The teenage son of a burly trader who chained Aboriginal children with zip ties because he caught them trespassing has defended his father and blasted efforts to buy the boys a swimming pool as a “gratifying intrusion”.

Matej Radelic, 45, was charged with three counts of aggravated assault on Tuesday after a disturbing video was uploaded to Facebook showing three children crying for their mother outside a property on Cable Beach in Broome, Western Australia.

The children had jumped over the fence of the vacant property to swim in the pool before Radelic, whose parents own the house, caught them and made the bizarre arrest of the citizens.

In the video, which caused a national uproar, the children’s mother, Rowena, could be heard crying as she asked Radelic to release Margaret, six, Stuart, seven, and another boy, eight, while he stood over them and refused to let them go until the police arrived.

Now, Luka, Radelic’s traditional son, has responded with a video on social media showing the same property with broken windows, along with the message: “This is NOT a race issue.” It’s a crime issue.’

Luka, who like his father works in air conditioning installations, also criticized the community’s fundraising for children to have their own pool.

Pictured: Luka Radelic, the son of a trader who tied Aboriginal children together with zip ties

In the photo: Matej Radelic with his two children, Margaret and Stuart, tied up in the entrance of his parents’ house.

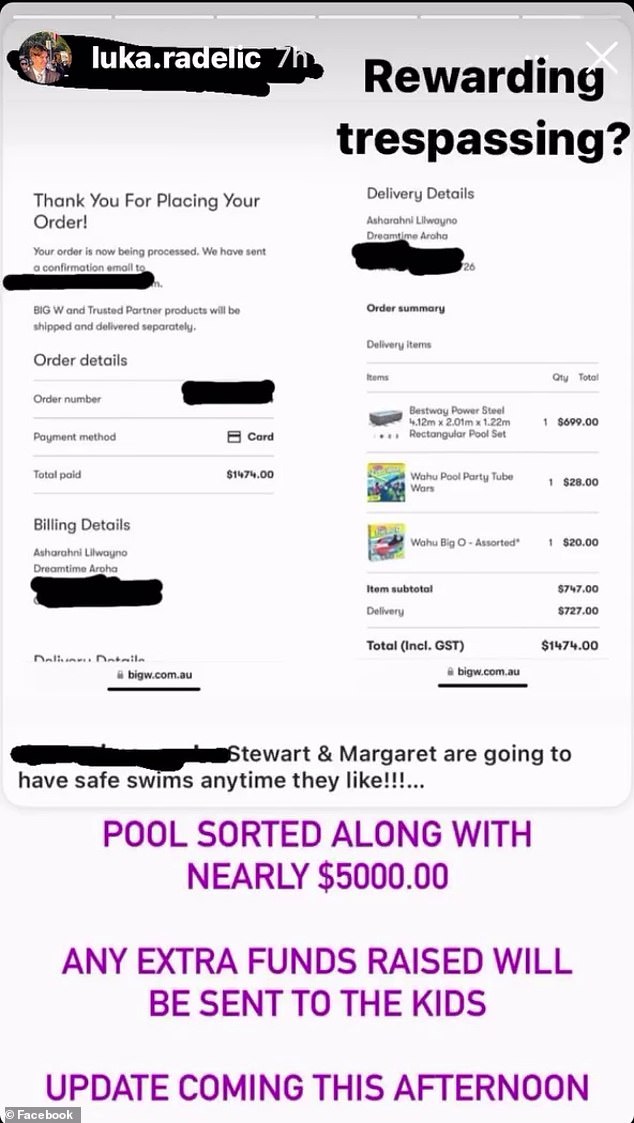

He posted a screenshot of a community campaign’s purchase of a backyard pool installed for children with the caption: ‘Reward trespassing?’

Luka also shared photos of several broken windows in the family’s home, writing, ‘Six times. Thousands of dollars in damage. We didn’t need this.’

It looked like a brick had been thrown through the sliding glass door. ‘Why does anyone feel the need to do this?’ she asked.

He then suggested that local vandals would use “bricks torn from the pavement, helmets, metal bottles, anything they could find” to destroy property.

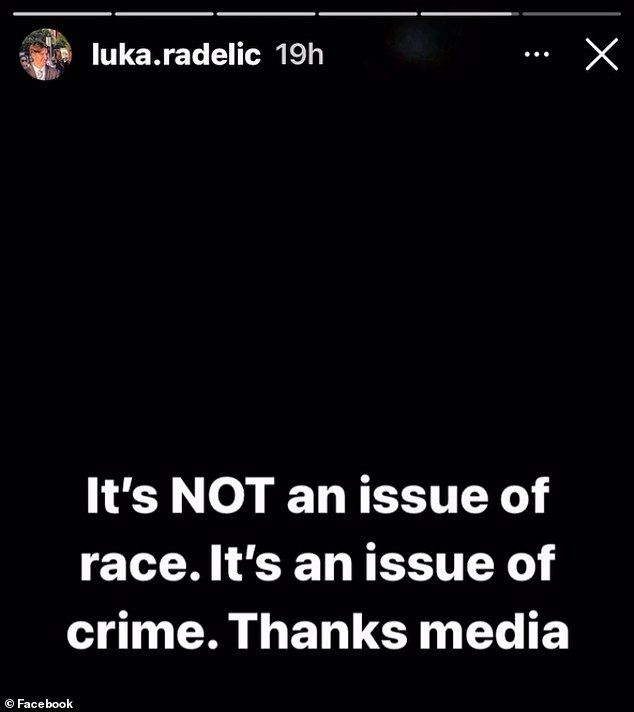

‘This is NOT a race issue. It is a question of crime. Thanks media,’ she wrote.

His father said earlier this week that the situation was not racially motivated and said he regretted his actions.

Luka’s video appeared to have been compiled from older footage.

The empty property appeared to be intact when Daily Mail Australia visited on Friday.

Pictured: Screenshot of a social media post by Luka Radelic, who suggested a community fundraiser for children was “rewarding trespassing.”

In the photo: Matej Radelic standing in front of broken glass on the same property.

Luka Radelic defended his father’s actions on social media, saying the incident was due to a crime, rather than an issue of race.

Members of the local indigenous community viewed Radelic Sr.’s actions as an act of racism.

The shopkeeper denied this and told the media that the incident was not racially motivated and that he was sorry for how the situation had developed.

An indigenous group on Facebook was outraged by Luka’s video and noted that the children had not been accused of damaging property.

“Luka Radelic decided to publish his stories and gave us a ‘special mention,'” the Facebook post said.

“The man… who kidnapped the children and tied them up with zip ties, (his son) believes this is acceptable.”

“It is not right to hold children against their will and tie them with zip ties.”

Sniveling and frightened, the children were tied up with zip ties after being caught swimming in the pool.

Everyone in Broome that Daily Mail Australia spoke to acknowledged the high crime rate, but the children’s relative, Roberta Cox, said Margaret and Stuart do not engage in vandalism.

“They don’t steal or anything like that, they just wanted to swim in the pool,” he said.

Mrs Cox was at the scene at the time of the incident and called the police.

He said the children are “traumatized” and that Radelic could have handled the situation differently.

“The cable ties were too tight and I could see one was bleeding and crying,” he said.

Radelic was charged and granted bail to appear at Broome Magistrates’ Court on March 25.