Table of Contents

Balancing the books: Chancellor Rachel Reeves says she will take ‘tough decisions’ to restore economic stability

Britain is increasingly indebted to foreign governments who hold a much larger share of national debt than previously thought, The Mail on Sunday can reveal.

The news is a blow to Rachel Reeves as she prepares for next month’s Budget, which is expected to raise taxes on the wealthy to balance the books.

The Chancellor has vowed to take “tough decisions to restore economic stability” after claiming a “disastrous” legacy from her predecessor Jeremy Hunt.

But experts fear that Britain’s growing reliance on foreign powers, some of which may be hostile, to fund its growth around the world means the economy is even more vulnerable to future crises.

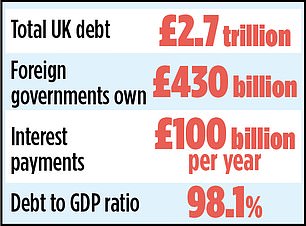

It has also emerged that the Office for Budget Responsibility (OBR) – the independent body tasked with scrutinising Reeves’ plans – miscalculated how much of Britain’s £2.7 trillion debt was held by foreign governments. Foreign investors own 28% of the UK’s national debt – almost double the share two decades ago – and the bulk was thought to be held by private investors.

But OBR chairman Richard Hughes has revealed that foreign governments own more than half of that debt, some £430bn. In a report to the House of Lords Economic Affairs Committee published last week, Hughes said these investors own 16% of all government debt, not the 2.9% previously thought.

The OBR discovered who really owned the debt when it contacted the International Monetary Fund.

The IMF said it had recently been told that the figures provided by the Bank of England only reflected the central bank’s government bondholders. Hence the huge error.

Hughes warned that “fickle and fickle” foreign buyers of UK government debt lacked “domestic bias”, were susceptible “to geopolitical considerations in their portfolios” and posed a “growing risk to the stability of the government bond market”. Government bonds are government IOUs issued to UK pension funds, insurers and foreign investors to fund spending on public services such as schools and hospitals.

In recent years, public debt has soared to almost equal the size of the economy’s annual output (or gross domestic product), as the Treasury borrowed billions of dollars to pay for lockdowns and the cost of living crisis. Runaway inflation also pushed up interest paid to holders of government debt to more than £100bn a year – a sum similar to that spent on education.

Asked whether foreign financing of UK debt was really a problem, independent economist Julian Jessop said: “I think so: it’s relatively easy for foreigners to decide not to invest in the UK.”

Mohamed El-Erian, chief economic adviser at insurer Allianz, told peers that foreign debt holders were like tourists.

“As soon as something goes wrong, they head to the airport and leave,” he said. “That’s what usually happens during crises.”

The OBR has warned that an ageing population and rising spending on defence and tackling climate change could push the UK’s debt-to-GDP ratio from its current level of 99 per cent to 274 per cent over the next 50 years.

Hughes said taxes would need to be raised or public spending cuts would be needed “to keep public finances at a sustainable level.”

The report was published as the Labour government warned of painful options to tackle a hotly contested £22bn-a-year “black hole” in the country’s finances.

Analysts expect interest rates to remain at 5 percent when the Bank of England’s Monetary Policy Committee meets this week, although two quarter-point cuts are planned for later this year.

The Bank is also expected to announce plans to sell another £100bn of government bonds it bought after the 2008 financial crisis to shore up the economy.

Investor appetite for government debt is strong, with demand far outstripping supply at a recent government bond auction.

The decision on how quickly to sell government bonds has big implications for the government, as the bank is losing billions on the trades, losses that are covered by the Treasury.

The magnitude of the losses in the coming years will affect the room for manoeuvre that Reeves will have to meet his goal of reducing the debt-to-GDP ratio.

The OBR and Treasury have been contacted for comment.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.