moon, it could provide astronauts with valuable resources, such as providing oxygen by splitting H2O molecules, which can also be used as rocket fuel.

The water could also provide astronauts with much-needed hydration, effectively reducing the cost of lunar exploration: it currently costs $1.2 million to transport a liter of water from Earth to the Moon.

If NASA manages to send astronauts to the Moon’s south pole this year, the United States will again surpass other countries, including Japan and India, which plan to launch a joint mission in 2026.

China reportedly plans to land on the southern region of the Moon the same year and intends to build a research station on its surface by 2030.

NASA will launch the Odysseus lunar lander on a SpaceX Falcon 9 rocket on Wednesday after its Peregrine launch failed last month.

All of these plans add to NASA’s planning for the second launch of its lunar lander, dubbed Odysseus, on a SpaceX Falcon 9 rocket just a month after the failed launch.

If the second attempt is successful, it will be the first time a US rocket has landed on the Moon in more than five decades.

The Falcon 9 rocket will reach a 380,000 km (236,100 mile) orbit around Earth, and once in orbit, Odysseus will detach from the rocket and begin its journey toward the southern lunar surface.

NASA expects Odysseus to travel through space for a week, with a projected landing for February 22.

On January 8, an attempt to launch Peregrine failed after a fuel leak occurred just hours after launch and it burned up in the atmosphere 10 days later while descending toward Earth.

Stephen Altemus, CEO of Intuitive Machines, which built the lunar lander, believes there is about an 80 percent chance the company will successfully land Odysseus on the moon.

“We have stood on the shoulders of everyone who has tried this before us,” Altemus told CNN, adding that this is not just a one-time mission.

“It’s not a one-time operation at all,” Altemus told the outlet. “We have created a lunar program with the goal of regularly flying to the Moon.”