Table of Contents

More than £100bn was added to Tesla’s value last night as the promise of increased sales sent shares soaring.

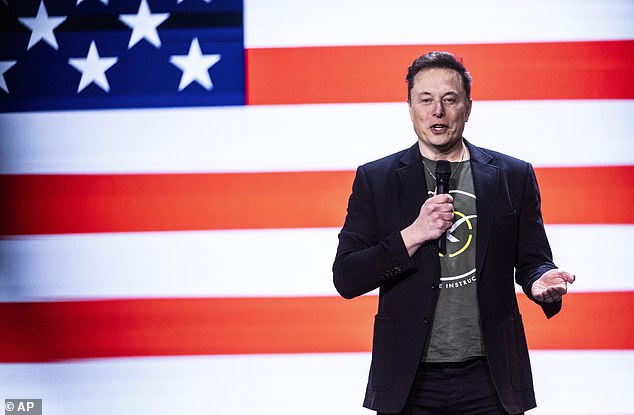

In an update that was applauded by Wall Street, boss Elon Musk reported an 8 per cent rise in third-quarter profits to £1.9 billion after an 8 per cent rise in revenue to £19.4 billion.

Musk also predicted that sales of Tesla electric vehicles could increase by up to 30 percent next year, as cost-cutting allowed him to reduce prices to stimulate demand.

Tesla boss Elon Musk reported an 8 per cent rise in third quarter profits to £1.9 billion after an 8 per cent rise in revenue to £19.4 billion.

The comments reassured investors that the billionaire tycoon was still focused on the core business of selling electric cars despite distractions, including his campaign for Donald Trump in the US presidential election.

Shares rose 22 per cent, boosting Tesla’s value by £105 billion to £630 billion, in the company’s biggest one-day gain in 11 years.

It also added £14bn to the value of Musk’s stake, which last night was worth £82bn.

“He definitely seemed more passionate and invested in it this time,” said Jessica Caldwell, chief insight officer at the car buying and research website Edmunds.

But Ross Gerber, CEO of Gerber Kawasaki Wealth and Investment Management and a prominent Tesla investor, called on Musk to do more.

‘The days were good when Elon slept in the factory. He was there every day, working. Not attending Trump rallies, of all the things you could be doing,” Gerber said.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.