<!–

<!–

<!– <!–

<!–

<!–

<!–

Apple killed off its ‘Apple Car’ last month after years of broken promises and while the world has never seen an actual photo, new details reveal what could have been.

The features were shared by a trusted industry expert who suggested the vehicle would have been a futuristic-looking minibus with a “private jet” interior.

Mark Gurman, an Apple insider, mentioned that the truck-like car would feature an all-white exterior, self-driving capabilities, and a giant screen inside for FaceTime calls, watching videos, and scrolling through apps, much like the iPhone.

Experts had predicted the world could see the Apple Car in 2028, but then ruled it out after an internal memo circulated among about 2,000 company employees in February.

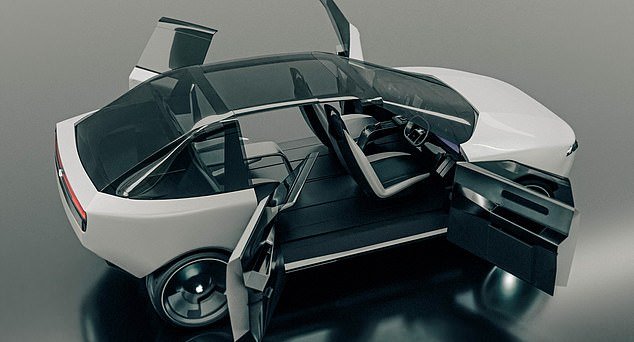

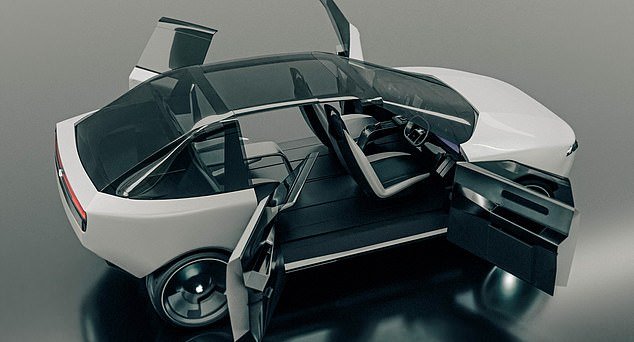

Apple’s car would have reportedly looked like a futuristic van, similar to a Canoo Lifestyle Vehicle (pictured)

The new version of the vehicle reportedly had gullwing doors like those on a Tesla Model

A version of the Apple Car had a function similar to that of the iPad

Apple had never officially confirmed when consumers could expect the vehicle to launch, but announced it was abandoning the long-awaited project after a decade in the works.

The company began designing the Apple Car in 2014 as part of its so-called Project Titan amid reports that Apple had its sights set on building electric vehicles since 2013.

While the world has yet to see an actual image of the tech giant’s car, and may never get one, Gurman gave his thoughts on what features it would have had.

Alongside the vehicle’s white interior are whitewall tires with a black center and it appeared to have the same front and rear, looking like something out of a futuristic dystopian movie.

According to Gurman, author of Light In the newsletter, the appearance of the Apple Car has changed several times but was reportedly always intended to have a minimalist look.

The interior would be designed like a limousine or private jet, making passengers feel as if they were in a “contoured bubble” that could comfortably fit four people.

And the seats would have had footrests and reclining options.

While Gurman was sure the vehicle would have a central screen, he went back and forth between one that was the size of a television or an iPad.

Apple’s car went through several versions, including one that resembles a 1950s Volkswagen. Pictured, a Canoo electric vehicle.

Apple was said to have developed a unique air conditioning system that pushed air along the sides of the cabin, similar to that in airplanes.

Gurman reported that other versions of the Apple Car included one that looked like a 1950s Volkswagen microbus and another that looked almost identical to the 2017 Volkswagen ID Buzz prototype.

The last design Apple created was a variation on the minibus idea, adding wing-shaped doors similar to the Tesla Model X instead of sliding van doors.

It also reportedly went from a Level 5 vehicle (meaning it was fully autonomous) to a Level 2 vehicle, which required Apple to add a steering wheel, pedals, and a front and rear window.

For years, Apple CEO Tim Cook has been hesitant to confirm that the company was working on the Apple Car, despite reports that it had hired a team of automotive specialists in 2014 and 2015.

‘There are products we are working on that no one knows about; That hasn’t been rumored yet,” Cook told The Wall Street Journal at the time.

People familiar with the matter had told the outlet that Cook approved Project Titan a year earlier and that then-vice president of product design, Steve Zadesky, was assigned to lead the group.

The Journal reported that Apple is known to create numerous prototypes for products it will never sell, but said the size of the project team and the number of high-level people involved showed that the company was serious about the vehicle.

About 2,000 employees were working on the car when Apple decided to cancel the project, reassigning many to its generative AI team, sending some to other internal divisions or laying off staff.