- Kantar: Food revenue increased just 1% for the four weeks ending June 9

- Bad weather affects demand for traditional summer products, such as sun protection products

Wet weather and lower inflation caused takeaway sales at supermarkets to rise at their slowest pace in two years, according to new figures.

Grocery sales rose just 1 percent in the four weeks to June 9, market research organization Kantar said, compared with 2.9 percent in the previous four weeks.

Fraser McKevitt, head of retail and consumer insights at Kantar, said people were “being put off going to stores” as Britain experienced its wettest spring since 1986 and one of the wettest on record.

Wet days: Wet weather and lower inflation caused takeaway sales at supermarkets to rise at their slowest pace in two years, according to new figures from Kantar

Footfall decreased slightly: shoppers visited the supermarket an average of 16.3 times a month, compared to 16.4 in June 2023.

The poor conditions affected demand for traditional summer products such as sun protection items, which Kantar said fell about 25 percent from the same month last year.

At the same time, Britons were buying products they wouldn’t normally anticipate buying in June, such as freshly made hot soup, sales of which soared by almost a quarter.

However, Kantar found that the proportion of households describing their financial situation as “comfortable” reached 36 per cent, its highest level in two and a half years.

This followed falling costs in almost a third of grocery categories such as milk, butter and toilet paper.

Food inflation fell for the 16th consecutive month to 2.1 percent, its lowest since October 2021, amid a continued decline in energy and fertilizer prices.

Online giant: Ocado was the fastest growing supermarket for the fourth month in a row, with sales in the online group rising 10.7 per cent during the 12 weeks to June 9.

While McKevitt acknowledged the cost of living crisis was not over, he said: “There are positive signs that many of us no longer feel the need to restrict our spending as much.”

Kantar believes the UEFA European Football Championship could bolster grocery stores and pubs, depending on the success of England and Scotland in the tournament.

It noted that the proportion of beer and lager sales on promotion had increased by more than 40 per cent over the past four weeks.

“Retailers will compete with fans who come out to watch football and also with each other,” McKevitt said. “Pubs could especially benefit from a boost, regardless of whether football comes home.”

Pubs especially could benefit from a boost, whether football comes home or not.’

Alongside this announcement, Kantar revealed that Ocado was the fastest growing supermarket for the fourth month in a row, with sales at the online giant rising 10.7 per cent during the 12 weeks to June 9.

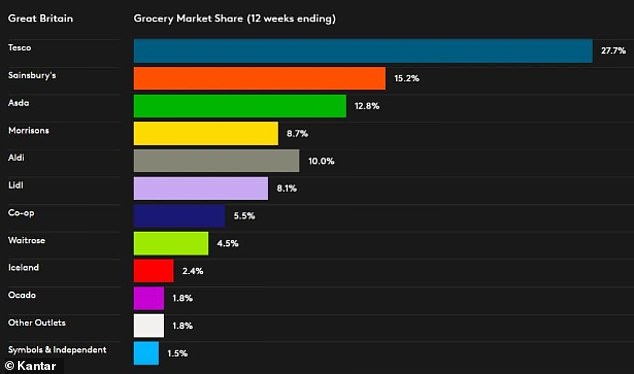

It also stated that Tesco, Britain’s largest supermarket, expanded its market share by 0.6 percentage points to 27.7 percent, the best figure since February 2022, as its revenue increased by 4.6 percent. hundred.

In contrast, Asda’s market share fell from 13.1 per cent in the previous 12 weeks to 12.8 per cent as the company struggled with strong competition in the discount retail sector.

Russ Mould, investment director at AJ Bell, said: ‘Asda has traditionally positioned itself at the value end of the market, but this has become a crowded space.

It is losing out to German discounters Aldi and Lidl in one corner and some of the big traditional players in the other, including Sainsbury’s and Marks & Spencer, who are pushing hard on the value side of things.’