Table of Contents

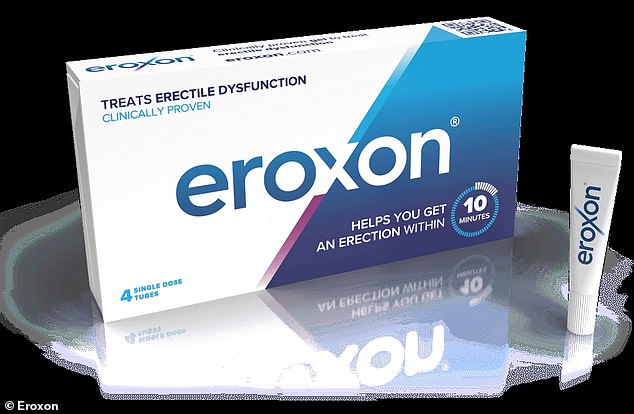

It is rare for a company to take a drug from the clinical phase to commercial success, but James Barder and his team at Future Doctor They have done exactly that with their fast-acting erectile dysfunction (ED) gel, Eroxon.

This week has been crucial for Futura, as it recorded its first profit, well above expectations.

Analysts have since upgraded their financial forecasts for the company, encouraged by this success. And the best may be yet to come, as Eroxon’s US launch looms.

Futura Medical Fast Acting Erectile Dysfunction Gel, Eroxon.

If the company’s choice of partner is any indication, Futura could be poised to make a significant inroad into the United States.

It has partnered with Haleon, a subsidiary of GSK and one of the largest consumer healthcare companies in the world.

Eroxon will also have the distinction of being the only erectile dysfunction treatment available over the counter in the US, giving it a substantial competitive advantage.

Despite these milestones, Futura’s progress was largely overlooked by the market this week, with shares falling 5% to 36.6p, valuing the business at just over £100m.

Analysts, however, expect a much larger increase and are pricing the share at between 125 pence and 130 pence.

In the broader market, the AIM All Share fell one point to 743.68 amid thin trading volume. Investor interest remained focused on the FTSE 100, which rose 75 points to 8,257.87.

Elsewhere in the small-cap space, Carriagean oil and gas group focused on Morocco, appeared to deflate investor expectations when the Anchois-3 pilot well failed to generate additional resources. The stock fell 49% to 3.37 pence, a steep drop considering the deviation was more of a plus than a critical factor for the investment story.

Down 43% to 14p, Vector capital has joined a growing list of companies leaving AIM due to lack of interest and high listing costs. The company will cease trading on Monday.

Ethernity Networks The company’s shares fell 37% to 0.31p, despite the positive-sounding announcements. The fall was likely due to last week’s discounted funding round of £540,000 to provide working capital for a US aerospace contract. Despite the settlement, the milestone payment for the contract suggests the company is in a better position than the share price implies.

Another case of success disguised as failure (based on the direction of the stock price and possibly just for technical reasons) was Great golden land (down 22% to 5.42p).

On Wednesday, it announced it would buy mining giant Newmont to take full control of the Havieron gold-copper project, as well as acquiring ownership of the nearby Telfer operation.

The $475 million cash-and-stock transaction will create an integrated operation in Western Australia’s Paterson province. The share price was slightly affected as the company turned to the market for capital investment to fund the deal.

Havieron, with a mineral resource equivalent to 8.4 million ounces of gold, is estimated to produce 258,000 ounces of the yellow metal per year, while Telfer could produce 426,000 ounces. There is also potential for expansion.

While declines dominated the headlines, some success stories emerged this week.

In the natural resources sector, Orusur Mining’s share price rose 49.1% to 3.95 pence after it announced it would acquire full ownership of the Anza gold project in Colombia.

The agreement, subject to regulatory approval, includes a 1.5% net smelter return (NSR) royalty and a fixed royalty of $75 per ounce for the first 20,000 gold equivalent ounces produced.

Quantum Blockchain Technologies rose 26% to 0.63p following the appointment of Jose Rios as a strategic advisor. Rios, a former Intel executive with 25 years of experience in the tech industry, played a crucial role in Intel’s Blockscale ASIC project for Bitcoin mining, bringing valuable experience to Quantum’s blockchain development efforts.

Meanwhile, Blackbird PLC rose 29% to 6.39p after reporting a significant rise in users of its video editing platform, elevate.io, and a narrowing of first-half losses. User numbers rose from 800 to 1,800 in September following a Google Ads campaign. Chief executive Ian McDonough highlighted this as a crucial step towards monetising the platform, with new features in the pipeline and a payments gateway planned for early next year.

For all the latest small-cap news, visit www.proactiveinvestors.com

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.