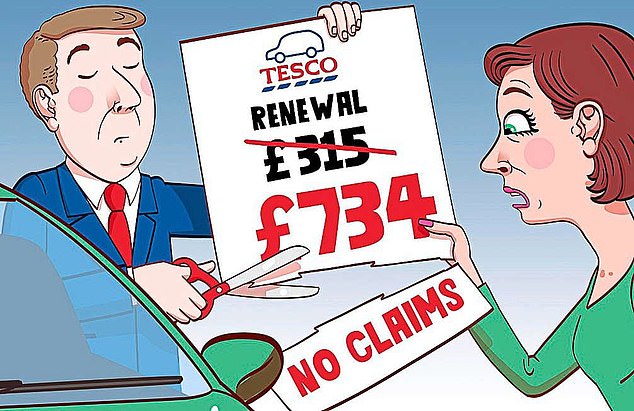

Tesco Bank has more than doubled my car insurance renewal premium because it says there is an outstanding claim on the policy which has damaged my no claims bonus. But I have not made any claims. Many months ago Tesco Bank emailed me to say my car had damaged another vehicle on 1st November 2023. I replied that it couldn’t have been me as I was on holiday and my car was parked in a secure airport car park. I thought this issue had been resolved but obviously it hasn’t. My premium will increase from £315 to £734.

GP, West Dereham, Norfolk

Sally Hamilton responds:Tesco bank had initially accepted that you had suffered a case of mistaken identity and told you not to worry about it. I asked Tesco to investigate and a few days later they confirmed that, contrary to your understanding, the claim for damages against you was still open. This resulted in a massive increase in your renewal fee.

You were rightly upset as you were the innocent party and were relaxing on holiday in Morocco, with your car safely parked at Luton Airport, when the incident occurred at Paddington railway station in central London.

According to Tesco, the damaged car was a taxi, which was hit when the driver of the mystery car opened the door.

Tesco told me it had tried to contact the insurer of the damaged taxi to explain the situation but was unable to get a response.

At first, I wondered if you had been a victim of license plate cloning. This involves a scammer who copies the license plate of another car and places it on a vehicle which he then drives recklessly without paying fines or insurance claims.

But Tesco thinks otherwise. It believes the complainant wrote down the wrong number plate after the incident (perhaps just a letter or a number), a mistake it says happens frequently.

I tried to contact the company handling the claim on behalf of a third party (Drive Car Hire in Ilford Essex) but received no response.

Tesco says it has also been met with stony silence. However, it has changed its mind about your case and provided you with a reduced renewal premium quote of £463, which you have accepted. It has also reinstated your no-claims bonus. A spokesman says: “While the correct process has been followed, we feel we could have done more to explain this to GP. We have offered £40 compensation for the inconvenience.”

My accountant filed my self-assessment tax return for the 2022-2023 tax year, which included £157.50 in voluntary class 2 National Insurance contributions, which I was required to pay in order to receive the maximum state pension. I sent a cheque for the full amount requested and also attached the payment receipt provided by HMRC. The cheque was cashed and the money was withdrawn from my bank account on 4th January. I had already started receiving my state pension in November last year and was expecting to receive a retrospective increase once the National Insurance payment had been received. But instead, to my horror, I received a letter dated 6th February, accusing me of not paying my income tax and informing me that it is now too late to increase my state pension by making class 2 National Insurance contributions. I have been trying to sort out the mess, but with no luck. Please help.

BK, Surrey

Sally answers:He told me that, on receiving this worrying letter from HMRC, his accountant took action on his behalf. His enquiries revealed that his payment had been allocated to a general HMRC account, despite it having been sent with the appropriate receipt of payment.

The HMRC agent she spoke to on the phone assured her that everything would be sorted and her retrospective pension increase would be applied before 11 March.

Nothing happened. Her accountant went back to work on the case and discovered that the full sum (both her income tax bill and the £157.50 National Insurance contribution) had been credited to her income tax account. As a result, her National Insurance contribution had not been applied to her National Insurance account.

He contacted HMRC on his own and, after two hours of listening to hold music and being transferred from one department to another, he finally managed to get through to a manager. He apologised and explained that the misdirected part of his payment could only be transferred from his tax account to his NI account manually, and that he would set it up himself at the end of the call. He was flabbergasted when he was told that this could take several weeks to process, but decided to leave it at that.

However, things got worse when she received a letter from HMRC dated 11 June, demanding £61 in late payment of income tax. After frantic calls, it turned out that the entire income tax payment had now been transferred to her NI account in error. This had resulted in a penalty for unpaid income tax. Oops, oops!

Exasperation had already set in, but when you were told that this problem could take until August to be resolved, you had reached the limit of your patience and came to me.

I asked the IRS to speed up the resolution of this second payment mix-up, so that you and your accountant could spend less time on the phone trying to sort it out and more time enjoying your retirement with the correct level of state pension. I am pleased to say that within a fortnight your nightmare was finally over. As an apology for their mistakes, HMRC paid you £200.

An HMRC spokesperson said: “We are very sorry for the problems faced by BK. We have written to apologise, confirm that their records are correct and to waive the penalties and interest.”

Your problem arose simply because you wanted to make up for some missing NI contributions. People do this every year to boost their state pension entitlement. To receive the full amount (currently £221.20 per week), you need to make at least 35 years’ worth of contributions. You can find the records at gov.uk/check-national-insurance-record. Gaps can occur, for example, if you’ve lived abroad, are on a very low wage, are self-employed and make small profits, or are unemployed and not claiming benefits. People who receive benefits can usually get credits for contributions if they’re not working.

Class 2 contributions are a flat rate paid by self-employed individuals, while Class 3 contributions are designed to cover gaps. Both can be paid voluntarily for up to six tax years after the gap occurs.

Before deciding whether to pay to cover shortfalls, it’s best to apply for a state pension forecast at gov.uk/check-state-pension or fill out a BR19 application form. Normally, people can only go back six years, but with the change from the old state pension to the current flat-rate system, anyone with shortfalls between 2006 and 2016 has until 5 April 2025 to consider whether to pay for the missing years.

- Write to Sally Hamilton at Sally Sorts It, Money Mail, 9 Derry Street, London, W8 5HY or email sally@dailymail.co.uk — Please include your phone number, address and a note addressed to the offending organisation giving them permission to speak to Sally Hamilton. Please do not send original documents as we cannot be held responsible for them. The Daily Mail accepts no legal responsibility for any responses provided.

Straight to the point

For 18 months Microsoft has been taking small amounts, such as £6.99, from my bank account. I have asked NatWest to stop this, but they have since taken another £6.99. I have changed my debit card three times, but it is still happening.

JA, via email.

Sally answers:Microsoft has refunded the money and says it was charged for someone else’s account. That account is now flagged as fraudulent. NatWest says it had raised the issue with Microsoft and has offered it a new card.

In April I was due to fly to Bali with Emirates to attend my stepdaughter’s wedding, but my flight was cancelled. My stepdaughter booked me on another flight that was leaving a few days later. But when I landed in Dubai for a stopover, I was told that my connecting flight to Bali had already left and I would have to fly the next day. I missed the wedding and have not received any compensation.

JE, via email.

Emirates has offered you £520 compensation which you plan to use towards a well-deserved holiday.

I took out a loan to buy my car and make the monthly payments without fail, but last week law enforcement tried to seize it. The loan company says I missed two payments, but my online banking shows that I did pay them. The company has terminated my lease.

Cb, Cambridgeshire.

The company has apologized and has reactivated the contract and your account, and payments have resumed.

In June, my boyfriend and I were delayed for 11 hours on a Ryanair flight. We spent £40 each on food and drink at the airport, but we didn’t keep receipts. I sent Ryanair screenshots of the transactions on my banking app, but they didn’t refund my money.

PA, London.

Unfortunately, Ryanair is not budging, saying that banking apps do not constitute official receipts, which must be paid. However, it says that affected passengers were given vouchers for refreshments while they waited.

.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.