- Rents in 18 of the 50 largest US metropolitan areas have increased this year

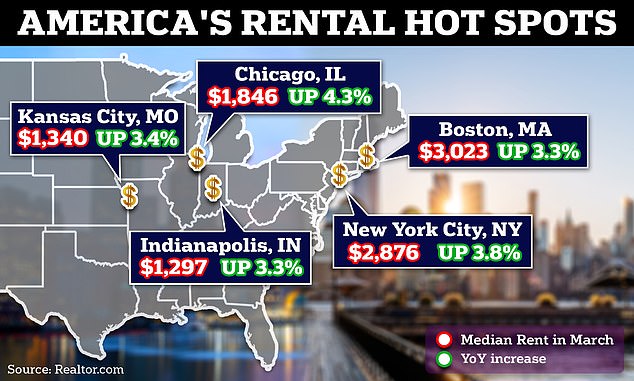

- A new report from Realtor.com shows renters in Chicago have seen the biggest increase

- Rents have been a key driver of inflation, which is around 3.5% for all items.

Rents in 18 of the 50 largest U.S. metropolitan areas have increased over the past year, new data shows.

A report from Realtor.com found that renters in the Northeast and Midwest are seeing the biggest increases, with Chicago and New York taking first and second place respectively.

This comes as rents have become a key driver of inflation, with Federal Reserve officials calling them the “biggest obstacle” to controlling the economy.

The median rental price in Chicago rose to $1,846 in March, up 4.3 percent from the same month last year, Realtor.com said.

Meanwhile, renters in New York have seen their rents rise 3.8 percent to $2,876. The complete list is at the end of the article.

A report from Realtor.com found that renters in the Northeast and Midwest are seeing the biggest increases, with Chicago and New York taking first and second place respectively.

In third place was Kansas City, MO, where the median rent increased 3.4 percent to $1,340.

Boston, MA and Indianapolis, IN followed, where costs increased 3.3 percent to $3,023 and $1,297 respectively.

The researchers analyzed the average costs of studio, one- and two-bedroom units in each city.

Realtor.com economist Jiayi Xu said the Northeast region in particular had suffered from a lack of available land for new multifamily construction, driving up prices.

“High housing prices in these expensive markets, plus high mortgage rates, may force people to stay in rental markets longer,” he said.

Rising mortgage rates – now above 7 percent – coupled with record prices have caused housing affordability to plummet over the past year.

According to Realtor.com, the median rent in Chicago (pictured) rose to $1,846 in March, up 4.3 percent from the same month last year.

Meanwhile, renters in New York (pictured) have seen their rents rise 3.8 percent to $2,876.

Xu notes that this trend puts more pressure on the rental market. Low unemployment rates in cities can also exacerbate the problem.

“For Kansas City and Indianapolis, in addition to affordability, they both have strong labor markets, with unemployment rates of 3.6 percent and 3.7 percent respectively in February.”

Earlier this month, Chicago Fed President Austan Goolsbee warned that rents and rising mortgage rates had become a key driver of inflation.

“Housing is the biggest obstacle,” Goolsbee said in Bloomberg.

‘We thought we basically understood the short-term mechanical model of how much housing inflation should go down.

“And it hasn’t gone down as fast as we thought it was going to go down right now.”

The annual inflation rate rose slightly to 3.5 percent in March. Gasoline and housing costs – which include rents – accounted for more than half of the increase, according to the Consumer Price Index (CPI).

| Meter | Average rent (0-2 bedrooms) | Year-on-year (0-2 bedrooms) |

|---|---|---|

| Atlanta-Sandy Springs-Alpharetta, GA | $1,626 | -3.70% |

| Austin-Round Rock, Texas, USA | $1,531 | -4.70% |

| Baltimore-Columbia-Towson, MD | $1,795 | -1.90% |

| Birmingham-Hoover, Alabama, United States | $1,240 | -2.40% |

| Boston-Cambridge-Newton, MA-NH | $3,023 | 3.30% |

| Buffalo-Cheektowaga, New York, USA | N/A | N/A |

| Charlotte-Concord-Gastonia, North Carolina-SC | $1,539 | -0.90% |

| Chicago-Naperville-Elgin, IL-IN-WI | $1,846 | 4.30% |

| Cincinnati, OH-KY-IN | $1,300 | -1.40% |

| Cleveland-Elyria, Ohio, USA | $1,247 | -2.50% |

| Columbus, Ohio, USA | $1,189 | -1.70% |

| Dallas-Fort Worth-Arlington, TX | $1,515 | -1.00% |

| Denver-Aurora-Lakewood, CO | $1,902 | -1.90% |

| Detroit-Warren-Dearborn, Michigan, United States | $1,326 | 0.70% |

| Hartford-West Hartford-East Hartford, CT | N/A | N/A |

| Houston-The Woodlands-Sugar Land, TX | $1,399 | 2.30% |

| Indianapolis-Carmel-Anderson, IN | $1,297 | 3.30% |

| Jacksonville, Florida, USA | $1,547 | -1.00% |

| Kansas City, MO-KS | $1,340 | 3.40% |

| Las Vegas-Henderson-Paradise, NV | $1,520 | -0.30% |

| Los Angeles-Long Beach-Anaheim, CA | $2,869 | 1.60% |

| Louisville/Jefferson County, KY-IN | $1,224 | 0.40% |

| Memphis, TN-MS-AR | $1,258 | -4.40% |

| Miami-Fort Lauderdale-West Palm Beach, FL | $2,378 | -3.60% |

| Milwaukee-Waukesha, Wisconsin, USA | $1,568 | -1.70% |

| Minneapolis-St. Paul-Bloomington, Minnesota-WI | $1,500 | -0.90% |

| Nashville-DavidsonâMurfreesboroâFranklin, TN | $1,614 | -2.90% |

| New Orleans-Metairie, Louisiana | N/A | N/A |

| New York-Newark-Jersey City, NY-NJ-PA | $2,876 | 3.80% |

| oklahoma city, state of oklahoma | $977 | 1.00% |

| Orlando-Kissimmee-Sanford, Florida, United States | $1,683 | -2.80% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | $1,803 | -0.60% |

| Phoenix-Mesa-Scottsdale, Arizona, USA | $1,554 | -3.20% |

| Pittsburgh, Pennsylvania, USA | $1,439 | 2.80% |

| Portland-Vancouver-Hillsboro, OR-WA | $1,683 | 0.50% |

| Providence-Warwick, RI-MA | N/A | N/A |

| Raleigh, North Carolina | $1,523 | -2.20% |

| Richmond, Virginia, USA | $1,506 | -0.30% |

| Riverside-San Bernardino-Ontario, CA | $2,209 | -0.20% |

| Rochester, New York | N/A | N/A |

| Sacramento-Roseville-Folsom, California, United States | $1,878 | 2.80% |

| San Antonio-New Braunfels, TX | $1,266 | -0.70% |

| San Diego-Chula Vista-Carlsbad, CA | $2,866 | 2.90% |

| San Francisco-Oakland-Berkeley, CA | $2,867 | 0.10% |

| San Jose-Sunnyvale-Santa Clara, CA | $3,227 | 1.50% |

| Seattle-Tacoma-Bellevue, Washington, USA | $2,014 | 0.00% |

| St. Louis, MO-IL | $1,306 | -4.00% |

| Tampa-St. St. Petersburg-Clearwater, Florida, United States | $1,732 | -2.50% |

| Virginia Beach-Norfolk-Newport News, VA-NC | $1,510 | -1.40% |

| Washington-Arlington-Alexandria,DC-VA-MD-WV | $2,222 | 1.50% |