Table of Contents

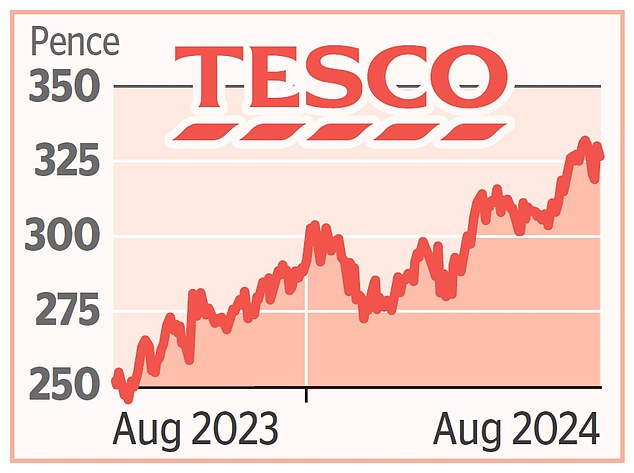

The shares are trading at 330.5 pence, up 12.8 percent from the start of the year, despite this week’s stock market rout.

However, the price is still only 5 percent above its level a decade ago, when the supermarket chain was embroiled in an accounting crisis that threatened its future.

The somewhat lacklustre share performance that followed belies the progress the £21.9bn FTSE 100 company has made since the scandal. There has been a turnaround, first under David Lewis and then his successor, Ken Murphy.

Will Tesco continue to grow?

This “quintessential supermarket of the British aisles”, as Richard Hunter of brokerage Interactive Investor calls it, is luring customers from rivals at a faster rate than at any time in the past two years, despite competition from rapidly expanding German discount chains Aldi and Lidl.

What is your market share?

The company tops the supermarket charts with a 27.7 percent share of the UK grocery business. Sainsbury’s is second with a 15.3 percent share. Asda is third with 12.7 percent.

How important is Clubcard?

This loyalty scheme is a key part of Tesco’s appeal. Food price inflation has eased, which should mean shoppers are less obsessed with getting a bargain. But 22 million British households with a Clubcard still benefit from discounts in stores and online that are available only to them.

What will be your next big move?

An effort to attract Marks & Spencer and Waitrose’s well-heeled gourmet clientele, who eat restaurant food at home. Tesco aims to boost sales of its Finest range from £2bn a year to £3bn by updating its more expensive Finest range.

Any other initiatives?

Murphy will want action to be taken soon against the rising tide of shoplifting – thefts at Tesco and Sainsbury’s account for 40 per cent of all cases.

Millions have been spent on body cameras and protective screens for staff and security to deter criminals. But Murphy remains outraged by the attacks on his staff and hopes the new Crime and Policing Bill will include stronger measures to tackle the crime wave.

Should I buy the stock?

This may be a stock to add to your shopping list if you are looking for more exposure to UK stocks.

Tesco has been buying back its shares and intends to spend another £1bn over the next year on this strategy. Share buybacks should boost a company’s share price as they reduce the total number of shares in circulation.

Meanwhile, most analysts rate Tesco a “buy” with an average target price of 338p. There is also the appeal of its 3.78 per cent dividend yield.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.