A Sydney real estate agent has revealed a common tactic used by agents to pressure home buyers into submitting higher offers – and the only way to reveal their deception.

Amir Jahan, 25, owner of A-Class Estate Agents, warns buyers to be wary when agents claim they have received higher offers.

‘Many agents try to get extra money for the supplier by saying they have higher offers when they don’t. “They’re lying,” he told Daily Mail Australia.

Jahan believes this tactic is not just about securing the best price for sellers, but is also a way for agents to showcase their skills and attract more listings.

‘It’s greed. “Suffice it to say that there is a building or an area and most of the properties sell for 1.5 or 1.6 million dollars,” he said.

‘But if one agent outsells the others, who is likely to get the next business?

“It’s not fair to buyers because they can lose a lot of money for no reason.”

Jahan explained that even if a property owner is satisfied with an offer, the agent could still try to “prove themselves” by telling the buyer that there is a higher offer, even if it is not true.

“And now the buyer loves that property and might be happy to pay to secure the house,” he said.

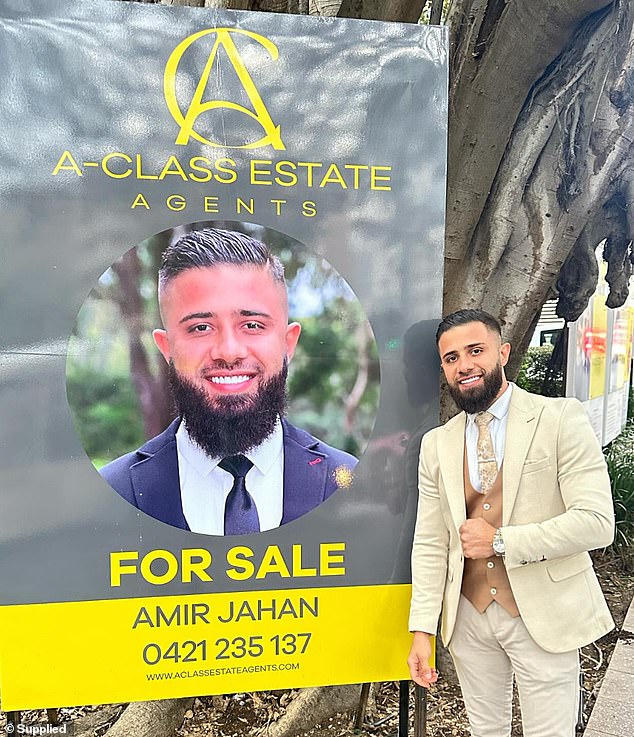

Estate agency owner Amir Jahan, 25 (pictured), has exposed how some agents lie when receiving higher offers.

The agent (pictured) said buyers can “play the same game” if they don’t show too much interest in a property.

Jahan urges buyers to use the same tactics that real estate agents use.

“Don’t show much interest in the property,” he said.

‘If you want to submit an offer, just submit it and leave it there.

‘Don’t try to chase the agent. Leave it like this.

“And if the agent doesn’t have a buyer and really wants to sell it, they will contact you.”

He also warned buyers to hold their ground if an agent responds: “Your offer is good, but we had a higher one.”

He advises: “Don’t show any interest.” Say “okay, choose the highest offer,” he explained.

“Because if they really have a higher offer, there’s no point in the agent wasting their time with you when your budget is lower, they immediately go for the higher offer.”

Jahan (pictured) says that if an agent really had a higher offer, they wouldn’t waste their time on people making lower offers.

Jahan admits that sometimes there can be really higher offers on a property and there is an easy way to find out.

“You can ask for proof,” he said.

‘If it is a private contract, an agent can reveal what the offers are.

‘But if it is a property at auction, an agent cannot reveal the bids. It’s illegal.

“However, there is nothing stopping them from telling you what the highest bid amount is on a private property under contract.”

Jahan explained that the best way to avoid overpaying for a property is to do your research.

Jahan said to ensure an agent is genuine, potential buyers can ask for proof of the highest offer if the property is a private treaty (photo of buyers inspecting a property in Sydney in August)

“Many first home buyers are just excited to buy a property, they don’t think,” he said.

‘They just say they love it and are willing to pay for it.

But do your homework. Look at the street: what price did the recent property sell for?

‘Are there others in the area similar to the one you like on the market?

‘Are you paying the right amount or are you overpaying for the property?’