‘I’ve never been a spendthrift’: but Sir Vince Cable enjoys the finer things in life

Sir Vince Cable was leader of the Liberal Democrats from 2017 to 2019 and Secretary of State for Business in the Conservative-Liberal Democrat coalition government from 2010 to 2015, York Member writes.

Born and raised in York, the 80-year-old was an economic adviser to the Kenyan government and the Commonwealth Secretariat, and later chief economist at Shell, before entering politics.

The father-of-three lives with his second wife, Rachel, in Twickenham, south-west London, where he represented as an MP. His first wife, Olympia, died of breast cancer in 2001, aged 57.

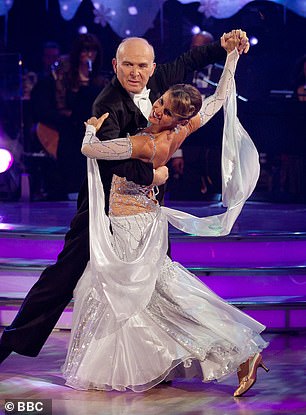

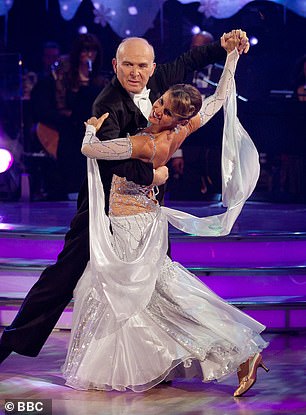

Sir Vince, who appeared on Strictly Come Dancing in 2010, is a visiting professor at the London School of Economics.

What did your parents teach you about money?

I was one of two children and grew up in York. My parents left school at 15 and started out as factory workers, which is probably why they were quite thrifty and worried about money. However, my father became a teacher at a technical school, so we gradually moved from a semi-detached house with an outside bathroom to a detached house.

That said, there wasn’t much expense or anything that could be considered extravagant. He worked as a milkman at weekends while he was at school to earn a few pounds and we were usually the last ones on our street to get an appliance, like a refrigerator.

Like my parents, I have never been wasteful but at the same time I believe that life is for living. I like to stay in good hotels and I went skiing until the pandemic and, while the spirit is still willing…

Have you ever struggled to make ends meet?

My first wife, Olympia, and I struggled financially after getting married in our 20s and initially living in a fairly small flat in Glasgow. But I didn’t let that get in the way of, for example, buying him a £700 Steinway grand piano on credit, even though we couldn’t really afford it. Everything you should tell your kids not to do, I did.

Have you ever been paid silly money?

I have given many paid lectures, but not for astronomical sums. If you are a former prime minister, you can be paid hundreds of thousands to give a speech. But if you’re a former cabinet minister and Liberal Democrat leader like me, you’re more likely to get paid a few thousand.

What was the best year of your financial life?

I enjoyed a bit of fame and fortune at the time of the 2008-9 financial crisis and published a book, The Storm, in 2009 about the global economic crisis of the time, which became a bestseller.

It generated many invitations to appear at book festivals and I also wrote a column for The Mail on Sunday, for a bit of extra money. So the years 2009-2010 were probably the best. I was also comparatively well paid during the five years I was a minister during the 2010-2015 coalition government.

Most expensive thing you’ve done for fun?

Last year I went on holiday to Cambodia and Laos for a couple of weeks with my wife Rachel to celebrate my 80th birthday. It cost around £18,000, partly because we flew business class due to the 12 hour flight, but my children contributed to the cost.

However, it was worth every penny and we were able to see the former royal capital of Laos, Luang Prabang, among other cultural sites.

What has been your biggest money mistake?

Good move: the former MP during his time on Strictly in 2010

Buying and selling properties at the wrong time. My wife and I bought our first property, a red sandstone apartment in Glasgow, at the start of one of these property booms for £7,000-£8,000 (a lot of money at the time), and sold it in the next recession. Later I became wary of buying and selling property.

Best money decision you’ve ever made?

Taking weekly dance classes and having my own personal trainer put me through a series of grueling exercises. Altogether that costs about £200 a week, but it keeps me fit. Dancing is also very good for you mentally.

Do you have a pension?

Yes, pensions for my generation of MPs were quite good, so it is possible to live comfortably after retirement. I have combined my Shell pension with the pension scheme of my MP and cabinet minister.

Do you have any property?

I own a 1930s four-bedroom semi-detached house in Twickenham which I bought for £12,500 in 1974.

We’ve made some improvements and I’m not sure what it’s worth now, but any family home in this part of London, close to the train station and parks, will be quite valuable. My wife has a cottage in the New Forest.

If you were Chancellor, what would you do?

I would be honest about the fact that there is no way to sustain quality public services without a substantial increase in taxes, but no one is willing to say that.

The idea that we are an overtaxed nation is nonsense: it is about 38 percent of GDP, while in Denmark it is more than 50 percent. Secondly, taxes should be changed so that they affect more the older generation, who have benefited from the appreciation of property prices, and do more for young people and, in particular, those with families.

What is your number one financial priority?

Saving money at my age doesn’t seem very sensible, so I’d like to travel a little more while I can. At the same time, you can’t talk about it because you have to think about the future. So it is a case of moderation in all things.

Fortunately, I have no aspirations to own a big, fancy car: I drive a ten-year-old Toyota Yaris.

- How to Be Political (Penguin) by Vince Cable and Partnership & Politics In A Divided Decade (The Real Press) by Vince Cable and Rachel Smith are available now.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.