Table of Contents

Who would be most affected by an attack on pension tax breaks? Older people, the rich, the highest earners?

If Rachel Reeves and Keir Starmer were to go ahead and scrap the higher-rate pensions tax cut in the Autumn Budget, they would surely want us to think that it is those with the “broadest shoulders” who pay the price.

But I would say that is not the case.

Older workers and retirees have already benefited from years of full pension tax relief, the wealthy are less reliant on their pension pots and top earners can use their windfall wages to build larger retirement pots.

Instead, the biggest impact of switching from full pension tax relief to a flat rate would be on younger workers, who are not wealthy and have more modest salaries but are dragged down by a higher tax rate.

The fun police: Keir Starmer and Rachel Reeves have borrowed from Jeremy Hunt’s grim script to pour cold water on post-election optimism in the face of the threat of looming tax rises

Savers aged 45-49 and under are most at risk of losing out if pension savings from tax-free income are replaced by a flat rate.

They would lose the valuable tax-free retirement savings that can add up considerably over the years, along with the incentive to save for retirement that this brings.

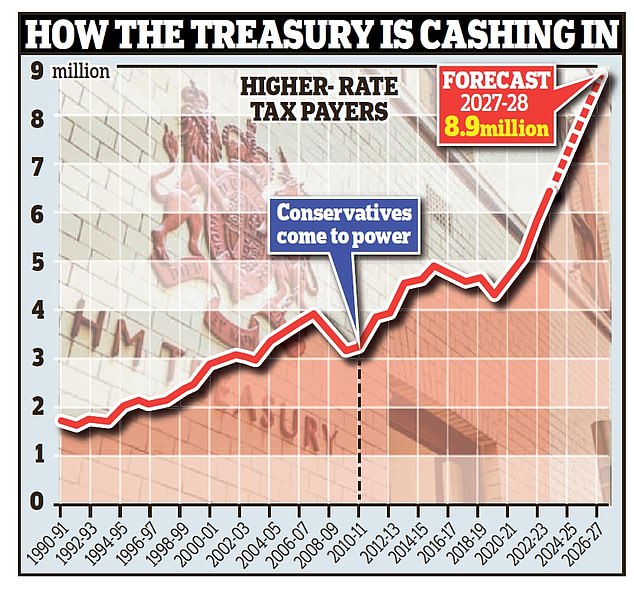

And that would come at a time when what it means to be a high earner has been radically redefined, as frozen thresholds drag the 40p tax to record numbers and will continue to do so.

> How Pensions Work: Your Guide to Saving for Retirement

The suggestion to scrap the full tax break on pension contributions to offer a flat rate, of perhaps 30 per cent, has been put forward against the backdrop of Starmer and Reeves’s hilarious policing.

The Prime Minister and Chancellor have been pouring gloomy water on post-election optimism and signalling that tax rises are on the horizon in the October Budget.

Over my 20 years as a financial journalist, I have heard many arguments in favour of removing the pension tax credit at personal income tax rates and replacing it with a flat rate.

And if I had £10 in my pension for every time a budget rumour has it that it will happen, I’d be looking at a much richer retirement.

Others are strongly in favour, but I have always been against it, because it would be another case of intergenerational injustice.

Workers would lose yet another benefit enjoyed by their parents’ generation, while also receiving much worse treatment in pensions, with employer-backed defined benefit plans replaced by employer-based defined contribution plans.

But more importantly, changing the pension tax cut would also do something that is always dangerous: it would eliminate a long-standing principle.

You save into a tax-free pension fund and then pay tax when you earn income from it later.

Pension tax relief is often described as a benefit, but I would argue that it is actually a principle.

The tax relief applied to pension funds is based on personal income tax rates, which are 20%, 40% or 45%.

Pension contributions are usually automatically topped up by 25 per cent to return savers to their pre-basic rate tax position: subtracting the £80 contributed after tax from the £100 earned before 20 per cent tax.

Higher earners can then claim 40 or 45 percent tax on their contributions above those income thresholds.

This appears to tilt the system in favor of those with higher wages, as they get greater tax benefits, but this is simply because they pay a higher tax rate in the first place.

There are already things like the annual allowance in place to limit how far people can take advantage of this.

Fiscal burden: In 2010, 3.3 million people were subject to higher income tax rates, and that number has now soared to 7.4 million people, according to the IFS

A flat rate of 30 per cent may seem fairer, as it would put more money into the pensions of basic-rate taxpayers at the expense of higher-rate taxpayers, but once you start manipulating the rate, Pandora’s box opens.

Who’s to say that this or a future government wouldn’t cut the rate a little when it needs to save money? Once that starts, how long will it be until it’s cut to less than the current base rate increase and everyone loses out?

Meanwhile, many basic-rate taxpayers may hope to one day earn enough to become higher-rate taxpayers.

Someone earning £30,000-£40,000 in their 30s might be hoping to top out at £50,270 before they retire, and the way things are going, it could be frozen tax thresholds that make that possible.

I am also very concerned about how a government could introduce a measure for a 30 percent tax relief and try to manipulate the numbers.

Would it be a 30% increase or would it turn £70 into £100? You can understand how a canny Chancellor of the Exchequer would try to save money by selling us the former rather than the latter.

Would you offer a 30 per cent increase on what savers contribute, or reduce it from £70 after tax to £100 before tax?

Proponents of a flat rate pension tax relief generally promote the latter, but it is understandable how a canny Chancellor of the Exchequer would try to save money by selling us the former.

There is quite a big difference between the two: from £70 to £100 there is a 43 per cent increase.

This time around, the Budget threat to pension tax relief looks set to be bigger than before and our columnist Steve Webb has warned that Reeves will be considering a raid.

But there are very good reasons not to be tempted to attack it: attacking pension tax relief would be highly controversial, complicated and would cause problems for public sector defined benefit pension systems and workplace salary sacrifice schemes.

My advice to Rachel Reeves and any Chancellor of the Exchequer would be: “leave pensions alone”.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.