The financial pain faced by many renters shows no signs of abating and research suggests they could end up spending £150,000 on rent before getting on the property ladder.

The alarming new figures are based on the typical age of a first-time buyer being 37 and the average renter in England expecting to rent for around 18 years before buying.

This assumes they first started renting when they were in their teens or early twenties, although an increasing number are staying with their parents longer.

Cost of rent: The amount tenants can potentially spend on rent over 18 years is around £150,000, Goodlord suggested.

Rental platform Goodlord’s calculation used its own rental values, which amount to £699 per month per person on average over the past 12 months, and £1,167 per person for those living in London.

This potentially leads to £151,009 being spent on rent over your 18 years as a tenant.

And for those living in London, this figure would rise to a staggering £252,042 spent on rent before getting on the property ladder.

It is based on current rental prices and those who have been renting for several years may have previously paid less.

However, it does provide a good indication of how much young people starting today might be able to pay during their tenancy time, before future increases are factored in.

Mark Harris, of mortgage broker SPF Private Clients, said: “Is it any wonder that the vast majority of first-time buyers have to turn to the Bank of Mum and Dad for a deposit or help with the mortgage, given how much rent do they have to pay as tenants?

“Expensive rents, combined with the higher cost of living, make it incredibly difficult to save to upgrade, causing the average age of first-time buyers to rise. The problem is further exacerbated in areas with higher housing costs, such as London and the South East.

‘Many are resigning themselves to having to rent for longer, if not indefinitely. But while renting offers a level of flexibility, there is very little certainty and many still aspire to owning a home, especially if they want to start a family.

“Increasing the supply of affordable housing options, both for rent and purchase, should be a priority for the Government.”

| Average monthly rent, by property | Average monthly rent, per person | By year | Over 18 years | Lifetime | |

|---|---|---|---|---|---|

| East Midlands | £993 | 584.02 | 7,008.29 | 126,149.25 | 427,505.80 |

| Greater london | £1,984 | 1,166.86 | 14,002.35 | 252,042.28 | 854,143.28 |

| Northeast | £879 | 516.86 | 6,202.31 | 111,641.60 | 378,340.98 |

| northwest | £980 | 576.57 | 6,918.80 | 124,538.46 | 422,047.02 |

| Southeast | £1,291 | 759.19 | 9,110.32 | 163,985.78 | 555,729.59 |

| South west | £1,242 | 730.32 | 8,763.78 | 157,748.11 | 534,590.83 |

| West Midlands | £952 | 559.99 | 6,719.90 | 120,958.16 | 409,913.76 |

| England | £1,188 | 699.12 | 8,389.39 | 151,009.09 | 511,753.04 |

Goodlord’s research also suggests that money spent on rent could almost triple for those tenants who never make it onto the property ladder.

It suggested that a lifetime of renting based on the current British life expectancy of 80 years could cost renters £511,753.

For Londoners, this figure could rise to what seems a virtually impossible cost of £854,143, based on a similar calculation.

On this basis, it would seem reasonable that renters could more easily pay off their mortgage if they could take out a home loan at the beginning of their real estate journey rather than renting.

Total cost: A lifetime tenancy based on the current British life expectancy of 80 years could cost tenants £511,753, according to Goodlord.

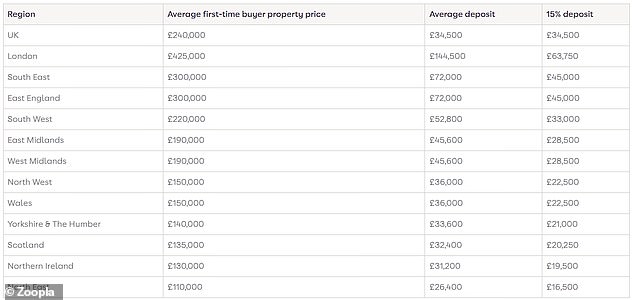

Zoopla revealed the average first-time buyer deposits paid across the country (figures are from last year)

Many buyers are unable to buy so early in life due to the high price of the property relative to their income and the difficulty in saving enough for a deposit.

He average deposit paid by a first time buyer last year for a three-bedroom house it was £34,500 for a £240,000 house.

This equates to a 15 per cent deposit on the property, according to separate Zoopla figures published last year.

In London, the average first home costs £425,000 with an average deposit of £144,500.

This contrasts with the North East, where first-time buyers pay the smallest deposit, averaging £26,400 for a £110,000 property.

Renters have faced a sharp rise in rents in recent years, making it increasingly difficult to save for a deposit to buy.

The North East is also where the lowest rents can be found, with renters typically spending £517 a month, which equates to £11,642 over 18 years.

It is less than half the costs faced by Londoners, according to data from Goodlord.

Oli Sherlock, of Goodlord, said: ‘Renters have faced a sharp rise in rents in recent years, making it increasingly difficult to save for a deposit to buy.

‘Ironically, this is compounding the problem of high costs as the number of renters continues to rise, increasing demand for available rental properties.

‘At the same time, rising mortgage rates are forcing some homeowners to question whether they should stay in the sector, further tightening supply and demand.

“The Government urgently needs to commit to a new housebuilding program and take steps to increase the number of rental homes to create a sustainable housing market for all.”