The Virgo Moon is in harmony with Venus and Uranus this Friday, a randomly selected online horoscope tells us.

True or not, what is clear is that the stars are aligning to Phoenix Copper Ltd. after seeing an $80 million copper corporate bond issue fully subscribed by one investor this week.

The bonds will be retired in stages as construction begins on Phoenix’s Empire open pit mine in Idaho, US.

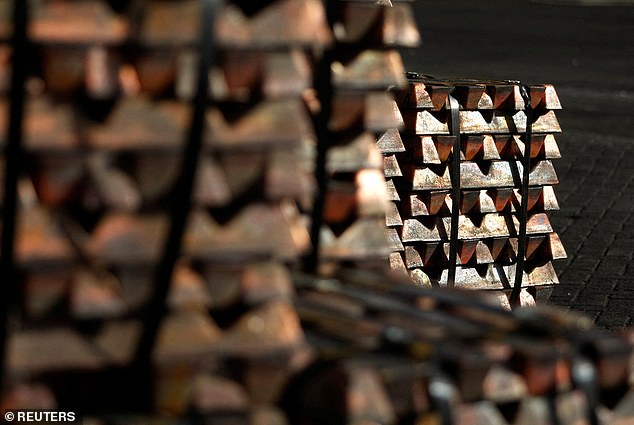

Copper is certainly hot at the moment, having soared to a new record this week and was, in fact, the catalyst for BHP’s rejected £34bn purchase from Anglo American.

Phoenix chief executive Marcus Edward-Jones said: ‘Uncertainties over the Chinese and US economies meant that drivers of electrification and supply issues were slower to reassert their influence on the copper price. Now it seems the money has finally run out.’

Popular: Copper is certainly hot right now, having soared to a new record this week and was in fact the catalyst for BHP’s rejected £34bn raid on Anglo American.

“Despite several delays and disappointments, we are hopeful that our stars will finally align,” he added.

Phoenix shares rebounded 33 percent on news of the bond signing. They have since recovered, but managed to close the week up a respectable 8 percent.

Less fortunate was the Belfast shipbuilder Harland & Wolffwhich reportedly saw a £200m round of government funding rejected.

Chief executive John Wood denied the reports, but negative coverage continued until Friday and The Telegraph reported today that a £1.6bn Ministry of Defense contract won in 2022 is on the ropes.

Wood called the contract “a truly defining moment” at the time. Not surprisingly, Harland & Wolff’s share price fell 26 percent over the week.

As for the overall health of small-cap stocks, the AIM All-Share Index remained relatively stable throughout the week, entering Friday afternoon up about 0.3 percent.

However, the junior market outperformed the FTSE 100, which lost 0.3 per cent despite briefly hitting another all-time high on Wednesday.

This must be attributed to some of the largest components, including Shell, BP, GSK and Unilever, going ex-dividend.

FireAngel Security Technology Group was one of the biggest weekly risers, with shares rising more than 50 percent on Friday alone and nearly 75 percent over the five days.

The rally came after the Secretary of State approved Intelligent Safety Electronics’ (ISE) £28m takeover bid for the group.

The offer required approval under the National Security and Investment Act 2021. In December, the offer schedule was suspended due to unmet conditions, until now.

Garden financing He is also on the verge of leaving the junior market, but in less desirable circumstances.

Legal and regulatory requirements, plus associated admission costs, low liquidity levels and its inability to attract institutions given the significant discount to net asset value, were all reasons cited for potentially delisting. Shares fell 13 percent.

Zotefoams jumped 22 percent after announcing “technical milestones” achieved in its ReZorce beverage carton product.

In a keynote presentation on Wednesday, chief executive David Stirling said the progress was “indicative of the growing momentum of this project”.

He said: “Retailers and brand owners understand the need for a sustainable alternative to LPB packaging and ReZorce meets that need: it is fully recyclable through conventional collections, contains recycled material in accordance with the thresholds set out in the EU Directive. EU on packaging and packaging waste”. and has a lower carbon footprint.’

Cornish Metals gave us the scratch of the week. Despite a 17 percent rally on Friday, the stock fell by a third over the five-day period without any observable catalyst.

“The company is not aware of any reason for the selling pressure on the Cornish Metals share price this week,” interim chief executive Ken Armstrong said.

Contrary to the falling valuation, Armstrong highlighted a positive preliminary economic assessment (PEA) for its South Crofty tin project in Cornwall.

The PEA estimates an after-tax net present value of $201 million and an internal rate of return of 29.8 percent, confirming the viability of the project and the 14-year mine life.

There appeared to be a broader appreciation in small-cap mining stocks, with Vast resources plc 27 percent discount, Metals Exploration plc 23 percent discount and Touchstone Exploration Inc 18 percent discount.

Active Energy Group It also lagged behind after confirming it is in talks with “several parties” about the possible sale of its CoalSwitch technology, which allows wood waste to be burned cleanly and efficiently for energy.

In the update, AEG also said it was looking for ways to preserve cash and other potential disposals. Shares fell 44 percent Friday afternoon.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.