A tattooed billionaire real estate agent has given his expert advice to young people looking to buy a home, as the average Australian cannot buy a home in any major city without being in mortgage stress.

An Australian earning an average full-time salary of $98,218 is already locked out of all capital markets when it comes to being able to afford a mid-priced home.

And they would need a staggering 67 percent pay rise to be able to afford a home without mortgage stress.

New research from the Parliamentary Library, commissioned by the Greens, found that a borrower would need to earn $164,400, two-thirds more than the average salary.

Mortgage stress – where buyers have to cut costs or dip into savings to pay bills – is said to arise when someone spends 30 per cent or more of their pre-tax salary on monthly mortgage payments.

A tattooed real estate agent has given advice to young people hoping to buy a house; The average Australian worker can no longer afford to buy a home in any major city without facing mortgage problems.

The average Australian worker can no longer afford to buy a home in any major city without facing mortgage problems, new research shows (pictured, Melbourne auction)

But someone with an average salary who borrowed a maximum of 5.2 times their salary would be spending 38 percent of their salary servicing a mortgage, according to RateCity calculations.

And the only way to get below the mortgage stress level of 30 would require a homebuyer to earn at least $164,400 to comfortably afford a median-priced home of $825,923 in an Australian city.

With a 20 per cent deposit, a home buyer with a large salary package would be borrowing a more manageable four times their salary, Parliamentary Library research, based on data from CoreLogic, revealed.

But property guru Adam Flynn says young people would be better off experiencing mortgage stress than missing out on buying their own home.

The founder of Flynn Estate Agents, a 26-year property veteran who was expelled from school at 16, said buying a home was vital as its value would only rise.

The man who started in real estate when he turned 18 now has a property portfolio valued at more than $7 million.

“Make the sacrifices now,” he told Daily Mail Australia.

“Over the years, I’ve heard so many times, ‘Oh no, we’re not going to buy now because the market is out of control,’ and five years later, that person says, ‘I should have gotten in five years ago.'” .

“It’s just a constant theme, a conversation of people regretting not buying sooner.”

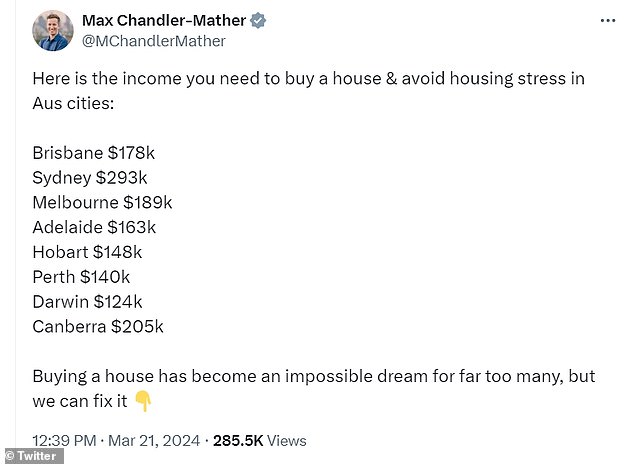

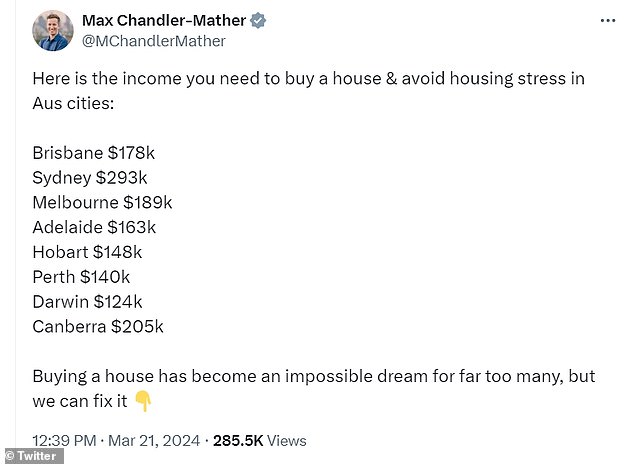

Max Chandler-Mather, the Greens’ housing spokesman, wants to scrap negative tax breaks for investor landlords and the 50 per cent capital gains tax discount.

“The only way to solve this crisis is if Labor finally works with the Greens to phase out the massive tax supports for property investors, such as negative gearing, which are denying millions of renters the opportunity to buy a home,” he claimed. .

In Sydney, where the median house price is $1.4 million, someone would need to earn $293,578 to avoid mortgages, putting them in the top 1.5 per cent of earners.

In Melbourne, with a median house price of $942,779, a salary of $189,962 would be needed, putting someone in the top 3.9 per cent of earners.

Flynn Estate Agents founder Adam Flynn, a 26-year real estate veteran who was expelled from school at 16, said younger people were better off enduring mortgage stress when they were young, rather than missing out the purchase of a house that would serve them. even in value

But new research from the Parliamentary Library, commissioned by the Greens, found that a borrower would need to earn significantly more – or $164,400 – to avoid being in mortgage stress (pictured, party’s housing spokesman Max Chandler-Mather, front to Prime Minister Anthony Albanese)

But Mr Flynn said someone had options to buy in Frankston North, a suburb 55 kilometers from Melbourne’s city centre, close to a train line and Port Phillip Bay, with a median affordable house price of $595,656. Dollars.

The suburb, where Flynn has an office, is also close to more expensive suburbs such as Frankston South, where the median price is $1.1 million.

“I think Frankston North is a sleeping giant,” he said.

‘You have good infrastructure, you have a train line, they are doing a complete review of the hospital.

“The Frankston market, over the next five years, is going to increase significantly – from a value for money proposition I would recommend Frankston North.”

Melbourne’s average house price growth of 4.4 per cent has also lagged behind other major state capitals, but Mr Flynn said rate cuts and the return of south-east Queensland residents would see Melbourne take off. the Victorian capital.

“The Melbourne market is an interest rate cut from a boom,” he said.

But Mr Flynn said someone had options to buy in Frankston North, a suburb 55 kilometers from Melbourne’s city centre, close to a train line and Port Phillip Bay, with a median affordable house price of $595,656. Dollars.

The Greens’ housing spokesman tweeted the astronomical salaries needed, as his party campaigns to scrap negative tax breaks for investor landlords and scrap the 50 per cent capital gains tax discount.

But housing in general remains expensive, even in the most affordable capitals.

For Brisbane, with a median price of $899,474, a salary of $178,090 is needed, putting someone in the top 4.6 per cent of earners.

A higher salary is also needed to buy a mid-priced home in smaller capital markets.

In Adelaide, it costs $163,627, where the median house price is $779,914.

In Perth, it takes a salary of $140,313 to buy a $718,560 home.

Hobart requires a salary of $148,948 to purchase a $696,508 home.

Darwin, Australia’s most affordable market with a median price of $577,786, still requires a higher salary of $124,339.

In Canberra, a salary of $205,073 is needed to buy a $967,671 house.

House prices in the capital rose 11 per cent in the year to February, CoreLogic data showed.

This came even after the Reserve Bank in November raised interest rates for the 13th time in 18 months to a 12-year high of 4.35 per cent.

House prices are rising, even though banks cannot lend as much because population growth is at its highest level since the early 1950s, with a record 548,800 migrants moving to Australia in the year Until September.

The Greens did not mention population growth in their press release.

The only affordable properties for people on below-average incomes who want to avoid mortgage stress are units in more remote capital cities.

A salary of $94,981 would buy an apartment in Perth, where the average price is $482,972.

A salary level of $83,648 would buy one Darwin unit, where $367,951 is the midpoint.

Flynn warned young people against buying a unit in a high-rise development in the hope of making a capital gain.

“In an apartment you will never experience good capital growth because there are so many that people can choose from,” he said.

‘You may get a reasonable return when it comes to rent.

“My advice is to always look to buy a house on a full-sized plot.”