Table of Contents

Thousands of people who were fraudulently sold investments in storage units could be targeted by criminals claiming to offer them compensation.

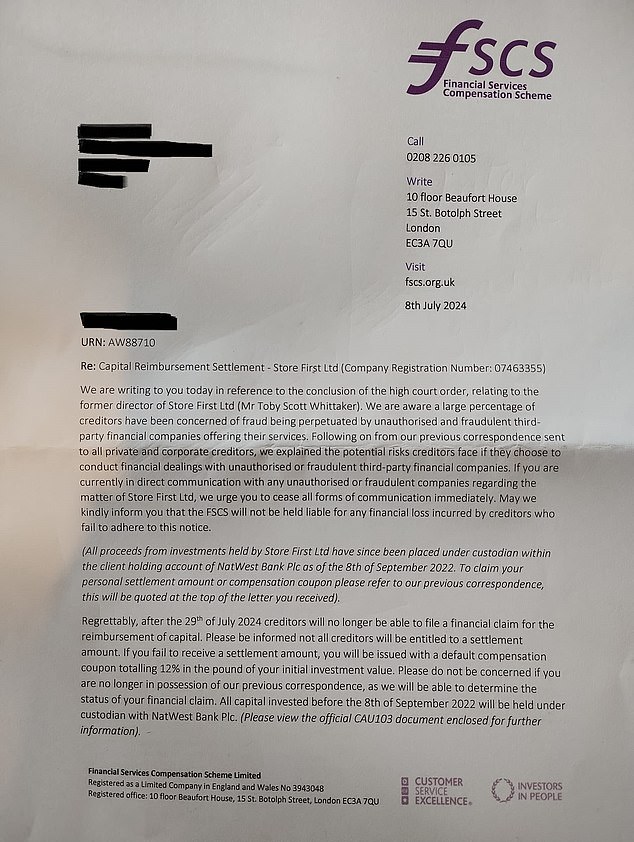

A This is Money reader has been sent a very convincing fake letter claiming to be from the Financial Services Compensation Scheme and giving details of a compensation scheme for investors in First Store Limited.

Store First was a storage module investment scheme owned by Lancashire-based businessman Toby Whittaker, which was wound up in court in 2019.

He They promised investors a guaranteed return of 8 percent in the first two years and then 10 percent in subsequent years.

Some 6,600 investors, many of them retirees, were persuaded to invest and were promised high rental returns, something that never materialised.

Adam Bennett, who had invested in Store First, received a fraudulent letter purporting to be from the Financial Services Compensation Scheme. (Archive image on the left)

What is the Store First scam?

Reader Adam Bennet, whose name we have changed at his request, told This is Money he received what appeared to be a letter from the FSCS about a Store First claim in July.

The FSCS has confirmed that this letter was not a genuine FSCS document but rather an attempted scam aimed at getting disbursed investors to complete and return a form containing personal and financial information.

The fake letter asked Adam to complete and return a Proof of Debt form with his details or call a number to “file a claim”. The enclosed form claimed to be from the Insolvency Service.

An FSCS spokesperson said: “We will never issue any forms on behalf of the Insolvency Service in the process of handling any claim.”

The FSCS confirmed that Adam Giles, whose name signed the letter, does not work for the company.

He also confirmed that the phone number used in the letter does not match the legitimate FSCS number.

The fraudulent letter appeared on FSCS letterhead, which confirmed it was not legitimate. The FSCS said the format of the letter was also different from the current format used by the financial compensation scheme.

What happened to Store First?

In April 2019, the Government Insolvency Service brought a case before the High Court over a £206m unregulated warehousing scheme set up by Store First.

The court heard that savers were tricked into investing their money through “misleading information and testimony”.

The government pushed for Store First and related companies to be wound up to protect investors.

Store First and three other related companies were liquidated by the courts in 2019.

One of them, SFM Services Limited, was purchased and now operates as Store First.

Adam said: ‘At first glance the letter looked pretty realistic with the FSCS logo, the correct return address and the fact that the scammer clearly knows I invested in this failed storage investment.

‘I became suspicious of the legitimacy of the letter when I looked up who signed it (Adam Giles, a senior financial officer) and found that it was not listed anywhere on the FSCS website.

‘There was some strange wording in the letter that was also a warning.

“It serves as a warning of how credible some of these fraudulent letters can appear.”

Adam suspects the scammers may have obtained his personal information by hacking into a database or purchasing it from other criminals on the dark web.

Convincing: The entire fraudulent letter, which could easily trick victims into believing it was real.

Can Store First investors get redress?

The FSCS protects up to £85,000 of the value of customers’ savings, pensions or investments if a financial firm fails.

Store First was an unregulated scheme, so did not have direct FSCS protection, meaning investors are not protected by the Financial Conduct Authority (FCA) or the FSCS.

The FSCS has confirmed that it can look into claims for Store First investments involving a regulated party.

For example, where an independent financial adviser incorrectly advised a client to make an investment, or a self-invested personal pension operator failed to carry out adequate checks before accepting investments into a Sipp.

An FSCS spokesperson said: ‘Sadly, fraudsters will try to use the identity of organisations like the FSCS for financial gain.

‘We have seen examples of fraudulent letters using the FSCS logo and other details that are readily available online, such as the name of a real company, to appear legitimate. We regularly update our website and social media channels to warn people about the dangers of scams.

‘The key message we want to convey is that the FSCS service is completely free of charge – we would never ask for money in exchange for compensation.

“It is also very rare that we contact anyone who does not have an active complaint with us. We always recommend that anyone with concerns about contacting the FSCS call us directly using the details available on our website.”

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible ISA now accepting transfers

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.