Table of Contents

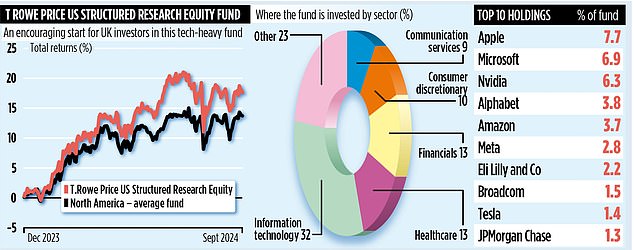

The T. Rowe Price US Structured Research Equity mutual fund may have a rather unwieldy name, but investors seeking exposure to the US stock market should not be discouraged.

It’s a £1.4bn fund that was launched 25 years ago and has held up quite well.

Available to UK investors since December, the fund is managed from Baltimore by a firm that has $1.5 trillion (£1.1 trillion) in assets under its wing.

The investment strategy, as with many actively managed funds, is to outperform a specific stock market benchmark index; In this case it is the Standard & Poor’s 500, a barometer of the market fortunes of the 500 largest listed companies in the United States.

US-based: Available to UK investors since December, T. Rowe Price US Structured Research Equity is managed from Baltimore by a firm that has $1.5 trillion in assets under its wing.

However, what sets it apart from the madding crowd is the investment process that takes place under the hood of the fund: there is no single manager responsible for managing the portfolio.

Instead, 30 of the company’s top analysts are given “sleeves” of the fund’s assets to manage, based on their specific sector specialization (e.g., healthcare).

Your job is to pick the best stocks with the amount of money under your wing determined in part by the importance of your sector to the S&P500. In some of the big industries, like IT, there are multiple analysts.

Above these stock pickers is a six-person “oversight” team whose role is to monitor performance and ensure they comply with the fund’s risk control rules.

All quite formulaic, but it works. Analysis of one-year rolling quarterly periods since the fund was launched in 1999 indicates that it has outperformed the S&P500 85 percent of the time.

Alexa Gagliardi is part of the supervision team. His role, he says, is to examine the portfolio daily – “eyes and ears” – making sure everything is in order.

And he adds: ‘The idea is to offer a fund that has the same appearance as the S&P500 and at the same time offers investors the possibility of obtaining higher returns.

‘What has made the fund successful is our ability to pick up the nickels and dimes along the way throughout the stock market. We don’t make big bets on a single stock.

The fund currently has almost 300 holdings, with the largest positions being in big-name technology stocks such as Apple, Microsoft and Nvidia. But these are largely in line with their representation in the S&P500.

This is because the oversight team ensures that no holding in the benchmark index is more than 100 basis points higher or lower than its contribution to the index.

So, for example, the fund’s 7.7 percent stake in Apple compares to the company’s index weighting of 6.8 percent.

Although the majority of the fund’s holdings are in S&P500 companies, analysts can invest outside the index (“off-benchmark”), but individual positions cannot represent more than 0.5 percent of the fund’s assets.

Gagliardi says 49 stocks are currently held “off-baseline,” comprising a mix of U.S. and foreign companies.

These include US financial firms Renaissancere Holdings and Corebridge Financial, as well as AstraZeneca in the UK and Swiss pharmaceutical giant Novartis.

T. Rowe Price’s success in managing assets based on an “American structured research strategy” is reflected in the $83 billion of client money that has now been invested in this way.

It has also generated interest outside the US, hence why the fund is available in the UK and Gagliardi has visited Hong Kong and South Korea in recent days to market it.

“We consider it a better alternative to a fund that tracks the S&P500 index,” he says. Current annual charges are 0.42 percent.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.