Auto insurers are paying out fewer bodily injury claims, which make up the largest portion of premium costs, so why have auto coverage costs skyrocketed?

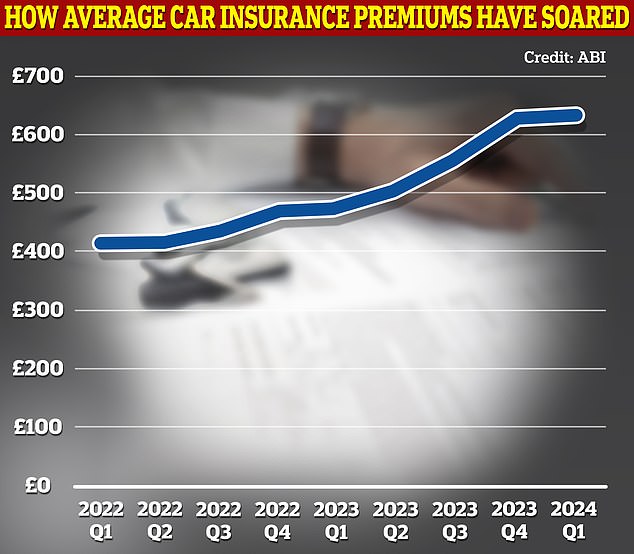

The average driver now pays record car insurance premiums of £635 a year, up 53 per cent from £416 in the same period in 2022.

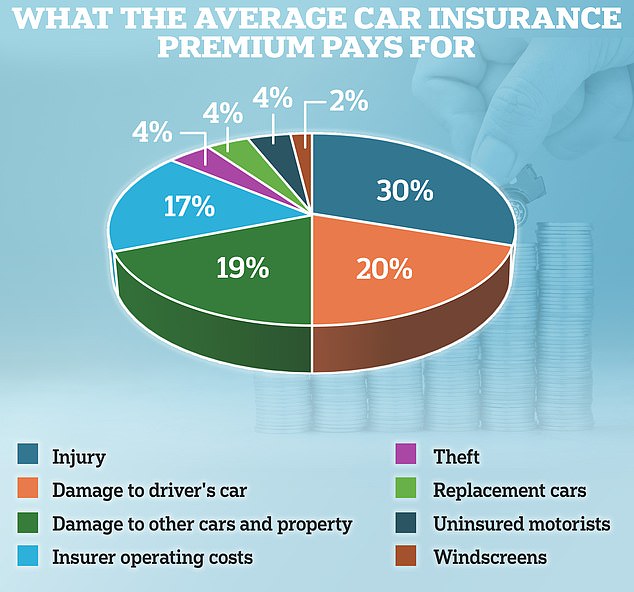

The largest component of car insurance premium costs is the payment of bodily injury claims, according to trade body the Association of British Insurers (ABI).

These represent 30 percent of the typical driver’s premium.

On the rise: Most drivers will have noticed the huge increase in coverage costs in recent years

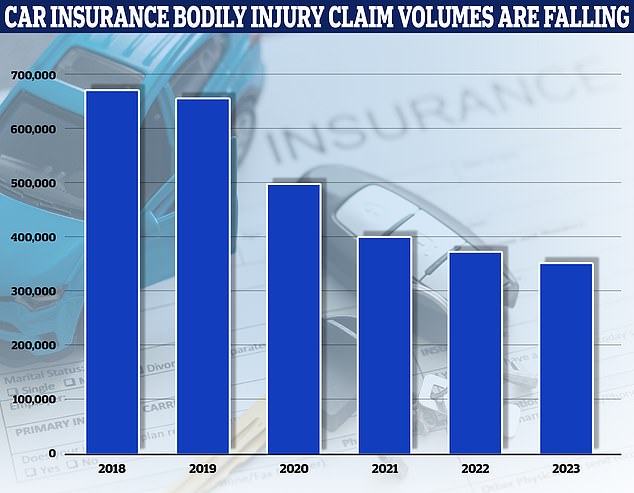

But the number of personal injury claims has fallen rapidly, according to analysis of Compensation Recovery Unit (CRU) figures by the Association of Consumer Support Organisations (ACSO).

These applications have decreased from 667,377 a year in 2018 to 352,230 now, a drop of 47 percent.

These CRU figures are useful because they show the number of car accident cases for which insurers are liable once a bodily injury claim is settled – at least, for those serious enough to require NHS treatment or government benefits.

The CRU is a government department that recovers taxpayers’ money that car accident victims receive in the form of NHS benefits or costs.

The CRU takes this money from the at-fault driver’s insurers and orders them to pay it to the Department for Work and Pensions.

ACSO chief executive Matthew Maxwell Scott said the figures contradicted claims by insurers that rising insurance premiums were due to rising claims costs.

Turning around: The number of personal injury claims has been declining

Scott said: “Insurers have blamed claims inflation squarely, but the number of claims has fallen by more than a quarter since the advent of the Public Liability Act, which insurers lobbied hard for, and continues to fall year on year.”

Car insurance premiums have had to rise to cope with the cost of repairs, vehicle replacement and theft, as well as other costs linked to inflation, according to trade body the Association of British Insurers (ABI).

Mark Shepherd, director of general insurance policies at ABI, said: ‘The largest element of what a car insurance premium fund covers is the cost of compensating injuries to other drivers, passengers or pedestrians.

‘This is because serious collisions can lead to life-changing injuries, with compensation awards sometimes reaching tens of millions of pounds.

‘While the number of injury claims resulting from road traffic collisions may have reduced, the overall average cost of a bodily injury claim has risen significantly in recent years, and an increasing number of whiplash claims now come with additional physical injuries that attract higher damage awards.’

The amount of money that car accident victims receive hasn’t changed much in the past three years.

The typical whiplash claimant received £746 in Q2 2024 with a solicitor involved, compared with £723 in Q2 2023 and £671 in Q2 2022, according to the official injury claims portal.

For those with “mixed injuries” (whiplash and other injuries), these figures are £1,000, £932 and £896.

But what has changed is the frequency of complaints.

In the second quarter of 2022, 34,947 claims were settled through the portal, a figure that increased to 148,767 in the second quarter of 2023 and 296,288 in the second quarter of 2024.

Shepherd added: “A number of other factors have also been driving up claims costs, such as above-inflation increases in the cost of repairs, theft and replacement cars.”

A recent report by accountancy firm EY found that car insurers are losing money on underwriting, paying out £1.12 in claims for every £1 they received in premiums in 2023, up from £1.11 for every £1 in 2022.

However, this does not take into account investment returns, which can represent a significant portion of the money insurers collect.

For example, the UK’s largest car insurer, Admiral, made a pre-tax profit of £597m in 2023, of which £111.8m came from investment returns.

Insurance experts say part of the problem with high auto insurance premiums is a lack of competition.

Although on paper there are almost 200 car insurance brands in the UK, in practice the top 10 control 70 per cent of the market through a series of sub-brands.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.