Former President Donald Trump could become more than $3 billion richer after Digital World Acquisition shareholders approved a merger with his social media site Truth on Friday.

And he could use that money.

The deal was announced as the presumptive Republican presidential nominee faces a $454 million judgment in a fraud trial in New York.

But the ins and outs of the deal, based on stock prices and a trendy “acquisition for special acquisition purposes,” mean he may not be able to get his hands on 3 .5 billion dollars before six months.

He was busy on his site Friday, saying he had earmarked the $454 million for his campaign and accusing New York Attorney General Letitia James of election interference.

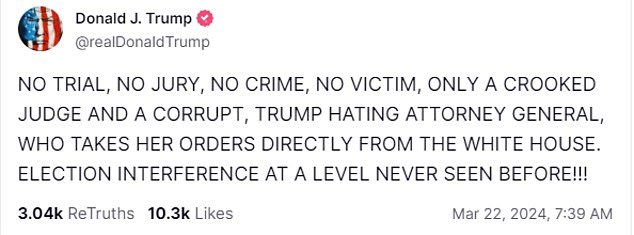

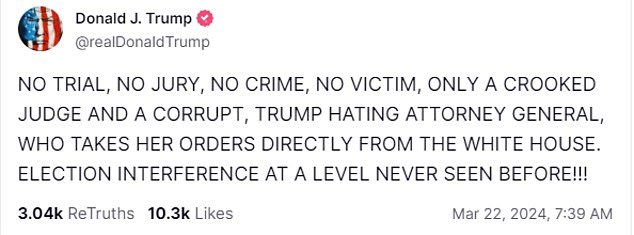

“No trial, no jury, no crime, no victim, only a crooked judge and a corrupt and Trump-hating attorney general who takes her orders directly from the White House,” he posted in all the capitals.

Former President Donald Trump could become more than $3 billion richer after Digital World Acquisition shareholders approved a merger with his social media site Truth on Friday.

Trump was busy using his Truth Social platform to attack New York Attorney General Letitia James on Friday morning, just before the deal was made.

“Election interference at a level never seen before. »

Truth Social has been its main public mouthpiece since it created it two years ago after being banned from other sites, including Twitter and Facebook.

For him, his value may now lie in a source of cash, even if the company loses tens of millions of dollars a year.

Enter Digital World, a publicly traded shell company created specifically for the purpose of merging with a private company. After courting Trump Media and Technology Group for more than a year, he closed the deal on Friday,

This means that Trump’s media group will take the place of the shell company and that “DJT” will soon appear on the Nasdaq stock exchange, perhaps as early as Monday, all without the red tape of an “IPO.”

This is an extraordinary salary for the former president. Its 79 million shares are priced at more than $42, with a paper value of $3.3 billion.

However, these “SPAC” deals typically come with a lock-up clause that prevents insiders from selling their shares immediately.

In the case of Digital World Acquisition and Trump Media and Technology Group, Trump must hold the shares for six months.

That’s a problem for Trump, who faces a Monday deadline to find a bond that would guarantee payment of a $454 million civil fraud judgment against him. So far, he has failed to find a company that supports him and risks having his property or businesses seized.

New York AG Letitia James previously threatened to seize assets if Trump doesn’t post bail

Trump created Truth Social in February 2022 after being kicked off other social media platforms, such as Twitter, Facebook and YouTube, following the January 6 attack on the Capitol.

Hurry up. This bill could increase by more than $100,000 in interest per day.

In some cases, the SPAC shell company may drop the lock-up provision, or the newly merged board may revise the terms after the deal closes. But board members would likely face the question of whether this was in the best interests of other shareholders.

A lot can change in six months. The value of Trump’s stake will rise and fall depending on his stock price.

A broad base of supporters could ensure the price remains supported, said Harry Kraemer, a professor specializing in mergers and acquisitions at Northwestern University’s Kellogg School of Management.

“In the short term, if a lot of people are saying, ‘I don’t care what it’s worth, I’m just going to keep buying it and I’m going to keep supporting it,’ you can do that for a while. reasonable,” he told CBS News.

For now, that means Truth Social, which reportedly has around five million active users, remains more of a spokesperson than a cash cow.

“Truth Social is my voice and the true voice of America,” Trump said Thursday night.

“Keep your dirty hands off Trump Tower,” Trump said during his fundraising speech.

Instead, his campaign relied on fundraising emails as a way to make money to avoid the leak. He sent at least four blasts on Wednesday and Thursday, with subject lines such as “Hands off Trump Tower” and “Trump Tower is mine.”

And on Friday, he continued his attacks against James, who filed a fraud complaint, accusing him of inflating or reducing the value of his properties depending on whether he used them to take out loans or to assess taxes.

He claimed she used a new law to pursue him.

“Under this statute, I don’t have a jury and I don’t have any rights,” he said.

“All decisions and all rights are given in this case to a corrupt, Trump-hating judge who invented a crazy reward out of nowhere in order to harm me politically and not allow me to use the great is the amount of money I have accumulated over the years, through tough words, insight, instinct and diligence, in my political campaign for the presidency.