Table of Contents

- Smiths Group now anticipates its organic sales will grow between 5% and 7% this financial year.

- It also expects operating profit margins to increase by 40 to 60 basis points.

Smiths Group Shares led gains in the FTSE 100 on Wednesday after the owner of John Crane raised its annual revenue guidance.

The engineering business now expects its organic sales to grow 5 to 7 percent this fiscal year, up from a previous forecast of 4 to 6 percent.

It also expects operating profit margins to rise by 40 to 60 basis points, having previously said there would be “continued margin expansion.”

Update: Smiths Group shares outperformed FTSE 100 gains today after John Crane owner raised annual revenue guidance

Smiths Group shares rose 10.6 per cent to £16.84 at midday on Wednesday.

In the three months to November 1, the London-based company recorded a 15.8 per cent increase in its organic turnover thanks to growth in its four main business divisions.

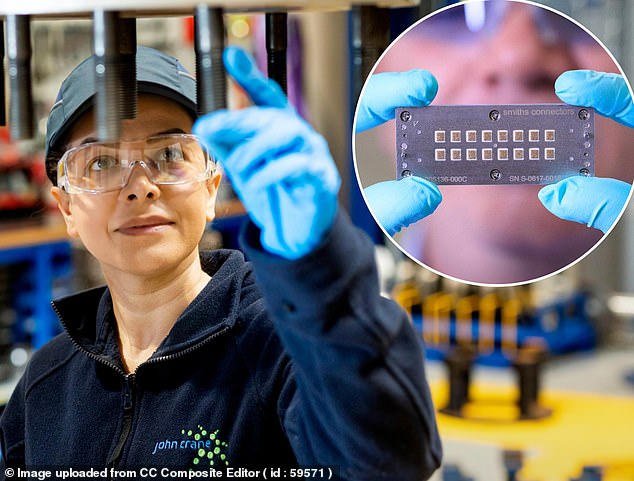

Organic sales rose by double-digit percentage levels at its SmithsDetection division, which makes airport security scanners, and Smiths Interconnect, a supplier of microprocessors and graphics chips.

The firm said the former division’s performance reflected “high levels of installation activity” and a large order book at the start of the year.

Meanwhile, revenue from the latter segment rose more than 30 percent as its semi-testing business was boosted by a strong rebound in semiconductor markets.

Roland Carter, chief executive of Smiths Group, also said the company benefited from a good result in the US, where it makes around 45 per cent of total turnover.

“Our strategy of generating profitable growth from secularly attractive markets continues to drive our performance,” he added.

Carter was named CEO in March after three decades of working for the company, including six years as president of SmithsDetection.

On the same day it took over, Smith Group announced a £100m share buyback program as part of its half-year results.

Having completed an initial £50m tranche, Smiths Group is beginning the second half of the plan but intends to spend a further £50m to buy back its shares before the end of the financial year.

Stifel analysts said Smiths Group’s trading update was “impressive” and “should be a clear positive for the share price which has been languishing.”

They added: “We also note that Smiths appears well positioned for the new geopolitical realities: low exposure to China, large dollar earner, large hydrocarbon end markets and largely local to local in its markets.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.