Table of Contents

St James’s Place’s Polaris range of funds has seen total client assets increase by £9bn in just two months, and has overtaken industry giant Vanguard’s LifeStrategy range in size.

The range, made up of the Polaris 1, 2, 3 and 4 multi-asset funds, now has assets of £45.6bn, compared with £42.8bn for Vanguard’s popular LifeStrategy range.

This is despite Polaris’ current entry and investment fees being much higher than Vanguard’s LifeStrategy funds, and it is not scheduled to launch until November 2022.

Biggest fund: St James’s Place’s Polaris fund range has overtaken Vanguard’s LifeStrategy with assets under management of £45.6bn

Investors can expect to pay an annual fee of 1.52 percent for Polaris 1, 1.62 percent for Polaris 2, 1.67 percent for Polaris 3 and 1.72 percent for Polaris 4.

In comparison, LifeStrategy has a 0.22 percent fee, as well as a 0.15 percent account fee.

SJP’s Polaris funds are actively managed, while Vanguard offers passive funds.

SJP also currently has a combined fee structure, meaning that advisory, product and administration fees are rolled into one.

This means that clients also receive advice for the money they pay. The firm is currently in the process of separating these charges, which it says will reduce what clients pay in many cases.

A St James’s Place spokesman said: ‘Comparing the rates of the Polaris range with those of Vanguard’s LifeStrategy range is not an equivalent comparison.

‘Vanguard invests 90 percent in index funds, while Polaris is mostly actively managed with an active overlay, and this is reflected in the associated fees.

‘Under our current charging structure, clients pay a single ongoing fee, which represents the cost of external fund managers (ranging from 0.43 per cent to 0.47 per cent), advisory and administration costs.

‘In contrast, other managers, such as Vanguard, only take into account the fund manager’s costs, meaning that to compare like-for-like with Polaris’s charges, you also have to take into account Vanguard’s platform fees and associated advisory costs.’

SJP also charges a 5 percent entry fee for new clients, which it says is largely made up of charges for an initial meeting with an SJP advisor.

Juliet Schooling Latter, research director at Chelsea Financial Services, said: ‘Upfront charges should be a relic of the past, and a 5 per cent charge seems particularly excessive.

‘Ultimately, investors should carefully evaluate all their options, prioritising value for money in their investment decisions, as fees can reduce investment returns over time.’

However, there is no 5 percent fee for existing SJP clients. A significant portion of the asset growth is likely due to existing clients transferring their assets to Polaris funds.

Given the range’s track record, it’s understandable why existing customers might make this switch, and this would explain much of the growth in AuM.

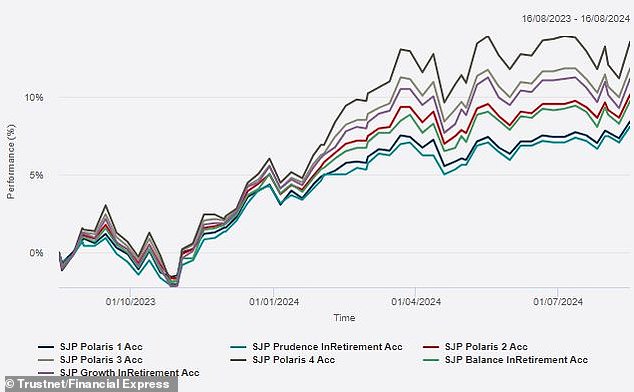

Popular Product: Polaris funds have generally outperformed SJP’s InRetirement funds

The spokesperson said: ‘The Polaris range has grown substantially in value since its launch in November 2022, as a result of new and existing customer entries.

‘Their performance, assets under management and inflows demonstrate that our clients and partners believe in SJP’s asset allocation process and investment management approach and highlight the value and demand for trusted financial advice.

‘The Polaris range has performed strongly since inception and has outperformed similar funds managed by our peers, or even better returns from representative private clients.’

How does performance compare?

The highest-risk funds in the range, Polaris 3 and Polaris 4, have returned 11.79 percent and 13.38 percent respectively over the past year, according to data from Trustnet.

This reflects an outperformance of its benchmark index, but is below its Vanguard equivalent.

LifeStrategy 80%, which like Polaris 3 targets an 80 percent allocation in stocks and the remaining 20 percent in other assets such as bonds, has returned 18.1 percent over the past year.

LifeStrategy 100%, which is typically a 100 percent equity allocation like Polaris 4, is up 20.7 percent.

A similar theme can be seen in each firm’s lower-risk funds, although it should be noted that as benchmarks and strategies differ, so will performance.

| Finance | Profitability over the previous year (%) |

|---|---|

| Life strategy 20% | 10.8 |

| Life strategy 40% | 12.9 |

| Life strategy 60% | 15.5 |

| Life strategy 80% | 18.1 |

| 100% Life Strategy | 20.7 |

| Polar 1 | 8.4 |

| Polaris 2 | 10.1 |

| Polaris 3 | 11.8 |

| Polaris 4 | 13.5 |

| Mixed investment IA 0-35% Shares | 10.5 |

| Mixed investment IA 20-60% Shares | 12.3 |

| Mixed investment IA 40-85% Shares | 14.7 |

| Source: Trustnet | |

What has allowed Polaris to enjoy the growth it has had?

The key to growth, according to AgeWage President Henry Tapper, is confidence.

He told This is Money: ‘What makes people buy Polaris is not necessarily the quality of the product, but rather the quality of sales.

Despite the fees, SJP is still able to attract new clients and retain old ones who are willing to invest their money in a company they trust.

“SJP invests heavily in building trust in its products. This trust is so valuable that they can sell the same products at a higher price,” Tapper said.

“They have customers who trust them or who have received recommendations for SJP products from someone who has had a good experience with them.”

The SJP spokesperson said: ‘People choose Polaris and our broader services because they want advice and ongoing service to help them achieve their financial goals.

‘While the services offered by Vanguard suit many people (and there are rightly options available on the market for amateur investors), they don’t compare to financial advice, which also offers many broader benefits, from financial resilience and inheritance planning to uncovering missing pension pots and unused tax reliefs.

‘In fact, a study by the International Longevity Centre found that those who take advice, regardless of their starting wealth, are worth an average of £47,000 more in retirement and also benefit from non-financial benefits such as greater control, peace of mind and security.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.