Table of Contents

The arrival of another Donald Trump presidency in the United States could signal interstellar returns for London-listed Seraphim Space.

Space played a huge role in the political agenda of Trump’s first term in the White House, and the emergence of Elon Musk in the president-elect’s inner circle suggests the next four years may be no different.

Seraphim, which is the world’s first publicly traded ‘SpaceTech’ investment company, told shareholders on Tuesday that a second Trump presidency “bodes well for the company’s prospects and its portfolio.”

It said: “Space was at the forefront of the first Trump administration that saw the establishment of the Artemis program, the relaunch of the National Space Council, and the creation of the Space Force.”

“While we will have to wait for the political details, with Elon Musk taking on a senior advisory role to the incoming administration, we expect space to once again be central to Trump’s agenda, driving demand for both the current top spaces/ defense as well as new market participants.

“We also expect to see considerable increases in the defense and space budgets of European and NATO members as a result of Trump’s re-election.”

The November launch of a SpaceX Falcon 9 rocket, owned by Elon Musk, at Cape Canaveral Space Force Station in Florida, carrying a GSAT-20 communications satellite.

Seraphim invests in an international portfolio of unlisted SpaceTech businesses, predominantly early and growth stage.

But he actively avoids investing in launch companies such as Virgin Orbit, which fell into bankruptcy after the failure of its LauncherOne rocket at one of Britain’s new spaceports in Cornwall.

Seraphim shares They have added almost 80 percent in the past 12 months, and the company raised $900 million in new investments during its most recent financial year as its portfolio holdings took significant steps toward profitability.

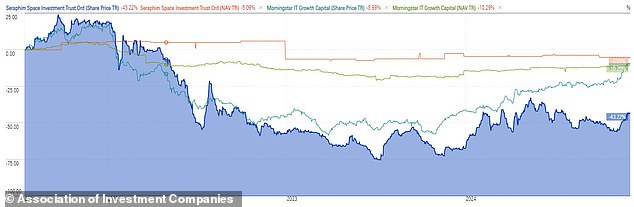

But the shares are down more than 40 percent since their listing in July 2021 and are trading at a 36.4 percent discount to net asset value, according to the Association of Investment Companies, as higher interest rates have taken their toll on both growth and investment stocks. trusts.

Analysts at QuotedData recently wrote that while “deep discounts appear to be the norm” for Seraphim’s peer group, its current discount “seems unreasonable.”

He added: ‘The market is yet to recognize the material progress that SSIT’s investments have made.

‘This suggests that the discount offers an attractive opportunity. Especially considering the powerful tailwinds that interest rate cuts would bring.’

In the last two years, a wide discount has been opened on the net asset value of SSIT

How Seraphim is progressing

On Tuesday, Seraphim also updated investors on the progress of some portfolio holdings over the past month.

Space-to-cloud data and analytics company Spire Global has sold its maritime business to Belgian business intelligence firm Kpler for $241 million, in a “pivotal move” to reduce debt and strengthen its financial position, according to Seraphim.

SatVu, which provides thermal imaging from space, has secured £10m funding ahead of two satellite launches scheduled for next year.

Satellite designer and manufacturer AST SpaceMobile has secured launch services agreements to expand its space-based cellular broadband network, which “aims to provide continuous global coverage in key markets such as the United States, Europe and Japan and for the United States government,” Seraphim said.

Top SSIT holdings at the end of June

Low Earth orbit specialist LeoLabs and Finnish microsatellite group ICEYE have joined the US Department of Defense’s commercial Augmentation Space Reserve program.

The latter also partnered with defense giant Lockheed Martin to improve AI-enabled guidance capabilities, while Xona Space Systems partnered with Astranis to improve the US military’s GPS resilience by providing backup GPS systems based on the space.

Seraphim said: “The portfolio continues to perform commercially, with SSIT well positioned to benefit from the continued rise in global defense spending.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.