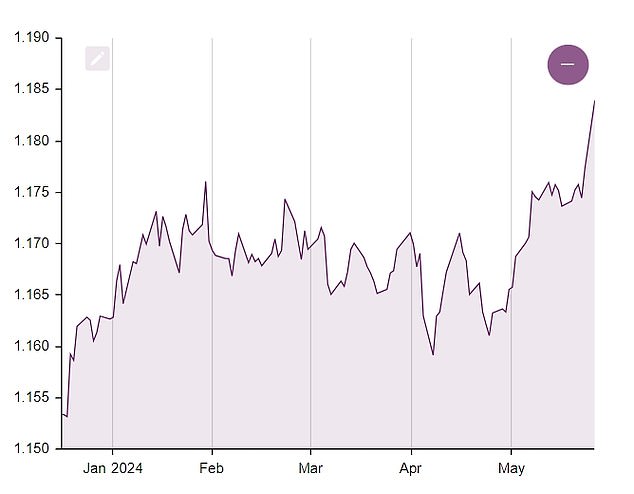

The pound has continued its strong gains against the euro since the start of the year this week, with sterling now trading at a 22-month high against the eurozone currency.

Sterling overcame an initial drop on the back of a higher UK unemployment rate to add almost 0.3 percent against the euro to 1.19 euros yesterday, having risen around 2.8 percent from the beginning of 2024.

The move is driven by Eurosceptic gains in EU Parliament elections and French President Macron’s decision to call early national elections on Monday.

But sterling’s gains against the euro so far in 2024 have largely been the result of changes in expectations about when central banks will choose to cut interest rates.

How far will the pound take British tourists this summer?

Last week, the ECB moved to cut rates for the first time in five years, while markets estimate just a 7 percent chance of a Bank of England cut at next month’s Monetary Policy Committee meeting. week and a 46 percent chance of one in August.

Similarly, the US dollar has shown strength this year as expectations for the Federal Reserve’s first rate cut are further delayed, until November.

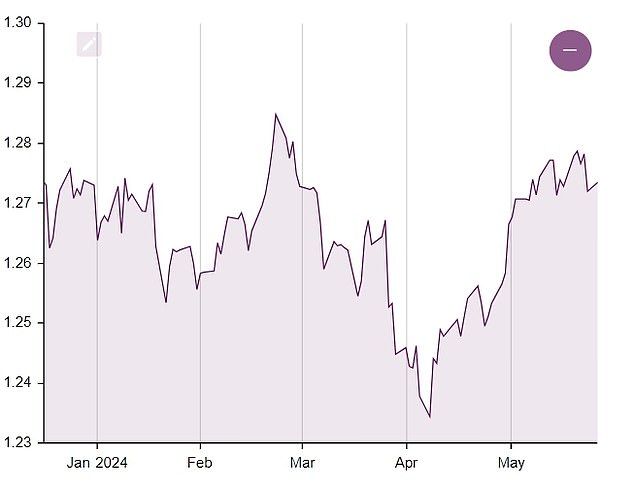

Sterling is down about 0.8 percent against the dollar since the beginning of 2024.

So, as Brits prepare for their summer holidays, how far will their pound go against the two major currencies?

French problems could mean more problems for the euro

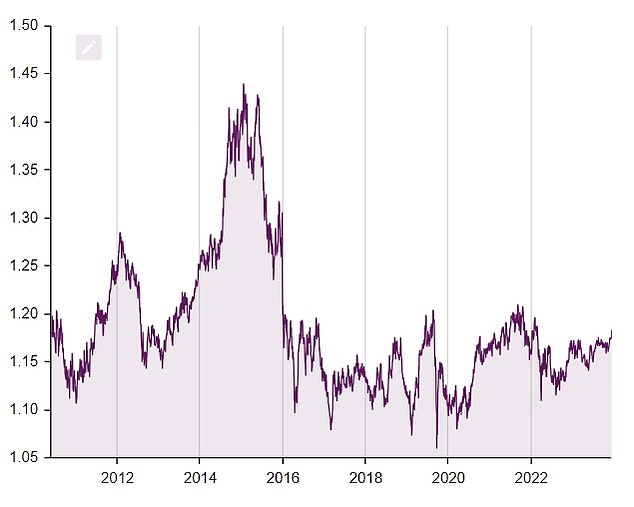

Before the global financial crisis, Brits could expect the pound in their pockets to rise much higher in the eurozone. The pound sterling constantly traded between 1.40 and 1.50 euros between 2003 and 2007.

In the wake of the crisis, the pound almost reached parity with the euro at around 1.04 euros in early 2009. The pound currently trades more than 13 percent above that level, but is still around 16, 8 percent below its 2015 high of 1.42 euros. .

Britain’s exit from the European Union has weighed on the currency, but sterling is still up more than 8 percent from its post-Brexit vote low of around 1.09 euros in August 2017.

ING’s Chris Turner said the bank expects European authorities to take action soon on France’s economic situation, which would have implications for the euro.

The French economy will struggle to achieve 1 percent growth this year, which in turn is affecting its public finances, “and will shrink only slightly this year and next,” he added.

The pound has performed well against the euro this year

The pound is about 16.8 percent below its 2015 high of 1.42 euros.

Turner said: ‘The European Commission could well launch its excessive deficit procedure against France. How the next French government responds will affect the euro.

“Needless to say, this is not an attractive proposition for the euro: fiscal consolidation or a possible French debt crisis if warnings from Brussels are ignored.”

However, ING believes a Bank of England rate cut this summer is “much more likely” than markets are currently pricing in. If the bank is right, the pound would likely fall against the euro.

Dollar strength will fade

British tourists before the advent of global finance could reliably approach $2 per pound, and sometimes higher.

This reached a high of $2.05 in October 2007.

Having plummeted to $1.38 in January 2009, the pound is now around 9 percent below that $1.27 level, although it represents a significant improvement from the paltry low of $1.08. registered in September 2022.

The dollar’s strength in 2024 has largely been the result of stronger-than-expected economic numbers (including May’s excellent jobs data) combined with sticky inflation data to deter the Federal Reserve from beginning its cycle of interest rate cuts.

The pound traded at a high of $2.05 in October 2007.

The pound has held firm against the strength of the US dollar this year

Its perceived role as a “safe haven” asset has also served it well during an unstable geopolitical period.

However, UBS analysts said they do not expect the dollar to “rise markedly above its recent range” and can see “several reasons why the latest bout of dollar strength is unlikely to last.”

Mark Haefele, chief investment officer for global wealth management at UBS, said there are “signs that the (U.S.) labor market is cooling,” which is “consistent with other recent economic data – across the board, from job offers to spending on credit cards – which point to a slowdown in the US economy.

He added: ‘The Federal Reserve should feel confident enough that inflation is sustainably returning to its 2 percent target to begin cutting rates later this year, most likely at the U.S. policy meeting. September.

‘The dollar is not cheap and is at levels comparable to those of the mid-80s or early 2000s, which, in our opinion, leaves limited room for further increases.

“In the absence of extreme events, such as the war between Ukraine and Russia and the explosion of natural gas prices in 2022, we find it difficult to call for a further rise in the dollar beyond this year’s ranges.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.