- Car insurance premiums are rising and drivers will pay an average of £543 in 2023

- Citizens Advice says steep price rises are impossible for many to afford

- Insurers defend premium increases by saying their own costs are rising rapidly

Some families are being forced to choose between buying food or car insurance, charities warn.

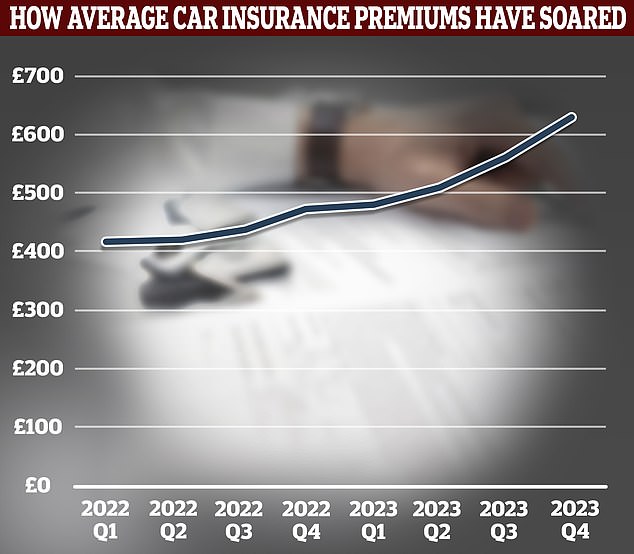

Motorists face huge increases in insurance costs, with the typical driver paying £543 to insure their car by the end of 2023, up from £434 in 2022.

In response, MPs on the Treasury Select Committee launched an inquiry into the cost of car insurance.

Speaking to the committee, the Citizens Advice charity said an increasing number of drivers cannot afford insurance and are even forced to choose between buying food or covering their car.

Shooting up: Car insurance costs have accelerated in recent years

Citizens Advice chief policy director David Mendes da Costa said: ‘That’s the situation people come to us with.

“That is why it is essential for us and for the FCA [Financial Conduct Authority]to investigate whether we are seeing fair value in this market.’

Da Costa added that the people most affected by the premium increases were those on lower incomes, who paid £250 more on average for car cover.

Last year, more than half of Citizens Advice advisors reported seeing clients canceling car insurance because of cost, up from 5 percent in 2002.

“For us, the fundamental concern is affordability and people not being able to access these products,” Da Costa said.

Overall, the average driver now pays 70 per cent more to insure their car than they did 10 years ago: £627 now compared to £370 in 2013.

Insurers have defended the price increases by saying their own costs have increased, including the cost of repairing cars and replacing vehicles, as well as increased theft.

Car insurance premiums may even continue to rise if these pressures continue, the head of regulation at the Association of British Insurers, Charlotte Clark, told MPs.

The committee is also investigating higher payments made by customers who pay for auto insurance monthly, not annually.

Paying monthly usually means paying more, and today which consumer group? found that some drivers are hit by annual percentage rates (APRs) of nearly 40 percent.

Which? She asked 39 auto insurers and 34 home insurers what APR rates applied to monthly payments and, when there was more than one rate, why.

For auto insurers, the highest rate was 1st Central’s 39.11 percent: it charges between 5 percent and 39.11 percent, giving each customer a personal interest rate after an evaluation of the credit risk.

First Central told Which?: ‘We understand that it is important for customers to keep the price of insurance as low as possible, and benchmarking tells us that we are competitive for both annual premiums and those who wish to pay monthly through a credit agreement. .’

The average rate among 27 interest-charging providers who disclosed their rate was 23.37 percent.

Only two motor insurers surveyed, NFU Mutual and Hiscox, said they do not charge interest on monthly payments.

Ten auto insurers refused to disclose their rates to Which? – AXA, Budget, Dial Direct, Esure, First Alternative, Geoffrey Insurance, Nutshell, Sheilas’ Wheels, Swiftcover and Zenith.

Which? Policy and advocacy director Rocío Concha said: “Motorists need car insurance to drive legally and the vast majority of mortgage lenders will insist that homeowners have cover; however, those who cannot afford the luxury of paying their premiums in one go are being penalized with exorbitant interest rates.

‘The regulator has been clear: paying insurance monthly is a tax on poverty and it is shocking to see that providers are still trying to justify this practice.

“Because many companies’ interest rates do not appear to reflect the modest risk they are taking, customers who pay monthly are charged disproportionately more than those who pay annually.”