All eyes will be on Anglo American this week as the deadline approaches for rival BHP to make a formal takeover bid.

BHP has until 5pm on Wednesday to do so.

A takeover of London-listed Anglo could be the biggest deal the sector has ever seen.

Anglo, whose empire includes De Beers diamonds, a potash mine in Yorkshire and vast deposits of copper and iron ore, has agreed to talks with suitor BHP after rejecting the Australian miner’s £39bn offer.

It marked a significant concession by Anglo’s board, which had rejected previous bids worth £31bn and £34bn.

The decision to speak out could pave the way for an agreement.

City analysts have said a bid of £40bn or more could seal a takeover of the FTSE 100 group.

But investors will keep a close eye on whether other predators pounce.

Glencore and Rio Tinto are rumored to be considering approaches.

Liberum analyst Ben Davis has suggested that a combined bid from BHP and Glencore could generate enough firepower to clinch a deal.

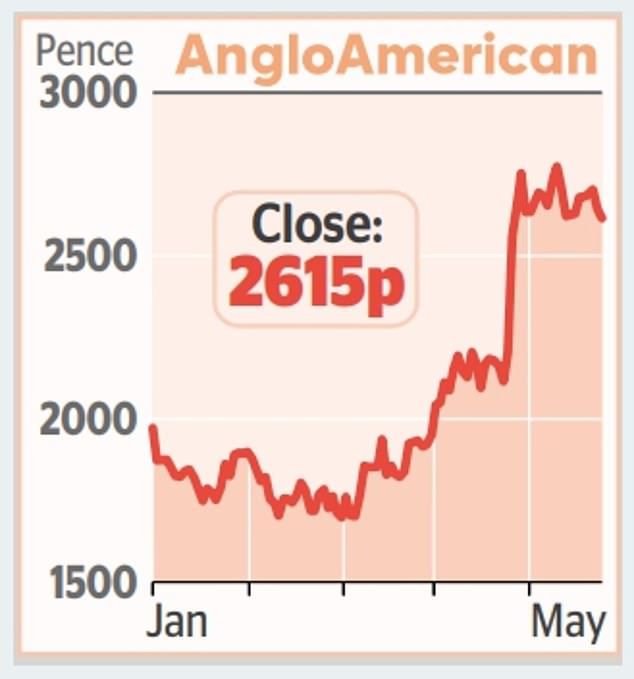

Shares have risen on acquisition talks. Anglo’s value has risen by more than a quarter since the end of April.