Table of Contents

Just a couple of weeks ago a tax-cutting spring budget was delayed as the Chancellor prepared for the general election.

But now rumors suggest that Jeremy Hunt lacks “fiscal space” and that instead of a tax bonfire we will get a wet firecracker.

Rumors about kite flying included cuts to income tax, national insurance and even the abolition of inheritance tax or stamp duty.

However, judging by the noise just a week before next Wednesday’s budget, it seems unlikely that we will have a spectacular explosion.

And maybe that’s not even what we need.

Instead, I would say Hunt would be better off coming up with a radical but coherent plan to fix the illogical mess our tax system has gotten itself into.

What is in the box? Jeremy Hunt could deliver a tax-cutting budget or a bust

A set of clearly laid out changes that remove tax traps and quirks, make the system fairer and rebuild some of the trust in it that has waned in recent years.

This would not be a sugar rush between Truss and Kwarteng, but rather the kind of common-sense changes that would be difficult to criticize (or that a new party in charge could reverse).

Here is my list of results:

The 60% tax trap

The personal income tax-free allowance is removed at a rate of £1 for every £2 earned over £100,000.

This introduces a 60 per cent marginal income tax rate into the system, between £100,000 and £125,140, when it’s all gone.

That means our tax rates are really 20 percent, 40 percent, 60 percent, 45 percent, which is clearly stupid.

People who earn £105,000 are paid a lot of money, but they shouldn’t pay a higher tax rate on the next pound they earn than someone who earns £150,000.

If the £100,000 threshold had increased with inflation since it was announced in 2009, it would now be £153,000.

Mr Hunt should completely end this terrible part of the tax system and stop the removal of the personal allowance.

> Our real top income tax rate is 60%, and it’s not the highest earners who pay it.

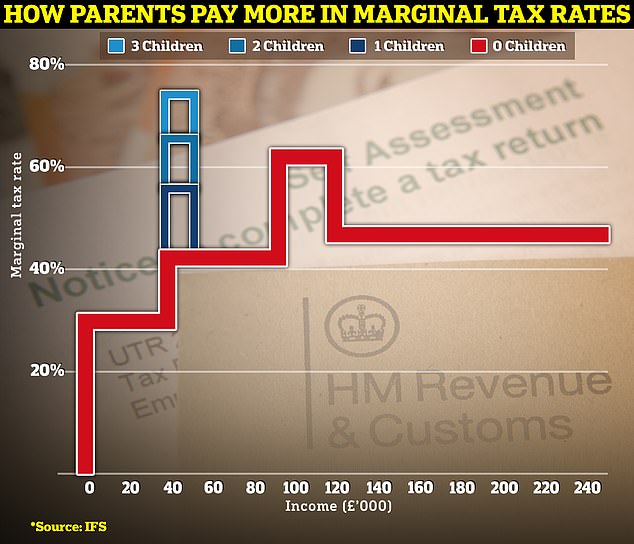

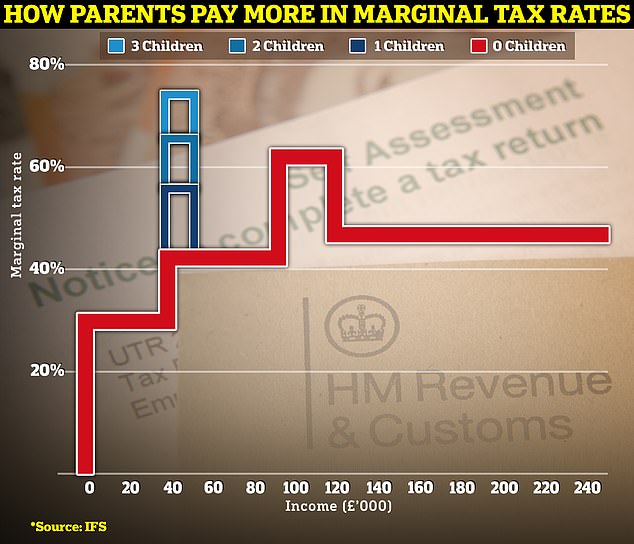

Tax traps: The graph above shows marginal tax rates for income tax and national insurance on the red line, rising to 62% between £100,000 and £125,000 due to the removal of the personal allowance. The blue lines show the effect of removing child benefit between £50,000 and £60,000.

Child benefit

High-income child benefit charging was poorly designed when George Osborne invented it, and it has only gotten worse since.

It removes child benefit if one parent’s income exceeds £50,000, but both could earn £49,999 each and still receive payments.

The removal of child benefit creates marginal income tax rates of between £50,000 and £60,000 of 52 per cent for a parent with one child, 61 per cent with two children and 69 per cent with three children.

The threshold has not increased in the 11 years since the taper was introduced; if it had increased with inflation, it would be £67,000.

Ideally, Hunt would do away with politics altogether and return to the old principle of universal benefit.

If you are not willing to do this, you should increase the kick-out threshold so that it starts at least up to £75,000 and is spread over a wider band up to £100,000.

> Child Benefit Elimination Tax Trap Explained

Stamp duty

We definitely don’t need a stamp duty holiday. These time-limited cuts are foolish and cause more problems.

However, stamp duty should be reduced or, ideally, abolished.

Getting rid of it completely seems crazy until you remember that until Gordon Brown started tinkering with it, stamp duty was a flat 1 per cent above £60,000.

If we survived until 1997 at that rate, we could probably get by now or eliminate it entirely.

Stamp duty is another bad tax as it inhibits movement and economic activity.

If the Chancellor does not remove it, a flat 1 per cent above £250,000 should.

> Stamp duty calculator: How much would you pay to move house?

Student loans

Student loans are a mess and require more space than I have here to properly discuss them.

What we definitely shouldn’t do is charge interest based on the RPI, which hasn’t been an official inflation figure for years.

We should also go back to the principle that there is no real interest rate and link all existing loans to official CPI inflation.

With pensioners looking likely to once again receive the triple lock on the state pension, I would make a similar promise to students.

Why should students suffer because the government and the Bank of England cannot control inflation?

Double-locking student loans would ensure the interest rate was the lower of CPI inflation or 2.5 percent.

> My student loan has increased 25% in six years… although I am paying it off

Tax thresholds

The freezing of tax thresholds is costing us all dearly and must stop. We have attracted more people to tax, large numbers to higher tax rates and have dramatically increased the number of 45p taxpayers.

Without tax thresholds that rise in line with the cost of living, people become poorer even if the rise in their salaries or pensions matches inflation.

The Chancellor should commit to tax thresholds rising at least in line with inflation and create a rule to build this into the system. This should start from April.

Ideally, we would also see a renewed commitment to taking those on the lowest incomes out of tax – an ambition to raise the basic rate threshold to £20,000, for example.

> The stealthy freezing of tax thresholds is affecting our savings, investments and income

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.