Spirit Airlines is preparing to file for bankruptcy after merger talks with Frontier Airlines collapsed, according to a report.

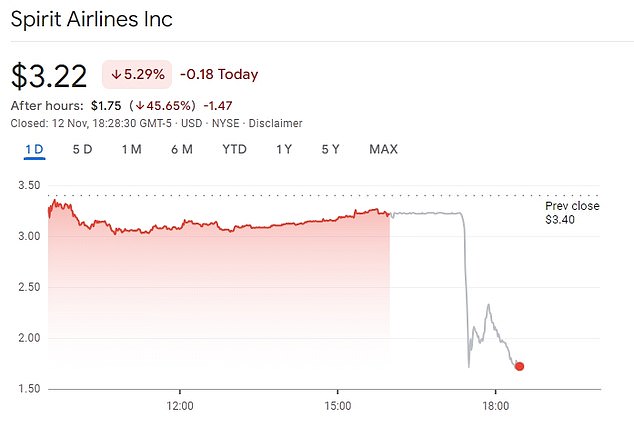

After the news broke at 5:30 p.m., the share price plummeted 45 percent in seconds, wiping hundreds of millions in market value from the low-cost airline.

The Florida-based airline is in final negotiations with bondholders over a restructuring plan to secure support from key creditors, the The Wall Street Journal reported this afternoon. He owes more than 3 billion dollars.

The airline could move forward with its bankruptcy filing in the coming weeks, sources familiar with the matter told the WSJ.

Already this year it reduced its growth plans, suspended staff and signed a plan to sell 23 aircraft.

Spirit is expected to file for Chapter 11, a form of bankruptcy that allows it to continue operating while it tries to reduce its debts.

However, this could mean significant reductions in routes and personnel. If cost-cutting efforts are not sufficient, the airline could face the prospect of complete closure.

Spirit Airlines’ stock price plunged 45 percent in after-market trading Tuesday after the Wall Street Journal reported that it was on the verge of filing for bankruptcy. The drop occurred within seconds as investors rushed to sell the shares. He recovered briefly before falling again. This chart shows the stock price one hour after the news.

Spirit Airlines is reportedly planning to file for bankruptcy following its failed merger with JetBlue.

Spirit Airlines did not immediately respond to a request for comment.

The airline has been losing money despite strong travel demand.

Some of its massive $3.3 billion in debt is due soon, including more than $1.1 billion in secured bonds that mature in less than a year.

It had faced an Oct. 21 deadline from its credit card processor to refinance or extend those notes.

Last month, Spirit said it would furlough about 330 pilots on Jan. 31 as part of its efforts to cut costs and shore up its finances.

It has failed to report profits in the last five of six quarters, raising questions about its ability to manage looming debt maturities.

Spirit has been struggling with losses and declining revenue since the pandemic. In fact, while it may have turned a profit some quarters, it hasn’t turned an annual profit since even before the pandemic.

Then, when travelers started flying again, many turned to larger airlines, leaving Spirit and other low-cost airlines struggling to gain a foothold in the market.

Frontier Airlines and Spirit Airlines first planned to merge in 2022, but JetBlue Airways swooped in with a higher offer. That convinced Spirit shareholders.

Spirit executives saw the merger with JetBlue as a way to regain market share, but the Justice Department argued that such a deal would violate antitrust laws, and a judge agreed.

Spirit Airlines CEO Ted Christie previously said in June that the airline was not considering filing for Chapter 11 bankruptcy, instead saying he was “encouraged” by the plan it had in place after the bankruptcy failed. agreement with JetBlue.

Spirit executives saw the merger with JetBlue as a way to regain market share, but the Justice Department argued that such a deal would violate antitrust laws.

The judge ruled in January that the merged company would harm travelers who rely on Spirit’s low fares and said it would reduce competition.

As a result, JetBlue backed out of a merger deal.

Spirit was in talks with Frontier again in October, hoping to revive merger discussions. But Frontier walked away.

Since the beginning of the year, its shares are down more than 86 percent.