Older people are set to receive a £460-a-year increase in their state pension, to around £11,960 next spring, in line with 4 per cent pay growth for the working population.

This means the full state pension will rise to £230.05 a week, up from £221.20 at present.

The state pension is increased each year by the highest of inflation, average wage growth or 2.5 percent under the triple lock commitment to pensioners.

The Labour government promised during the recent election to maintain the triple lock throughout the current parliament.

Triple lock: the state pension is increased each year based on the highest of inflation, average wage growth or 2.5%.

The key figure for wage growth used in the calculation corresponds to total pay, including bonuses, in the three months to July, and was published today at 4 percent.

The preliminary CPI inflation figure is taken from September and published in October.

But this will almost certainly not come into play when it comes to setting the state pension this time around: it currently stands at just 2.2 percent.

The main state pension received an 8.5 per cent increase to £221.20 a week or around £11,500 a year last spring, for people who retired since April 2016 and qualify for the full rate.

People who retired before April 2016 on the old basic state pension currently receive £169.50 a week or around £8,800 a year.

A 4 per cent increase for them will equate to around £176.30 a week or almost £9,200 a year next spring.

Those on this lower rate also receive significant top-ups, called S2P or Serps, provided they were earned early in life. However, these are increased based on inflation, not the triple lock.

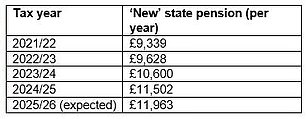

Full-rate annual state pension from 2021. Source: AJ Bell

The Government has pointed to blocked triple rises in state pensions to help justify its plan to scrap the Winter Fuel Payment for most pensioners.

Around 10 million pensioners are expected to lose the benefit, worth between £100 and £300 a year, before the next increase in the state pension in the spring.

Payments currently available to all pensioners will be restricted to those who apply for pension credit or certain other benefits.

> How to apply for a pension loan: Read the This is Money guide

The move has sparked an uproar among critics, who fear that those who do not apply for the pension credit or whose income is just above the qualifying threshold will face serious hardship and risks to their health or even their lives this winter.

Meanwhile, the Government will face a different challenge as the main state pension rate approaches the personal limit of £12,570.

This is the level at which income tax begins to apply, and has been frozen since 2021.

This creates an anomalous situation where millions of people are paid a state pension by the Department for Work and Pensions, part of which is then recovered by the Treasury in the form of income tax, potentially forcing ever-increasing numbers of people to file annual tax returns with HMRC.

Millions of pensioners already do this because they receive a state pension of more than £12,570.

STEVE WEBB ANSWERS YOUR QUESTIONS ABOUT PENSIONS

This is because they reached state pension age under the old, pre-2016 system and earned enough of the second state pension, also known as Serps, to build up more generous payments in retirement.

Meanwhile, an increasing number of retirees who receive a modest income from private pensions in addition to the state pension also have to file a tax return.

“Staying true to its triple lock promise may help redeem the government in the eyes of UK pensioners,” says Rachel Vahey, director of public policy at AJ Bell.

‘The Government is coming under increasing pressure to reverse its controversial decision to scrap the Winter Fuel Payment for all pensioners except those claiming pension credit.

‘And while the rise in state pensions should help cover next year’s bills, it does nothing to help those who will be living on the edge of their means this winter.

‘The triple lock guarantee has worked well for pensioners in the recent past, increasing the state pension by 28 per cent over the past four years.

‘But with the state pension inching ever closer to the frozen personal allowance of £12,570, and the concept of a universal payment coming under increasing scrutiny, the Government will have to take the bull by the horns at some point to address who should receive the state pension, at what age and how much.’

Alice Haine, personal finance analyst at Evelyn Partners, says: ‘The bumper rise may come as a comfort to pensioners still struggling with the fallout from the cost of living crisis, but the heavy shadow cast by Labour’s pledge to scrap the winter fuel payment for all but the poorest pensioners may take some of the shine off the news.

‘Add to this frozen tax thresholds, with the new full state pension inching ever closer to breaching the standard personal allowance of £12,570 (the point above which any income is taxable), the potential loss of the winter fuel allowance and the threat that Housing Secretary Angela Rayner could abolish a council tax exemption for single-occupant households, and it’s easy to see why pensioners feel under siege.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.