Table of Contents

tesco stock rose on Thursday after the supermarket giant raised its annual profit outlook after sales rose in the first half.

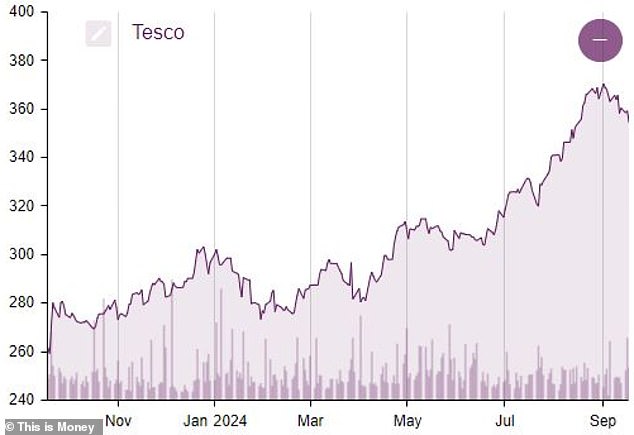

FTSE 100-listed Tesco, which has seen its share price rise 39 per cent in the past 12 months, said group sales rose 4 per cent year-on-year to £3.15bn in the 26 weeks until August 23.

The supermarket group told shareholders that shoppers were increasingly buying fresh food and produce from premium lines.

In charge: Ken Murphy is the chief executive of Tesco and is optimistic about the chain’s Christmas prospects.

Tesco saw a nearly 15 per cent increase in Finest sales volumes during the period, as more than 20 million shoppers purchased items from the premium range.

It also claimed that Clubcard loyalty pricing helped customers save “up to £385 on their annual grocery bill”.

The group, which is Britain’s biggest supermarket, said it forecast its full-year profits would be slightly ahead of previous forecasts thanks to a better-than-expected recent first half.

Ken Murphy, the chain’s chief executive, said he expected customer confidence to improve before Christmas, adding that the supermarket was preparing for a “good” festive period.

Murphy told reporters Thursday: “We track customer feedback every week, and while they’re not doing cartwheels down the aisles, they’re in reasonably good shape.”

‘We are preparing for a good Christmas and we are betting on a good Christmas.’

Murphy said the group, which is locked in a price war with Aldi, had lowered prices on “thousands of lines” and launched or improved more than 860 products in partnership with its suppliers and producers.

Popular: Shoppers are buying more products from Tesco’s top ranges, it said

Momentum: Tesco has raised its annual profit forecast amid strong interim results on Thursday

Revenue rose 2.9 percent to £34.77 billion, slightly above estimates, while adjusted operating profit rose 15.6 percent to £1.65 billion.

Its UK like-for-like sales rose 3.5 per cent in its second quarter, after a 4.6 per cent rise in the first.

But Booker’s sales fell 1.9 percent on a like-for-like basis, “reflecting a decline in the tobacco market and Best Food Logistics volumes,” Tesco said.

Looking ahead, Tesco now expects to generate an operating profit of £2.9bn by 2024. It previously said profits were likely to be around £2.8bn.

Tesco shares rose 1.8 per cent or 6.4 pence to 361.30 pence on Thursday, having risen more than 35 per cent in the last year.

The chain’s market share rose 60 basis points year-on-year to 27.8 percent in the 12 weeks to September 1, marking its highest level since January 2022, according to researcher Kantar.

On the rise: FTSE 100-listed Tesco shares have risen sharply over the past year

Richard Hunter, head of markets at Interactive Investor, said: “While Tesco continues to show its strength in a notoriously competitive environment, expectations are also progressively rising, decreasing the likelihood of positive shocks for investors.

“Still, this has done little to limit the share price, which has risen around 36 per cent over the last year, compared with an 11 per cent gain for the FTSE 100 overall, and a 72 per cent gain. cent during the last two. years.

‘Despite this rally, shares remain below long-term historical valuation, suggesting there is room for further appreciation. Meanwhile, the longstanding market consensus on the stock as a strong buy and the preferred play in the sector is unlikely to waver.’

Mark Crouch, analyst at eToro, said: ‘Tesco’s excellent performance in 2024 is reflected in this morning’s results, as the UK’s largest supermarket reported a further rise in profits as its shares hit a high of eleven. years.

“Throughout a period in which supermarkets have faced a host of obstacles, from a global pandemic to high inflation and a cost of living crisis, Tesco has not only maintained its market share but has risen to the highest point in almost three years.

“And despite the rise of budget supermarket chains, which have managed to take market share from other big names in the sector, Tesco has not been one of them.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.