It appears that Treasury officials tasked with guiding the Chancellor through the Budget have been whispering suggestions in her ear to exclude her pensions from their huge tax raid.

And is it any wonder, when they and other public sector workers have the most gilded pension schemes in Britain?

Civil servants receive a retirement income six times that of private sector workers for every £1 they set aside during their careers.

For years, gold-plated public sector pensions have been the envy of the British workforce, paying a guaranteed income in retirement that is protected from the ravages of inflation.

Today, with the help of industry experts, we lay bare the shameful gulf between the public sector’s generous pensions and the private sector’s meager schemes, and how much further it could grow after this week’s Budget.

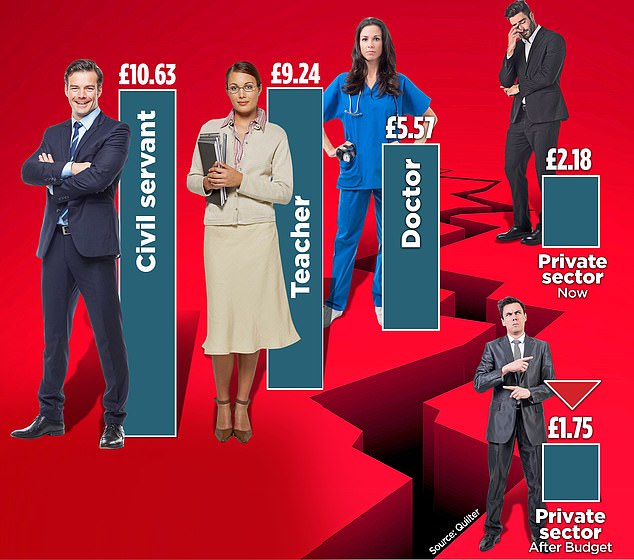

How much will your savings pay in retirement? What 1 euro invested at the beginning of your career will be worth more than 20 years of retirement

On Wednesday Ms Reeves is expected to collect a new National Insurance (NI) tax on the contributions employers pay to workers’ pensions, raising an estimated £15.4bn for the Treasury.

But last week it emerged that public sector workers would likely be shielded from this raid, leaving those in the private sector to bear the brunt of the huge fiscal hit.

Pensions industry leaders agree that this would inevitably result in lower retirement income for those working in the private sector. Meanwhile, workers with the most generous pensions and who expect a much more comfortable retirement (mostly with taxpayer money) would not be affected.

An exclusive analysis carried out for The Mail on Sunday by wealth manager Quilter confirms the extent of the stark divide.

Civil service and local government workers receive up to £10.63 and £9.24 respectively in pension benefits for every £1 they save at the start of their careers. Meanwhile, NHS healthcare workers receive £5.57 for every £1 they pay.

By contrast, most workers receiving a typical private sector pension receive just between £1.75 and £2.18 for every £1 they put aside for retirement.

State-backed plans, known as “defined benefit” pensions, promise to pay a guaranteed income that increases with inflation from the date of retirement until death. In contrast, most people who rely on a private workplace pension do not have that protection against inflation and are not guaranteed a set income in retirement. The size of the pension income they receive will depend on the whims of the stock market.

Most private sector workers save in modern ‘defined contribution’ pensions, where the responsibility for converting a pension scheme into retirement income falls on the individual, rather than the company they work for.

Employers are required to pay the equivalent of just 3 percent of their staff’s salaries into these retirement funds each year. Many will agree to pay more than this minimum, at a rate of 5 to 8 percent, which is considered generous.

Baroness Altmann, former Pensions Minister, says: “Forcing all taxpayers to pay employer NI contributions for these already hugely generous pension arrangements is patently unfair to private sector employers and workers.”

But this is a far cry from the effective rate that employers pay for public sector workers’ pensions.

On average, civil servants enjoy a hefty employer contribution of 28.97 percent, while police officers receive 35.3 percent. Doctors and healthcare workers receive a generous 23.7 per cent of the NHS pension scheme, and teachers see 28.68 per cent of their salary paid into their pensions.

Note that all of these pensions are “unfunded,” meaning they are mostly funded by the taxpayer.

And the already huge discrepancy in employer contributions could grow.

Experts have warned that if employers are forced to pay NI for workers’ pension contributions, they could make their plans less generous or curb pay rises to offset the costs.

Almost half of employers who pay staff more than the minimum pension will consider reducing their contributions if the Chancellor introduces NI into pension payments, according to a survey of business decision-makers by the Association of British Insurers and the Association of Employee Rewards and Benefits.

This means that private sector workers who today consider themselves lucky to receive 8 percent from their employers, for example, could see that reduced to 3 percent: the minimum allowed.

Workers with a typical private sector pension whose employers pay 5 per cent in contributions currently receive £2.18 for every £1 they set aside for retirement.

But if their employer reduces this to just 3 per cent, they would receive just £1.75 for every £1 they save into their pension, according to Quilter’s analysis. This is 20 percent less in retirement income.

Jon Greer, head of retirement policy at the wealth manager, says: “This move effectively creates a dichotomy between ‘good’ and ‘bad’ wealth, suggesting it is acceptable to tax private sector workers while protecting to their public sector counterparts.

“If public sector workers were not protected from this change, they would face impacts similar to those identified for the private sector, such as increased costs of their existing pensions and potentially reduced pay increases.”

Calculations by investment platform AJ Bell find that someone earning £35,000, whose salary rises by 2 per cent a year, would be £177,000 worse off after 35 years if their employer reduced the amount they pay into their pensions by 8 per cent. to a minimum. of 3 percent. Someone earning £60,000 today would be £303,000 poorer when they retire.

If this happens, workers will receive even less in retirement for every £1 they save in their pension, and their money won’t work as hard on its own.

The generosity of public sector pensions has long been justified by the suggestion that staff receive a lower salary during their working lives.

But official profit figures show that this is a myth.

According to the Office for National Statistics, average earnings (including bonuses) in the public sector were £698 a week, while private sector workers were paid £669 a week.

Baroness Altmann, the former pensions minister, says the move would be “indefensible” and “create havoc” for UK pensions.

He added: “Forcing all taxpayers to pay employer contributions for these already hugely generous pension arrangements is patently unfair to private sector employers and workers, and further deepens inequalities in pension provision for the workforce.” .

Tom Selby of AJ Bell says: ‘The fact that these types of (defined benefit) pensions have virtually disappeared in the private sector shows how generous – and expensive – they are.

“It costs so much to administer them that only the State feels capable of offering them to staff, because it has an entire country supporting the costs.”

jessica.beard@mailonsunday.co.uk

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.