With its excellent transport links, lively nightlife, cultural scene and excellent universities, it is no wonder Glasgow is popular with students and young professionals.

For real estate investors it also has its appeal. The Scottish city is where homeowners can expect to get the best returns on their investment, according to new data. This is due to high tenant demand and property prices that are more affordable than most other major cities.

Landlords can achieve a healthy 13.92 per cent annual return by investing in a property let to students, figures from estate agent comparison website GetAgent suggest. Glasgow is also one of the most student-populated cities in the UK, with more than 185,000 across its six higher education institutions. Newcastle and Durham in the north-east come second and third, offering returns of 10.7 and 8.8 per cent respectively.

House prices in central Glasgow are £231,243 on average, says GetAgent, which analyzed the Land Registry and its own customer data. This compares to the average UK house price of £285,000.

A three-bedroom house in Glasgow, perhaps with a reception room converted into another bedroom, would generate a total average rent of £2,684 a month, considering four students would pay £671 each. This would total £32,200 a year, a return of 13.9 per cent. If you left it as a three-bedroom house, you’d get a 7.7 percent yield, although students would probably pay higher rent to have a living room.

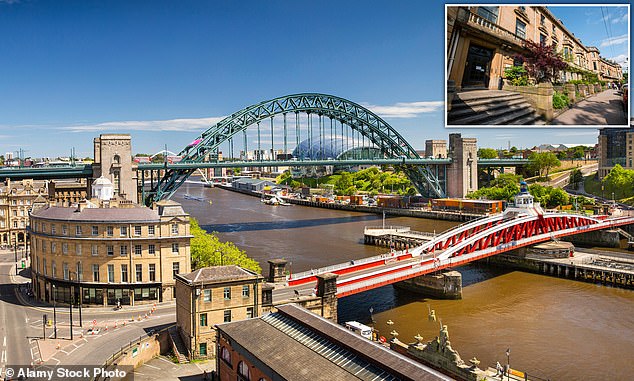

Featured Locations: Newcastle upon Tyne is a great location for student property investors. Top right, Glasgow campus

The yield or profitability is calculated by dividing the annual rental income by the value of the property and then multiplying by 100. However, it does not include costs such as mortgage interest, insurance or maintenance. These costs should always be included when estimating returns to see if it is worth it. For example, borrowing £170,000 on a £231,000 property with a 5 per cent interest-only mortgage would reduce your annual return from 13.9 per cent to 10.2 per cent.

Buyers of student accommodation are typically established buy-to-let landlords seeking rental income and capital growth, or parents purchasing a home for their child to live in while they are at university, to allow them to live more comfortably and potentially make money .

Pamela Aitken, from Savills’ sales development team in Glasgow, says the city’s popularity shows no signs of slowing down. Students often stay after graduating, thanks to good employment opportunities in the area. Barclays and JP Morgan are among the city’s big banks.

“The relative value of properties in and around Glasgow, together with the rental returns they can generate, is certainly an attractive proposition for the bank of mum and dad, especially when considering a long-term investment with retention rates of graduates in the city by 41 percent,” he says.

Newcastle upon Tyne and Durham also offer good yield potential. Both are home to prestigious universities that are part of the Russell Group. Dundee and Edinburgh complete the list of the five highest-performing student placements – each around 7.9 per cent.

Properties in the North tend to be more affordable and those in central city areas, close to shops, bars and restaurants, can command high rents, offering owners a higher return compared to properties in the South, where housing prices are significantly higher. For example, in Brighton, the average property price is £526,176 and the average annual rent (based on a four-bedroom property) is £31,896. This rental income is around the same as in Glasgow, says GetAgent, but the initial purchase price is almost double, meaning an annual return of 6 per cent before costs.

Students usually live in a shared house after their first year. Owners can rent the property to multiple students on an annual contract, and students are expected to pay rent throughout the year, including in the summer months when the semester ends. Vacancy or no periods are likely to be reduced in areas where there is high student demand. The popularity of this type of housing continues to rise thanks to the number of students in the UK, which now reaches a record 2.86 million.

Like other rental property owners, student property investors have had to adapt to changing market conditions in recent years. Higher interest rates have increased mortgage payments, while reduced tax relief has also hit yields. That said, for investors with a low or no mortgage, student rental income can generate a decent return on their savings.

Duncan Kreeger, founder of property investment platform TAB, says potential student owners should consider towns and cities where there is a high annual student intake. It is also worth considering areas where there are large numbers of international students. “For example, Chinese students often look for high-quality properties with high rental yields,” he adds.

Landlords renting houses may also face a growing supply of purpose-built student accommodation and will therefore need to ensure they are offering something competitive and that there is enough demand for everyone.

Students also tend to move out after a year, so landlords will need to be prepared to find and set up new tenants each year or factor in the cost of using an agent.

Pete Mugleston, managing director of OnlineMortgageAdvisor.co.uk, says Nottingham and Leeds are other cities that could prove lucrative for student property investors. In Nottingham, which has two leading universities, the average property price is just £196,037. The average monthly rent in the city is around £660, but properties near the city center can cost up to £1,242.

In Leeds, home to 65,000 students and five universities, returns can range from 6.5 to 7.05 per cent. Pete recommends Hyde Park, Headingley and Woodhouse as the best places to invest in student accommodation within the city.

“Rental prices have risen steadily each year, in parallel with the growth in property values, making it an opportune time to invest in this area,” he says.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.