Table of Contents

Change is on the menu at McDonald’s, Starbucks and other players in the fast-food market, which moves 291 billion pounds a year in the United States alone.

You may not be interested in a Big Mac, a Mighty McMuffin or a pumpkin cream iced coffee (yes, it’s a drink), but there could be benefits to your wallet if these companies can turn around the slump in demand.

Fast food’s big names may be down, but they are “not out of the game,” according to Joshua Cummings of Janus Henderson Global Research.

The long-term outlook for the sector is good. Goldman Sachs argues that people still want to eat out, as long as they feel they are getting good value for money.

Cost-conscious consumers tired of inflation are forcing the industry to offer discounts.

Tasty: According to McDonald’s CEO Chris Kempczinski, customers have become “more selective with their spending”

According to McDonald’s CEO Chris Kempczinski, customers have become “more selective with their spending” and the company is extending its $5 summer menu offer in the US until December. Fans of the offer were not happy with the higher price of burgers and fries.

There are warnings on both sides of the Atlantic about the health dangers of ultra-processed foods, and here the government plans to ban television advertising of junk food before 9 p.m.

Weight-loss drugs like Ozempic are said to pose another threat to “lunch stocks,” as Wall Street likes to call McDonald’s and other chains.

This GLP-1 medication may reduce appetite and taste for high-fat or high-sugar foods.

But fast-food giants are responding to these challenges, not content to rely on “patriotic nostalgia,” the term that sums up Americans’ fondness for the familiar taste of a Big Mac or similar treat.

Shares in Starbucks, the world’s second-largest fast food operator valued at £82bn, rose following news of Brian’s appointment.

Niccol, the executive who transformed burrito chain Chipotle Mexican Grill, as boss.

Niccol, who will start work in September and has vowed to turn Starbucks into a “community coffee shop” once again, will travel 1,000 miles by private jet three days a week from Newport Beach, California, to Starbucks headquarters in Seattle.

Chipotle is mourning its loss, but the company could be one of the beneficiaries of the huge cost savings that US bank Morgan Stanley says will result from the introduction of humanoid robots in kitchens.

An avocado-processing robot that makes guacamole is being tested at two Chipotle restaurants in California.

The risks are high, but the rewards could be, well, tasty. These are the stocks worth sampling in the US and UK.

USA

McDonald’s

McDonald’s Corporation, valued at £159 billion, is the world’s largest fast food company, with more than 38,000 restaurants in 100 countries.

countries. Its former employees include US Vice President Kamala Harris.

The various “industrial and competitive” challenges facing the business include the higher cost of ingredients, energy and packaging. Customers, deterred by “McFlation,” have opted to buy food at lower prices, i.e. at the supermarket. Customers have also opted for more sophisticated, “fast-casual” restaurants. In the United States, Chipotle is a favorite in this category.

Analysts see McDonald’s decision to “rightsize”

The price of some meals will force competitors to follow suit.

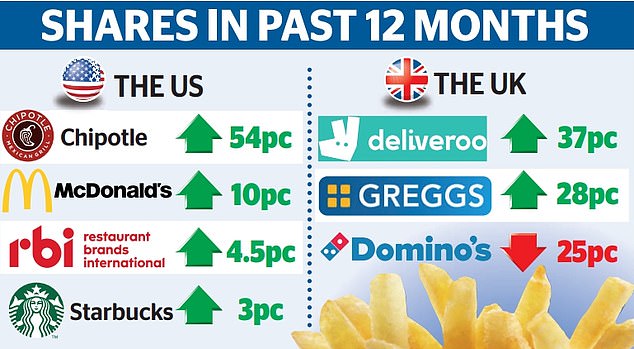

Meanwhile, a 16 per cent rise in the shares to $294 (more than £221) over the past three months suggests confidence in McDonald’s ability to win back diners.

Citigroup analysts have now raised their target price on the stock to $301 (£226), while Jefferies analysts are targeting $310 (£233).

Overall, 17 analysts rate McDonald’s stock as a “buy” and 13 rate it as a “hold.”

Starbucks

Among the challenges facing Starbucks, the second-biggest fast-food brand, are the impersonal atmosphere of its cafes and the need to appease New York activist investor Paul Singer of Elliott Management. Singer bought a sizable stake in July after the stock price fell. Like McDonald’s and other American brands, Starbucks has been hit by boycotts in the Middle East, a result of American support for Israel in the Gaza conflict.

Last week, Niccol said he would first address the chain’s problems in the United States, transforming what he calls the “transactional feel” of cafes and addressing Generation Z discontent with the Starbucks brand. He will then turn his attention to China and other places abroad.

Niccol, who has been called a “dream hire” and a “hall of fame” restaurant boss, “aims to have a perfect morning” in collaboration with his team of “green apron partners”. Such was the transformation Niccol brought about at Chipotle that this week Bank of America analysts said they now have “greater confidence” in Starbucks. Their target price is $118 (£89), up from $96 (£72) currently. But most other analysts are watching and waiting, so they rate the stock a “hold”.

Restaurant brands

The Canadian group’s £16.9bn fast-food empire includes Burger King, Tim Hortons and Popeyes. The company, which operates 30,000 restaurants in 120 countries, began its turnaround programme a year ago, spending £1.5bn to revitalise the look of its 7,000 US outlets.

The design is intended to encourage diners to buy more Whoppers and fries.

Like McDonald’s, Burger King has a $5 deal that has been extended through October because, for one, it seems to appeal to women.

The New York-listed shares are down 8% so far this year and now stand at $69 (£52), but analysts remain optimistic about the group’s ability to revive appetite for FAFH (food away from home).

Most analysts rate the stock a “buy”; RBC has set a target price of £71.

Chipotle

Niccol’s departure prompted some investors to sell the shares, which had risen 770 percent between 2018, when he joined the group, and his departure to Starbucks.

Bill Ackman, manager of FTSE 100 investment trust Pershing Square, is among those who have strategically reduced their stake in the £60bn business.

As a result, the company’s shares have fallen 15 percent to $57 (about £43) over the past three months.

Chipotle, which has 3,500 restaurants in the United States, Canada, the United Kingdom, France, Germany and Kuwait, is Goldman Sachs’ No. 1 pick in the sector, largely because it is not under pressure on pricing.

However, there has been controversy over the portion sizes of its Tex-Mex cuisine.

Customers complained on social media that burrito bowls were not filled to the brim.

The new policy is intended to be more generous, and analysts seem to think it will succeed, with most rating the stock a “buy” and some targeting a price of $73 (£55).

United Kingdom

Value is also seen as the recipe for success in the UK’s £22bn-a-year fast-food business. This week, private equity-owned Pret a Manger said sales of its 99p filter coffee rose 60 per cent last month as customers swapped £3.50 lattes for £3.50 lattes.

The £3.23bn Greggs chain will open more branches in future so customers can enjoy its oven-baked steaks, sausage rolls and vegan alternatives for dinner. Shares in Greggs have risen 28 per cent this year to 3,161p.

But despite this jump, most analysts still rate the stock as a “buy”, and are targeting a rise to 3,314p. Earlier this year, Deliveroo looked totally unattractive to investors, but opinion changed when the company made a small profit.

The shares, which traded at 390p in 2021, now stand at 156p, partly thanks to rumours of a bid from US delivery service Doordash.

Some analysts may still rate the stock a “sell” amid doubts that this low-margin business can ever reach sufficient scale to be competitive. But most are more confident and forecast a further recovery to 170p.

Shares in Domino’s Pizza Group, the US group’s London-listed franchise, have fallen 25% this year to 292p after a cut in profit forecasts. Orders were lower than expected, despite the Olympics. But the stock remains rated “buy”, and Investec has set a target of 383p.

Fast food may be a forbidden pleasure, but the view in the City and on Wall Street is that we won’t deprive ourselves of it if the indulgence is affordable and plentiful. Investors have the option of abstaining, but still fattening their portfolios.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.