Table of Contents

The Bank of England cut interest rates yesterday for the first time in more than four years.

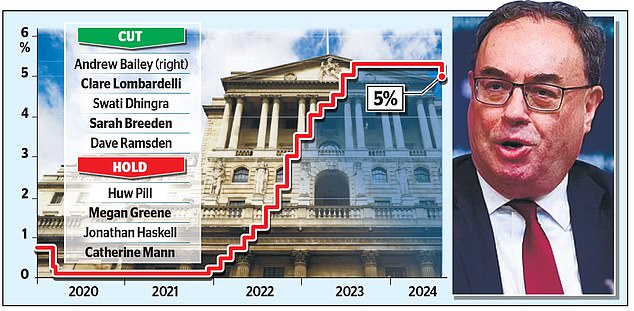

In a close call, policymakers lowered rates, with Governor Andrew Bailey casting the deciding vote.

The move ended a cycle in which borrowing costs rose for 14 consecutive meetings until August last year, when the Bank decided to pause and keep rates unchanged.

This marked a change of direction for the Bank, which has not cut rates since March 2020, and represented a boost for mortgage holders.

And traders are betting on two more cuts this year, with another expected in the fall.

Rate relief: Bank of England Governor Andrew Bailey cast the deciding vote for the Bank of England to cut interest rates for the first time in more than four years

However, Bailey warned that the Bank must “be careful not to cut interest rates too quickly or too much.” And it is unclear how Labour’s plans for the economy will affect future decisions.

But Britain’s biggest banks collapsed after the cut.

NatWest lost 8.1 percent, HSBC fell 6.5 percent and Lloyds fell 4 percent, among the biggest fallers in the FTSE 100, which fell 1 percent.

Lower rates could hurt interest margins, a key source of income for lenders.

The pessimism towards banks was also felt in Europe and the United States. The Dow Jones lost 1.7%, while the Nasdaq plummeted 2.8%.

This comes just days after new chancellor Rachel Reeves promised to give public sector workers an inflation-boosting pay rise.

Five of the nine members of the Bank’s monetary policy committee voted in favour of a 0.25 percentage point rate cut, bringing the rate down from a 16-year high of 5.25 percent to 5 percent.

Bailey, along with policy makers Sarah Breeden, Swati Dhingra, Dave Ramsden and new committee member Clare Lombardelli, backed the decision.

But the Bank’s chief economist, Huw Pill, voted to keep the rate at 5.25 percent, along with Megan Greene, Jonathan Haskell and Catherine Mann.

The MPC said progress in slowing wage growth and reducing service price inflation helped drive the decision.

Inflation has remained at the 2 percent target for two months, after peaking at 11.1 percent in October 2022.

However, the pace of price increases is expected to pick up to 2.75 percent in the second half of this year.

Close call: In a close call, Bank of England policymakers decided to cut the base rate by 0.25 percentage points.

The Bank of England also raised its growth forecasts for Britain for the year. It now expects the British economy to grow by 1.25% this year, up from a previous estimate of 0.5%. But it kept its 2025 forecast at the same level, at 1%.

“It is now appropriate to reduce the degree of policy tightening slightly,” the Bank said yesterday. But Bailey warned that rates are unlikely to fall back to the lows seen between 2009 and the start of the pandemic.

And borrowing costs are not expected to fall as quickly as they rose.

Lindsay James, investment strategist at Quilter Investors, said consumers and businesses would breathe a “huge collective sigh of relief”.

But Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, warned that “the policy easing is unlikely to herald the start of a major cycle of interest rate cuts” although it “marks a notable change of direction”.

And Laura Suter, personal finance director at AJ Bell, said the government’s first Budget in October “loomed large” over future MPC decisions.

“It is clear that the direction of travel is tax increases, as confirmed by Chancellor Rachel Reeves this week, so there is limited scope for big concessions causing inflation to soar again,” he said.

“But the Bank will take into account the implications of any policy decision in its outlook for the UK economy and the future direction of rates.”

UK bonds rose sharply and investors are now braced for further interest rate cuts as it is now clear that the Bank of England is easing monetary policy for the first time since 2020.

The 10-year UK government bond yield fell as much as 11 basis points to 3.86 percent, while two-year rates fell 15 basis points, the biggest drop this year.

“Following today’s decision, and in anticipation of further cuts in an easing cycle, we expect bond yields to move towards the lower end of their range,” said Van Luu, global head of fixed income and currency solutions strategy at Russell Investments.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.