Table of Contents

Savers are still chasing old state pension top-up payments made to the Government months or years ago, with a new deadline looming in April.

Lynne Cole, 71, paid more than £800 in early 2023, amid the latest big rush to take advantage of a deal to buy top-ups dating back to 2006.

Almost two years later, she still had not received any increase in her state pension, despite her MP’s attempt to help her, until her husband left a comment on a Steve Webb column last month, saying: “We are both possibly dead before she arrives.” he!’

A week after This is Money flagged the delay to the Department for Work and Pensions and HMRC, Ms Cole received a back pay of £530 and a state pension increase of around £7.70 a week.

It turned out that his case had been marked “complex” for an unknown reason, set aside, and not addressed by government staff until we demanded an explanation.

Buying top-ups can give a generous boost to retirement income if you buy the right years on your record.

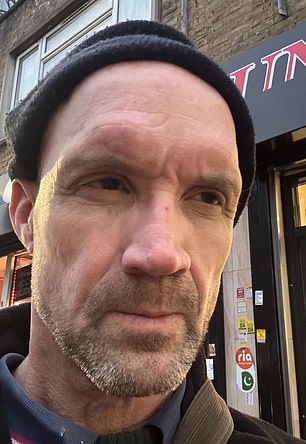

Lynne Cole: “It seems like I’ve been going around in circles getting nowhere for almost two years”

Savers now have until April 5 to take advantage of the 18-year-old top-up purchase agreement, after which it will revert to just six years unless the deadline is delayed.

In spring 2023, the limited-time deal proved so popular that savers blocked phone lines and overwhelmed the system.

The crisis ultimately forced the Government to extend the deadline twice, first until mid-summer and then, when demand did not slow down, until April 2025.

That led to a huge backlog of payments in processing, and This is Money readers contacted us in droves over the next year to complain about long delays, lost cash, and government staff providing incorrect information or being unable to help.

Some accused the Government of encouraging them to make unnecessary payments and then failing to help them find and refund their cash.

We are still receiving messages and we highlight below Ms Cole’s struggle to locate her missing payment and two other failed cases. If your payment was lost, scroll down to find out how to contact us.

Why are refills so valuable? Could YOU benefit? Are DWP and HMRC ready for another big avalanche?

This is Money’s guide to buying state pension top-ups offering six golden rules for deciding whether to fill the gaps, written by Steve Webb, former Pensions Minister and our retirement columnist.

It can be very cost-effective because an extra year will increase your state pension entitlement by 1/35 of the standard rate.

That equates to £6.32 a week, around £329 a year, or almost £6,600 over a 20-year retirement (without taking into account tax), for an initial outlay of £824.20 at the 2022 exchange rate. -2023, or less if you are completing a partial year. The fee for 2023-2024 and 2024-2025 is £907.40.

DWP and HMP launched new online tool in 2024 to help people check if they should fill state pension gaps and buy top-ups more easily and since then we receive many fewer messages from unhappy readers.

The system is managed jointly by the two departments. HMRC is responsible for maintaining National Insurance records, which you must check for gaps in your state pension records, and for processing top-up payments. The DWP is responsible for reviewing state pension forecasts or payments after purchases.

If money is lost, it is difficult to know when it happened and therefore which department to go to. Readers constantly tell us how they call and are sent spinning in circles, never finding a member of staff willing to help resolve the issue.

State pension top-ups: The system is jointly managed by HMRC and the DWP, which say they “work closely and always prioritize resources as needed to manage peaks in demand”.

Meanwhile, a state pension reform in April 2016 means some top-ups do not improve your payments.

If you gave money unnecessarily due to your own mistake or misguided advice from government staff, you will need to request a refund.

When we were investigating cases of missing cash for this story, we asked whether HMRC or DWP or both plan to assign additional staff to deal with top-ups in the run-up to the April deadline, and whether they intend to work more closely. so that payments are processed efficiently and are not lost among themselves.

In light of Ms Cole’s experience, we also asked how many top-up cases are currently flagged as ‘complex’ and dropped, and what DWP and HMRC are doing to address them.

A Government spokesperson says: “There is still time to make voluntary contributions before the deadline of April 5, 2025.” We encourage people to act now.

“HMRC and DWP will continue to work closely and will always prioritize resources as necessary to manage peaks in demand, particularly for the upcoming deadlines.”

“We have apologized to Ms Cole for the level of service she received and where errors occur we are committed to resolving them as quickly as possible.”

Do you want to buy refills or just see if it’s worth doing so in your own circumstances? Use the Online recharge service here or the HMRC application.

This is Money’s guide to buying state pension top-ups here. If you paid and haven’t heard anything else, please contact us at pensionquestions@thisismoney.co.uk.

Unfortunately we can’t help everyone, so you can also contact your MP. If you are an expat, you can contact the MP of the last constituency you lived in and still ask for help. Find your deputy here.

“It seems like I’ve been going around in circles and getting nowhere.”

Lynne Cole, a retired mortgage manager from Kent, saw her £824.20 payment to top up her state pension disappear in February 2023.

At that time, the avalanche of savers who took advantage of the special top-up offer increased.

This is Money was the first to report on the phone block the same month and on the first calls to extend the deadline, which ultimately came twice.

Mrs Cole’s check was also cashed at the same time, but despite her letters and phone calls and the involvement of her MP, by December 2024 there was no sign of her additional pension.

That’s when her husband Patrick left a frustrated comment on Steve Webb’s recent column about buying refills, we discovered it and emailed him that same day.

When we spoke to Mrs. Cole, she told us, “It seems like I’ve been going around in circles and getting nowhere for almost two years.”

Mr Cole added: “Perhaps we should have contacted you sooner, but who would have thought it would take so long?

‘Lynne called them and they told her there was a delay. It’s ridiculous. You wouldn’t believe it. Two years have passed.

A couple of days after This is Money reported her case, a member of DWP staff called Ms Cole to sort out the matter.

She told us: ‘We spoke to a very helpful person who made no excuses and said that for some reason my case had been flagged as complex, left out and not dealt with.

‘He couldn’t say why this had happened and said it was nothing complex. He said that a backdated pension payment of £533 would be credited to my bank account on Monday and that my pension would increase by around £400 a year.

‘Once again, thank you very much for your help in this matter, without which I would still be waiting. It’s one less thing to worry about.

The Government apologized to Mrs Cole for the level of service she received, her state pension was increased to reflect her updated National Insurance record and arrears were issued.

Richard Felton: Paid £982.80 in June to fill gaps in his state pension record, but his cash was stuck in the system for six months.

DWP put me on a ‘priority list’ but I still waited months

Richard Felton, 59, paid £982.80 in June to fill gaps in his state pension record but was left stuck in the system for months.

The IT business analyst, who lives in London, told us: ‘At first I was told to allocate two weeks, then eight weeks, then 26 weeks. Still waiting.

‘They know my NI shortfalls per year, they confirmed receipt of the money in June, they know the years that need to be completed. Surely the assignment should be automatic?

‘Maybe they are updating the computer systems and it has become overloaded, but this is a simple procedure, right? I think an intern could create a spreadsheet in days.

‘I’ve chased DWP a couple of times. They put me on a ‘priority list’, but the target date is still December 2024.’

When This is Money raised Mr Felton’s case with DWP and HMRC, they apologized and assigned his contributions to his National Insurance record.

Meanwhile, Christine Walker (name has been changed) first contacted us about delays in processing her cash top-ups just over a year ago.

We covered his and 10 other readers’ experiences at the time, and his £6,500 payment was allocated to his state pension record at the time.

But that wasn’t the end of the story for the 67-year-old, who lives in the United Arab Emirates, because she received advice from government staff to buy an extra top-up and paid around £820 in mid-March.

This payment was also lost in the system, until This is Money searched for it last June.

Mrs Walker had deferred her state pension while all this was sorted out, but when she finally applied, her last supplementary payment was not properly backdated.

This is Money called on the DWP and HMRC to investigate this third failure, prompting an apology and a late payment of £85.

What do DWP and HMRC say?

The Government provided the following additional information on the purchase of state pension supplements:

– People can check and fill any gaps in their National Insurance record quickly and easily, using our check your state pension forecasting tool on Gov.uk.

– We encourage people to check whether voluntary NI contributions would be worth paying using our online checker. It allows most people under state pension age to see gaps in their NI record and pay voluntary contributions to fill those gaps.

– People have until the April 5, 2025 deadline to pay record National Insurance shortfalls dating back to April 6, 2006.

– We always prioritize resources to deal with the expected busiest periods. This will include reviewing our resources before the deadline.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.