A New York City couple bought their $2 million dream home to retire with their disabled son, only to find a “nightmare” squatter who refuses to leave.

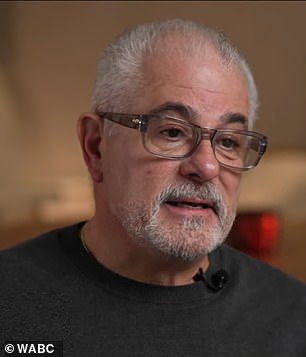

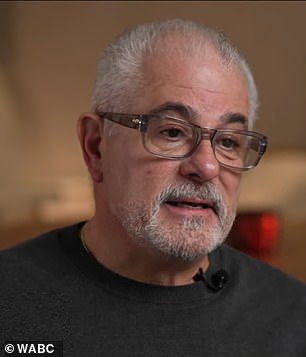

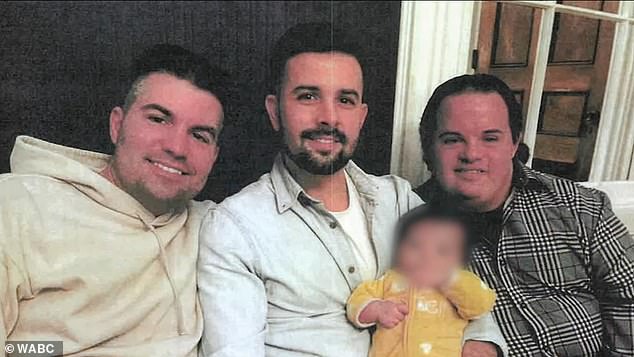

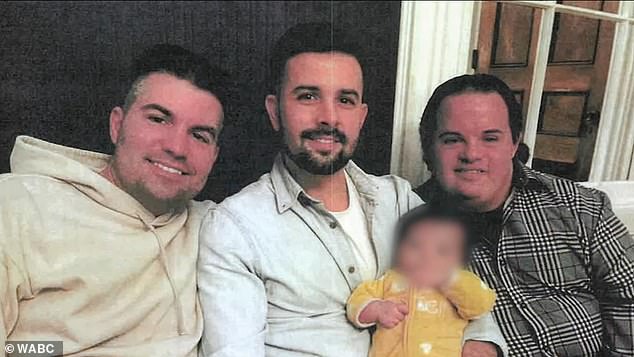

Susana and Joseph Landa, both 68, bought the perfect mansion in Douglaston, Queens, where they planned to enjoy their retirement and care for their son Alex, who has Down syndrome.

The multimillion-dollar property is located next door to family members and in a neighborhood where the Landa family has spent their entire lives.

“I just want to know that I can die tomorrow and he is next to his brother,” Susana said of her disabled son.

Susana and Joseph’s dreams were crushed when, after purchasing the house in October, they discovered that the house had been claimed by a squatter, identified as Brett Flores.

A New York City couple bought their $2 million dream home in Queens to retire with their disabled son, only to find a ‘nightmare’ squatter who refuses to leave.

Susana and Joseph Landa, both 68 years old, bought the perfect mansion in Douglaston, Queens, where they planned to enjoy their retirement

“I just want to know that I can die tomorrow and that he is by his brother’s side,” said Susana, a mother of three, about her disabled son Alex.

“It has become a nightmare, a total nightmare,” said Joseph Landa ABC7.

Four months after making the big purchase, the Landa family still can’t move into their dream home as they continue to face obstacles trying to expel the intruder.

‘I wake up and go to sleep thinking about the same thing, when is this guy going to come out?’ said Susana, mother of three children.

Flores claims he has every right to be on the property after being hired as a “caretaker” for the previous owner.

Flores described in his own words in court documents why he “deserved” to live on the property.

‘We couldn’t believe it, we couldn’t believe it,’ said Susana.

Court documents show that Flores, 32, was indeed hired by the former owner, who was an older man.

The man died in January 2023, but Flores claimed that he has a ‘license’ to stay in the deceased former owner’s house.

As a ‘caretaker’, Flores was paid $3,000 per week to care for the previous owner.

The squatter has been identified as Brett Flores, who claims that he has all the

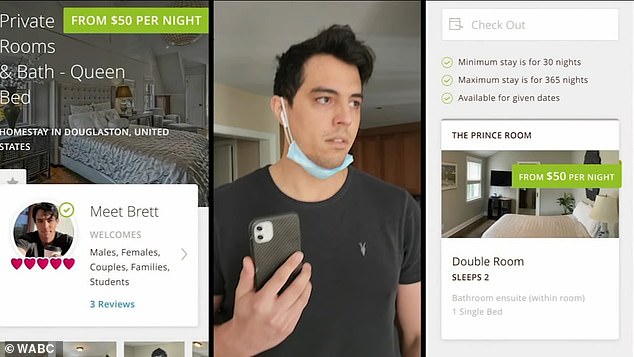

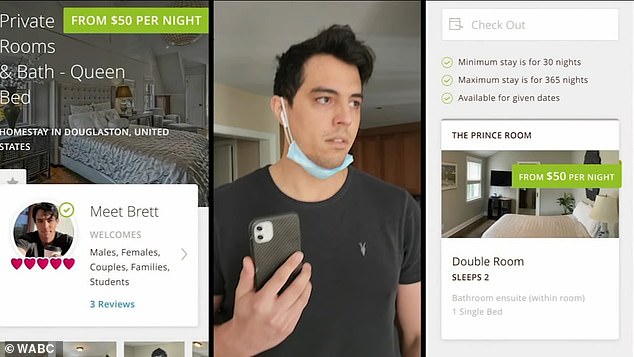

Not only has Flores taken over the Landas’ future family home, but they claim the squatter has also advertised the house online to rent the rooms to other people.

The owners attempted to enter the property along with an insurance inspector and Flores called the police.

Unfortunately for the Landa family, squatters who have set up camp on a property for more than 30 days have rights in New York City.

After 30 days of continuous occupancy, squatters can file adverse possession claims.

‘If you don’t have a lease and don’t pay rent, how are you right?’ said the indignant owner Joseph.

Not only has Flores taken over the Landas’ future family home, but they claim the squatter has also advertised the house online to rent rooms to other people.

In online listings, Flores advertised ‘The Prince Room’ for $50 a night for men, women, couples, families or students looking for a place to stay.

His rental services had even garnered three reviews, suggesting that Flores may have hosted paying tenants at Landa’s home.

The Landas are taking Flores to landlord-tenant court to try to evict him, but the coThe urgent hearing is not until April.

“Simply put, it’s still there,” Susana said.

The owners attempted to enter the property along with an insurance inspector and Flores called the police.

The family has already had five hearings in civil court and complains that the process continues to be delayed.

Flores appeared in court without an attorney and filed for bankruptcy on January 9, 2024, preventing any legal proceedings from moving forward.

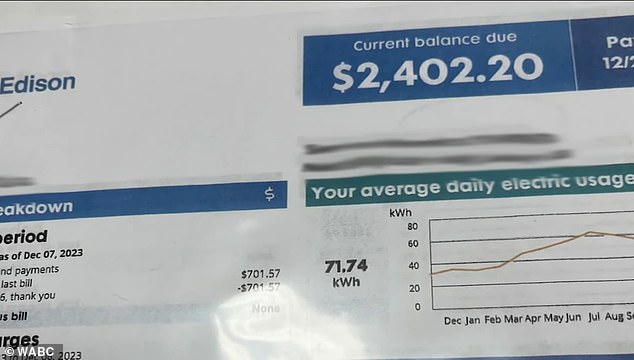

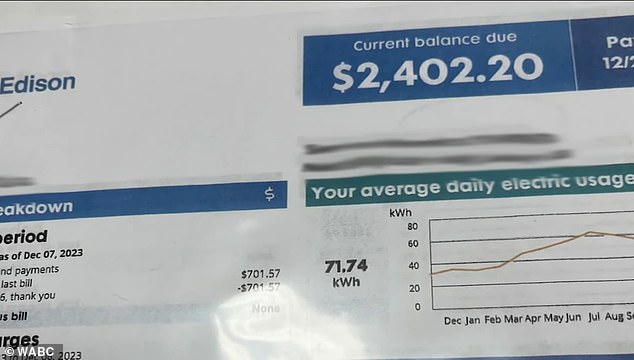

While Flores lives rent-free in their dream home, they pay all the bills to keep the house running.

Flores has racked up thousands of dollars in utilities while living at the Queens property, which Joseph and Susana have had to pay.

While Flores lives rent-free in their dream home, they pay all the bills to keep the house running.

Flores has accumulated thousands of dollars in utilities, which Joseph and Susana have had to pay.

Susana said Flores has been “leaving the windows open 24 hours a day” while they pay their heating bills.

“It’s crazy, our system is broken,” Susana said. “I never imagined that we have no rights, no rights, nothing, zero.”

“It makes me feel completely forgotten in this legal system, unfair and unable to do anything,” Joseph said.

Flores’ attorney told ABC7 “no comment.”