Sales of luxury homes in Los Angeles have been decimated by the so-called ‘mansion tax’ one year since it went into effect.

Launched on April 1, 2023, the policy imposed a four percent tax on all property sales between $5 million and $10 million, while funding homeless programs.

But a year later, the Measure ULA strategy has seen luxury home sales fall by 68 percent, while increasing just 22 percent of its stated goal.

Some 366 single-family homes were sold in the 12 months before April 1, 2023, compared to 166 sold in the year after, according to the Los Angeles Times.

Local property developer Hooman Ghaffari criticized the policy as “a sham” that “has not yet come close to meeting the stated goals” while making new developments “financially unviable”.

A stunning mansion inside a gated estate in the affluent Los Angeles suburb of Tarzana has dropped $2.9 million, from $17.9 million in July 2023 to its current price of $15 million, according to listings. .

Another stunning sun-drenched property, located in the coveted Encino neighborhood, was devalued by nearly $1 million from $12.9 million in July 2023 to just over $11.9 million today.

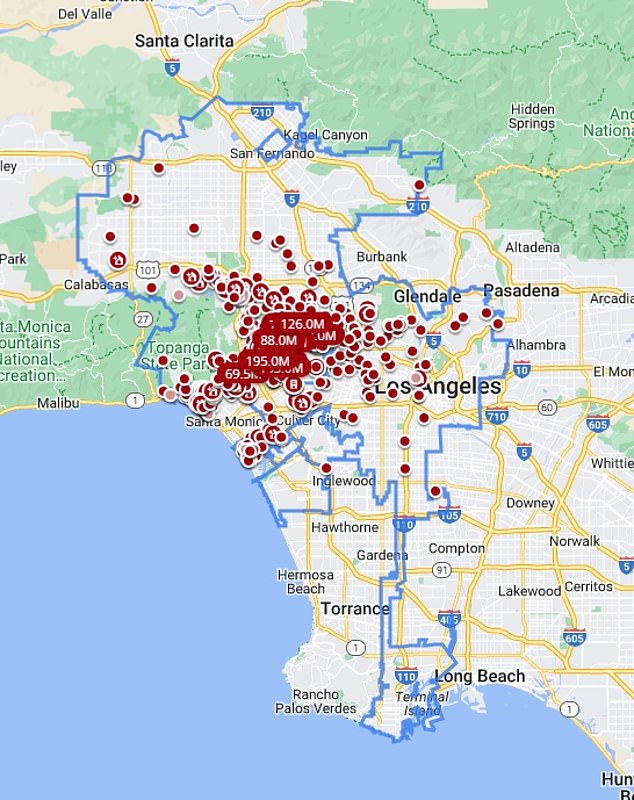

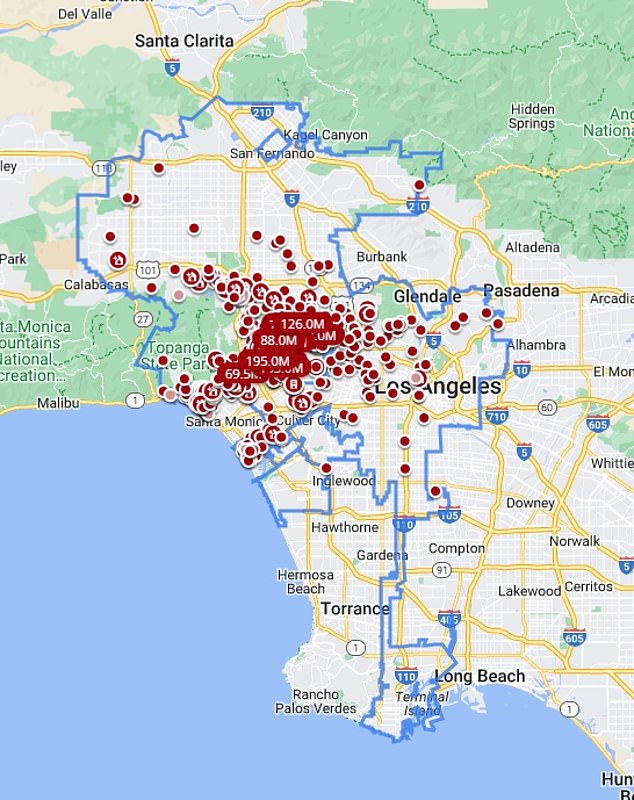

Pictured: Homes over $5 million are now more clustered outside the taxed metropolitan area.

The Los Angeles Department of Housing has generated $215 million from the tax over the past year, a disappointing sum compared to the $900 million it was projected to raise.

The city has defended the policy as something that will take time to gain traction, saying revenue from the tax snowballed toward the end of the first year.

In addition to the four percent tax on properties over $5 million, for mega-mansions that exceed the $10 million threshold, owners lose 5.5 percent of their sales price if they decide to take advantage of your assets.

A quick look at current Los Angeles home listings for properties in the ‘mansion tax’ danger zone: those listed for $5 million or more.

A stunning mansion inside a gated estate in the affluent Los Angeles suburb of Tarzana has dropped $2.9 million, from $17.9 million in July 2023 to its current price of $15 million, according to listings. .

Despite featuring a private entrance, marble fireplace, large heated pool, hot tub, outdoor pavilion, tennis court and wine cellar, it has been on the market for 270 days.

Stunning drone images of the 4.12-acre lot show that the pristine turret-roofed home is surrounded by pristine lawns and towering conifers that protect its privacy.

Its wood-paneled interior features six enormous bedrooms, seven bathrooms, and a bathtub with jets.

Real estate agents for a five-bedroom beachside property (pictured) in Pacific Palisades have reduced its price by $605,000, from $7.6 million in May 2023 to $6.995 million now.

The beautiful home features high ceilings, a large private pool, and stunning views of the ocean and surrounding hillside.

A Mediterranean-style mansion in Los Feliz valued at $7.25 million in November 2023 also plummeted to $6.89 million in March 2024.

Another stunning sun-drenched property, located in the coveted Encino neighborhood, was devalued by nearly $1 million from $12.9 million in July 2023 to just over $11.9 million today.

The six-bedroom, 11-bathroom property features floor-to-ceiling windows and a luxurious open-plan interior with surround sound speakers, and is surrounded by towering oak trees.

Meanwhile, real estate agents for a five-bedroom beachside property in Pacific Palisades have reduced its price by $605,000, from $7.6 million in May 2023 to $6.995 million now.

The beautiful home features high ceilings, a large private pool, and stunning views of the ocean and surrounding mountain slopes.

A Mediterranean-style mansion in Los Feliz valued at $7.25 million in November 2023 also plummeted to $6.89 million in March 2024.

Greg Good, senior policy and external affairs adviser to the Bureau’s Housing Department, defended the “mansion tax” by saying the gains would soon multiply.

He told the Los Angeles Times that the money he had raised had increased month over month, from an average of $15 million a month in the first quarter, to about $25 million a month between July 2023 and February 2024.

Good said about $28 million had been spent on aid for struggling renters and homeowners, and $56.8 million on loans to accelerate the development of affordable housing.

The policy was expected to raise between $600 million and $1.1 billion annually to fund a variety of affordable housing projects and support the city’s 40,000-person homeless community.

In March, a report from the City Administrative Office significantly reduced estimates to $672 million from July 2023 to June 2024.

“None of that happens without the ULA,” he told the Los Angeles Times.

When the plan was approved last year, Los Angeles Mayor Karen Bass touted it as the way forward to fund “real solutions that will help keep people in their homes and create more affordable housing.”

DailyMail.com has contacted the mayor’s office for comment on progress one year later.

Just before the policy was implemented, wealthy Los Angeles homeowners acted to avoid the new transfer tax by selling their homes en masse in March 2023.

House prices dropped sharply, and frightened sellers offered luxury cars and lucrative bonuses to anyone who could complete the purchase before the end of the month.

The policy also caused the increase of $4,999 million in housing