One of Italy’s most notorious mafia bosses, Francesco “Sandokan” Schiavone, has become a state witness after 26 years behind bars.

Schiavone, who led a Camorra mafia clan in Casal di Principe near Naples, operating out of the southern town of Caserta, was once considered one of the richest and cruelest criminals in Europe.

He was arrested in a secret apartment in his hometown, hidden by a sliding block of granite, while evading authorities in 1998, five years after he managed to escape the clutches of the law and evade surveillance and to detection.

Schiavone served several life sentences, including for several murders, after being convicted in the historic “Spartacus” mega-trial against 36 other members of the clan. He was also convicted of arms trafficking, bombings and armed robbery.

The sprawling trial saw dozens of people go to prison, including 16 ringleaders, as well as two female NATO officers who had relationships with Schiavone, and provided him with tools and weapons.

Following the trial, which took Italian prosecutors five years and covered mafia activities from 1988 to 1996, he was convicted in 2005 and his final appeal was rejected in 2010.

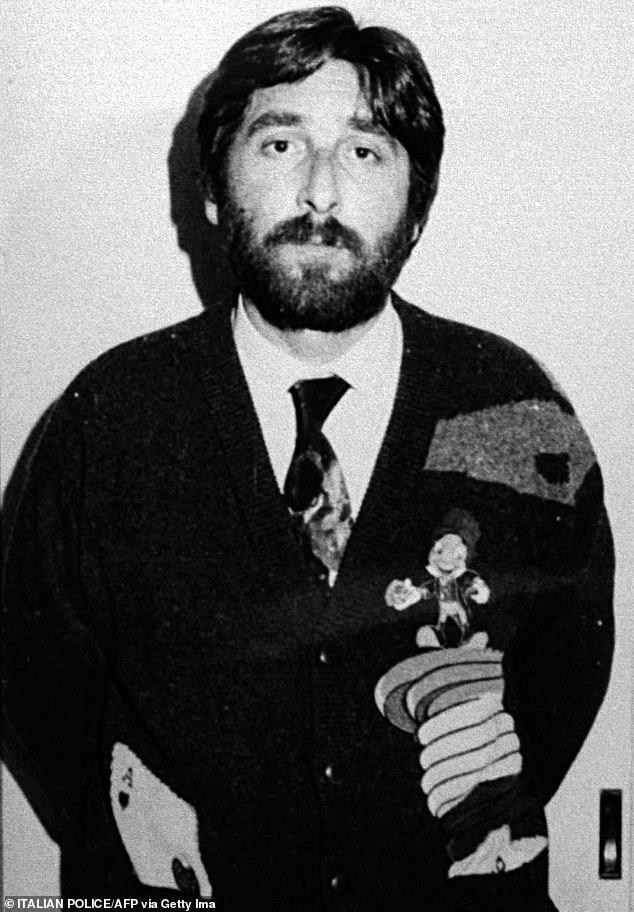

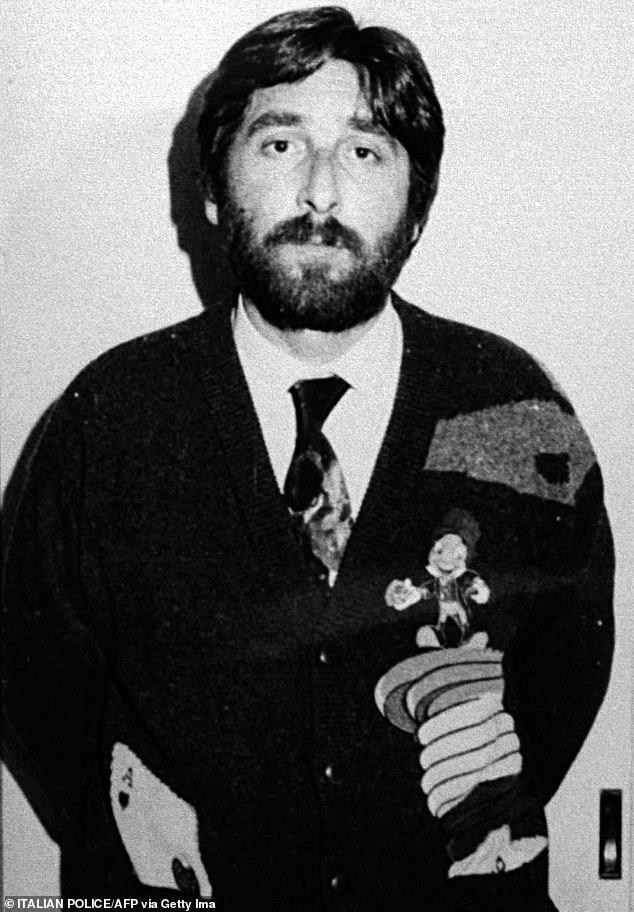

Mafia boss Francesco “Sandokan” Schiavone (pictured) turned state witness after 26 years behind bars

Schiavone was once considered one of the richest and cruelest criminals in Europe.

Schiavone’s life inspired the hit mafia television series Gomorrah

Chiara Colosimo, president of Parliament’s anti-mafia committee, hailed his decision to cooperate with authorities as “another blow to the Camorra and organized crime.”

Schiavone and his team were involved in brutal score-settling between clans fighting for control of Casal di Principe in the 1980s and 1990s, as well as illegal drug trafficking, which became extremely lucrative for him.

Schiavone was also involved in businesses in Italy and around the world.

His clan controlled seaports in Italy, clothing stores in Germany, Spain, Ireland, the Netherlands, Finland and Serbia, where they sold countless counterfeit designer clothes at high prices.

Their poor quality clothing was even found in shopping malls in New York and Chicago.

At one point, Schiavone’s family was worth an estimated $47 billion.

Their cruelty and economic and political power were exposed in Robert Saviano’s bestselling book, “Gomorrah,” which was later adapted into a film and television series. Saviano was forced into hiding and is still under police protection.

In an Instagram post Friday, Saviano said he would wait to see what kind of information the mobster would provide before praising his decision to transform.

“Will he manage to do this without revealing where the Camorra’s money is and without demonstrating real political and commercial connections?” Saviano wrote.

Several members of the mafioso’s family have already collaborated.

His cousin, Carmine Schiavone, became a prosecution witness in 1993, revealing in particular how the mafia dumped toxic waste in fields, wells and lakes, activities blamed for an outbreak of cancer in the local population.

His son Nicola (pictured) was arrested in 2010 and became an informant in 2018.

Walter (pictured), the mob boss’s son, became an informant in 2021

At one point, Schiavone’s family was worth an estimated $47 billion.

Two of his sons, Nicola, thought to have succeeded him, before being arrested in 2010, and Walter, who became “repentant” in 2018 and 2021, respectively.

Schiavone had recently been transferred from a prison in northern Italy to a facility in L’Aquila, where Sicilian mafia boss Matteo Messina Denaro was being treated before his death last year.

Schiavone was reportedly ill, but some media outlets suggested Friday that the rumors were a ruse to cover up a transfer actually motivated by his collaboration.

Schiavone was nicknamed “Sandokan” due to his apparent resemblance to the actor who played the pirate hero of that name in a popular 1970s television series.

After serving a three-year prison sentence in 1993, he managed to disappear before judges could put him under surveillance.

For five years he was on the run, before being arrested in his hometown near Naples.

He lived in a secret apartment in his family villa near Naples, accessible only by a sliding granite wall.

The mafia big man was so brazen that he managed to father two children with his wife while on the run, despite the police closely monitoring his every move.

But after getting caught, his power and influence dropped massively.

He was once forced to write to the Italian president begging for mercy during the Spartacus trial, and at one point tried to claim he was crazy by saying he would see ghosts and spirits in his cell before the trial.

Experts told MailOnline earlier this year that the mafia’s influence was declining year on year. Laura Garavini, a former Italian senator who spent several years of her career on the government’s anti-mafia committee, told MailOnline “it is possible” to have a mafia-free Italy within the next 30 years.