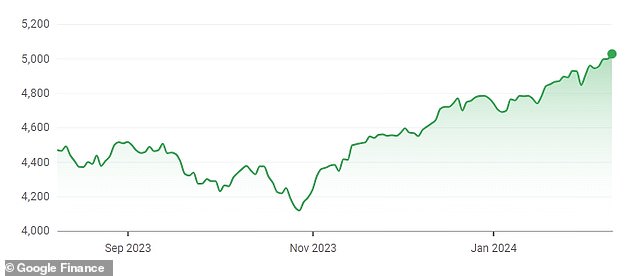

- The S&P 500 Index finished above 5,000 for the first time on Friday

- Investors Trust AI That Fed Rate Hikes Are Coming

The S&P 500 closed above 5,000 for the first time on Friday afternoon, as technology stocks rose and expectations increased that the Federal Reserve will finally lower rates.

The famous index tracks the performance of the 500 largest public companies in the US and is indicative of the perceived health of the economy.

The companies leading the charge are primarily tech giants fueled by the hype around artificial intelligence over the past year, many of which announced strong results for the latest quarter this week.

Chipmaker Nvidia gained ground on Friday after it was reported to be building a new business unit focused on designing custom AI chips for cloud computing companies.

The S&P 500 closed above 5,000 for the first time on Friday afternoon

Chipmaker Nvidia is one of the tech stocks that led the S&P 500 charge thanks to enthusiasm around AI

The current rally that took the S&P to the 5,000 level began in late October. The photo shows the S&P 500 index for the last five months.

Also contributing to confidence that greater economic growth is on the horizon is the expectation that the Federal Reserve will soon cut interest rates to record levels.

Doing so will reduce the high cost of borrowing currently faced by both businesses and consumers and increase the amount of cash circulating in the economy.

And while the index surpassing the historical level is fundamentally good news for corporate America, it will also benefit millions of ordinary Americans.

“It translates into gains in investment accounts, especially index-tracking mutual funds and ETFs, helping to bolster retirement savings,” said Mark Hamrick, senior economic analyst at Bankrate.

“This record rally has been driven by enthusiasm for big tech names, based on hopes for artificial intelligence amid the resilience of the US economy supporting corporate profits,” he added.