An economist has doubled down on his gloomy prediction that the United States faces a stock market crash that would eclipse that of the 2008 financial crisis.

Harry Dent first warned last December that an “everything” stock market bubble would burst, causing the “biggest crash of our lives.”

“If I’m right, it will be the biggest collapse of our lifetime and most of it will happen in 2024,” he previously said. Digital Fox.

Given that he predicted the accident would occur in May, critics who accused him of being “crazy” appear to be right.

But in a new interview, the Harvard Business School alumnus said he stands by his claims. He says the benchmark S&P 500 index, for example, will plunge 86 percent.

However, he admits that market bottoms are now more likely to be seen in early to mid-2025.

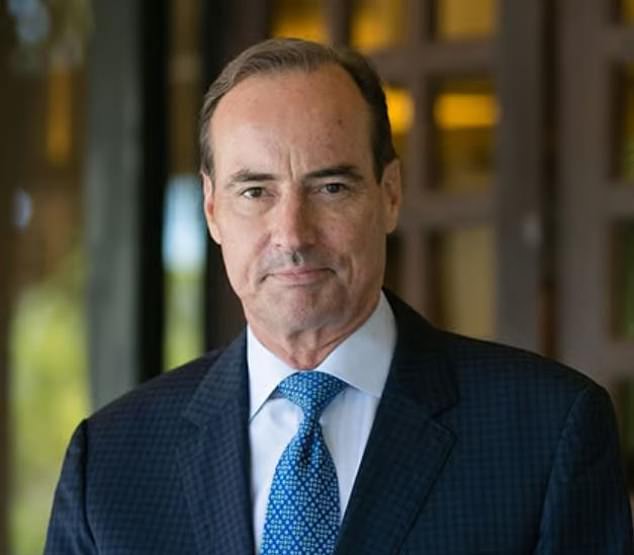

Economist Harry Dent has reiterated his warning that the stock market will crash much worse than during the 2008 financial crisis.

Dent is an economic analyst and best-selling financial author.

He reportedly accurately predicted the asset price bubble in Japan, which burst in 1991, and also the long recession that followed. He also warned about the American housing bubble, which burst in 2007.

Dent claims the crisis will be caused by overvalued markets and excessive stimulus spending, which he believes will create a recession much worse than other economists have predicted. Tens of millions would lose their jobs.

A decline would also affect American’s retirement accounts. Most have at least a portion of their 401(K) and IRA invested in the Dow Jones, S&P 500 and Nasdaq.

The worst crisis in many people’s lives would mean they would have to overcome the difficulties felt after the Great Recession of 2008, which was the worst economic crisis since the Great Depression.

‘Between 1925 and 1929, it was a natural bubble. There was no stimulus behind it, an artificial stimulus per se. So this is new. This has never happened.’ Dent said Tuesday.

‘What do you do if you want to cure a hangover? You drink more. And that’s what they’ve been doing.

‘Flooding the economy with extra money forever could actually improve the overall economy in the long run. But we will only see it when we see this bubble burst,” he added.

‘And again, this bubble has been going for 14 years. Instead of most bubbles (going) five to six, it has been stretched higher, for longer. Therefore, we would have to expect a greater drop than the one we had between 2008 and 2009.”

U.S. stocks ended May with gains, with the Nasdaq up 6.9 percent, the S&P 500 up 4.8 percent and the Dow Jones up 2.3 percent.

But Dent said, “I think we’re going to see the S&P drop 86 percent from the top, and the Nasdaq drop 92 percent.”

‘A heroic stock like Nvidia, no matter how good it is, and it is a great company, (down) 98 percent. Wow, this is over.’

‘We have never seen (the) government sustain a totally artificial bubble for a decade and a half, and we will see what happens after that.

“But I can tell you that there hasn’t been a single bubble – and this one is much bigger and longer – in history that hasn’t ended badly, period.”

People will be “the hardest hit” by the housing crisis, which he says will cause housing prices to fall to 2012 prices.

Dent lashed out at those who accused him of stoking fears and tensions among Americans.

“I’m just saying what I see and, frankly, I don’t give a damn,” he said. ‘If people don’t like it, because you have to choose: are you going to tell the truth or are you going to make people happy?’

‘They call me “permanent bear.” This is absolutely nonsense.

He added: ‘Looking at it from history and going back, nothing is more obvious.

‘Many other bubbles in history simply don’t have the depth or magnitude.

‘Because? “We have never realized the power that central banks can have to simply print money out of thin air.”

Dent claimed last December that an “everything” bubble would burst causing the “biggest collapse of our lifetimes” with the effects felt in May.

But critics accused him of being “crazy” and alarmist with his chilling predictions.

Dent has warned people to get their money out of the stock market before the “bubble of all bubbles.”

But Dent doesn’t think any impending accident is necessarily a bad thing.

He said: ‘The great fall will come at the end.

“This will take all this excess out of the markets, get them to where they need to be so that millennials can have a healthier boom and where they can invest their retirement savings.”

The economist has warned people to get their money out of the stock market before the “bubble of all bubbles” occurs.

In recent weeks, top bankers and even a prominent former CEO have issued chilling warnings about the U.S. economy.

In May, Jamie Dimon, head of the world’s largest bank, JPMorgan Chase, said that the worst result for the American economy It would be “stagflation.” This is when inflation It continues to rise, but unemployment is high and growth is slowing.

Stagflation, last seen in the United States in the 1970s, is considered worse than a recession by economists. It would send stocks tumbling, hitting 401(K) plans and other retirement savings.