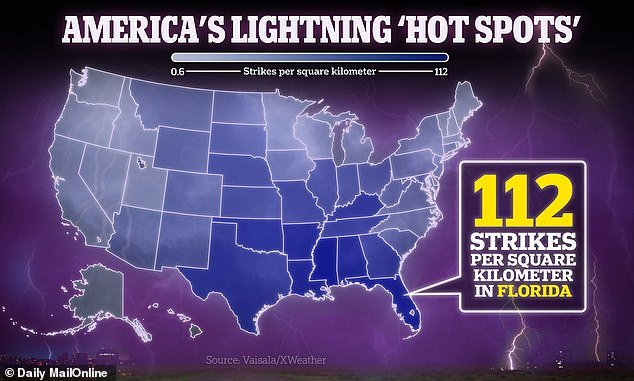

The odds of being struck by lightning are one in 15,300, but certain parts of the United States are lightning hotspots.

New data from the University of Wisconsin-Madison (UWM) has revealed that Americans experience 36.8 million ground attacks a year, with Florida being the hardest hit.

More than 120,000 lightning strikes were recorded in the Miami-Fort Lauderdale area alone in 2023.

The state’s location combined with the shape of its peninsula surrounded by water are the reason storms develop almost every afternoon.

Meteorologists found that Louisiana had the highest volume of deadly “cloud-to-ground” lightning strikes and “Tornado Alley” also receives its fair share of lightning strikes.

New data from the University of Wisconsin-Madison (UWM) has revealed that Americans experience 36.8 million ground attacks a year, with Florida being the hardest hit. More than 120,000 lightning strikes were recorded in the Miami-Fort Lauderdale area alone in 2023.

According to meteorologist Chris Vagasky, who works at the University of Wisconsin-Madison, lightning kills or maims about 250,000 people worldwide each year. Above, lightning strikes Chicago during two days of unusually warm weather, February 27, 2024

“In the United States, an average of 28 people were killed by lightning each year between 2006 and 2023,” meteorologist Chris Vagasky shared in The conversation.

According to Vagasky, lightning kills or maims about 250,000 people worldwide each year.

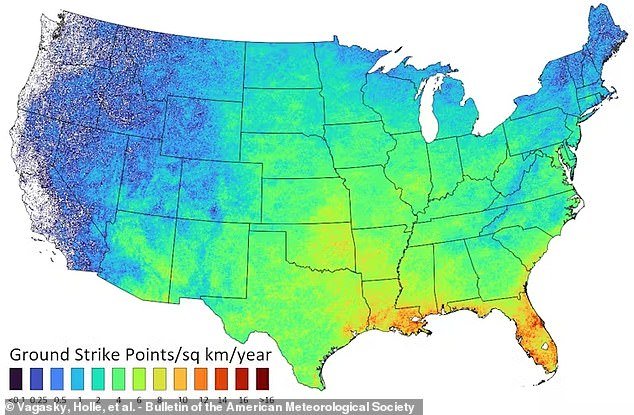

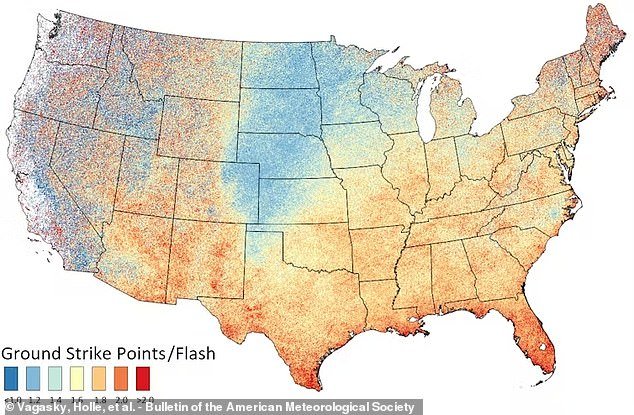

The new map revealed that lightning is denser around the Gulf Coast and southern plains, while fewer lightning strikes are seen in the western United States.

The reason states like California rarely see lightning is due to the Pacific atmosphere, which produces cloud-to-cloud lighting, rather than cloud-to-ground strikes.

And Arizona generally only sees lightning during the monsoon season, which occurs during the summer.

The frequency of lightning strikes per year, averaged over six years, shows the greatest activity along the Gulf Coast.

The map also showed that New England is in the safe zone, which is likely due to salt particles within the clouds, causing droplets to fall as rain instead of rising to form ice.

If fewer ice particles form, there is less chance of clouds becoming electrified.

Vagasky and his colleagues examined more than six years of data from the National Lightning Detection Network’s (NLDN) vast array of antennas, which records bursts of radio waves produced by lightning.

The researchers’ analysis of lightning data between 2017 and 2022, published this week in the Bulletin of the American Meteorological Societydiscovered that many lightning bolts or “flashes” hit the ground at several points at once, like the tips of a giant electric fork.

“We found that an average of 23.4 million flashes occur in the United States,” Vagasky said.

But each of those flashes of illumination fragmented, crackling into 55.5 million rays and 36.8 million “ground strike points” of lightning each year.

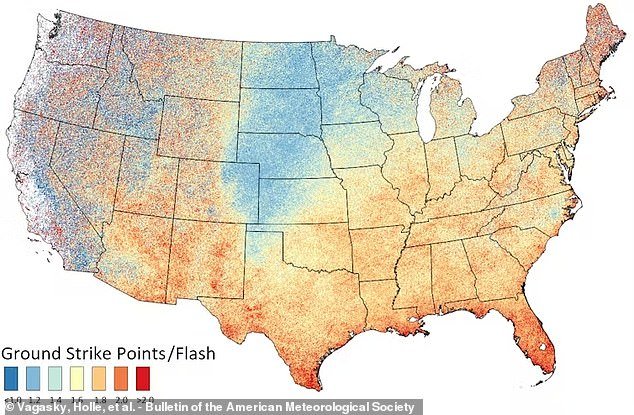

The average number of cloud-to-ground lightning strike points per flash in the United States between 2017 and 2022

Before this study, estimates of lightning strikes in the United States were rough and inconsistent, and meteorologists since the 1990s have often repeated the conventional wisdom of about 25 million lightning strikes across the United States per year.

The Centers for Disease Control and Prevention later stated that the rate was approaching 40 million lightning strikes a year, an inconsistency that has hampered lightning protection and safety efforts.

While Vagasky and his colleagues also found that lightning in some parts of the country is more likely to strike the ground at multiple points than others, most of the U.S. has a ratio between 1.4 and 1, 8 bolts per bolt, they found.

There were two notable exceptions.

The first was a triangle in the central ‘High Plains’ states, where the team recorded the only average rate less than a ground strike per flash, a rarity they linked to a 2014 study showing more ‘anomalously electrified storms’. ‘on the plains.

These storms had more lightning traveling within and between the clouds.

The second outlier occurred in the western US, which they said could be due to missing data due to lack of lightning or “statistical noise.”

The damage threatens not only people’s lives and the natural environment, Vagasky said, but also the country’s economy.

Insurance agencies shell out about $1 billion a year for lightning damage claims (above, lightning strikes an American Eagle plane full of passengers in Arkansas)

“Both exceptions to the typical ratio,” Vagasky and his co-authors wrote in the Bulletin, “should be considered when designing lightning protection systems in these regions.”

But the government’s climate assurance aside, the researchers expressed hope that their study will simply lead to more basic science about the geological and geophysical conditions that produce lightning.

There may be ‘applications’ or safety construction techniques that ‘benefit from knowing that a single flash can transfer charge to ground at multiple, widely spaced locations,’ they wrote.

What’s more, according to the Idaho-based newspaper National Interagency Fire CenterAbout four million acres of land across the United States are consumed each year in devastating wildfires sparked by lightning.

The damage threatens not only people’s lives, homes and the natural environment, but also the country’s economy, Vagasky said.

Insurance agencies shell out about $1 billion a year for lightning damage claims, according to the Insurance Information Institute.

“Each giant spark of electricity travels through the atmosphere at 320,000 kilometers per hour,” according to the meteorologist.

Each ray “is hotter than the surface of the sun and generates thousands of times more electricity than the outlet that charges your smartphone,” he said.

Lightning is most common near the warm waters of the Gulf, according to Vagasky, because the region is rich in the atmospheric ingredients essential for thunderstorms: warm, moist air near the ground, combined with cooler, drier air above, ready to strike. mingle.

“Anywhere those ingredients are present,” he said, “lightning can occur.” All it takes is one weather event that lifts the warmer, moister air upward.

Across the country, the comparatively colder waters of the Pacific Ocean tend to reduce the chances of thunderstorms, but those less frequent storms have still proven to be incredibly dangerous for sparking wildfires.