Table of Contents

- Energy costs are falling, but permanent charges continue to rise

- The average household will pay £219 a year on these daily rates from April.

<!–

<!–

<!– <!–

<!–

<!–

<!–

Millions of households will see their daily electricity rates rise to a record £219 a year from April, even though overall energy bills will fall.

The problem of skyrocketing fixed rates is a sore point for many households, as these rates cannot be avoided by reducing gas and electricity consumption.

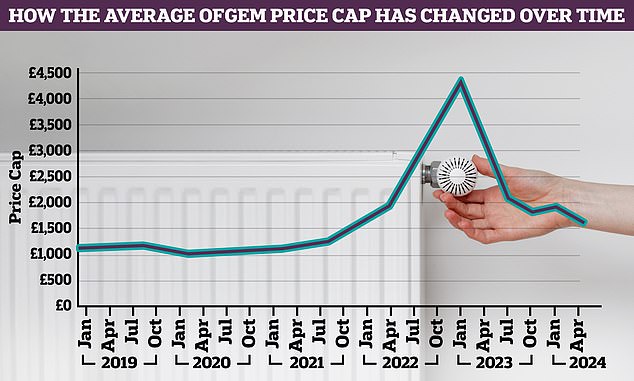

Yesterday, energy regulator Ofgem confirmed that the average household energy bill will soon fall by £238 to £1,690 due to a cut in the price cap of £1,928 a year from 1 April.

Falling: Energy price cap may be falling, but standing charges keep rising

The current price cap sets the energy bills paid by more than 80 per cent of UK households, although the exact amount varies depending on gas and electricity usage.

Energy bills are made up of two parts: unit rates, which pay for the gas and electricity consumed, and fixed charges, which are paid regardless of how much energy is used.

The overall decline in the average price-capped energy bill masks the fact that while unit rates are falling, standing charges continue to rise sharply.

The average electricity unit rate is falling by 14.39 per cent, from an average of 28.62 pence per kilowatt hour (kWh) now to 24.5 pence per kWh from 1 April.

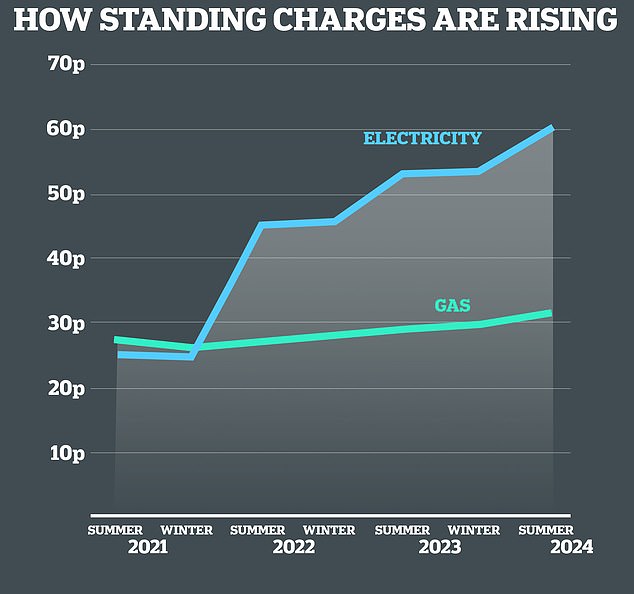

But the fixed electricity rate is rising by 12.6 per cent at the same time, from 53.35p a day now to 60.1p in April.

For gas, the typical unit rate of 7.42 pence per kWh is falling 18.5 per cent to 6.04 pence since April. The average gas cost of 29.6p a day is rising 6 per cent to 31.43p since April.

In summer 2021, the usual charge for electricity was 25p per day and 27p per day, meaning these charges will have increased by 219 per cent and 16.4 per cent respectively in April.

Decrease: the cost of fixed energy rates has skyrocketed in the last three years

Why have fixed electricity rates increased?

Because energy companies are passing costs through daily fixed charges and not through unit rates.

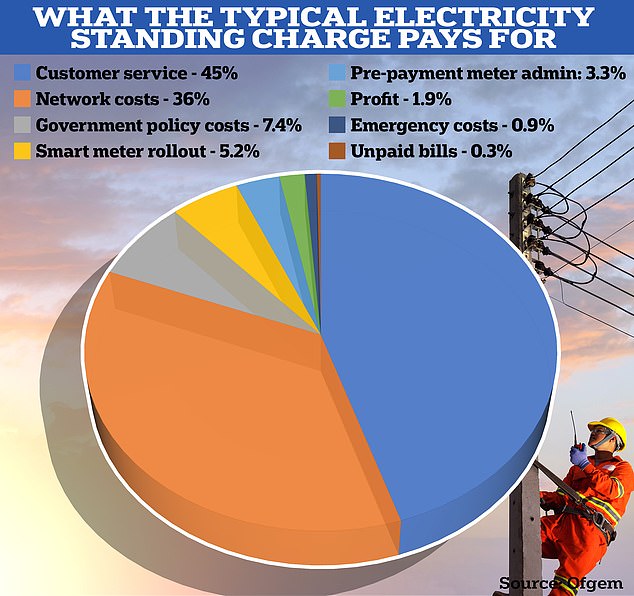

Part of this is due to Ofgem rules, such as its requirement that energy companies recover certain costs through ongoing charges, such as the cost of network costs such as maintaining power cables.

Another big reason electricity standing charges rise so quickly is that the cost of failing energy companies is largely paid for by standing charges.

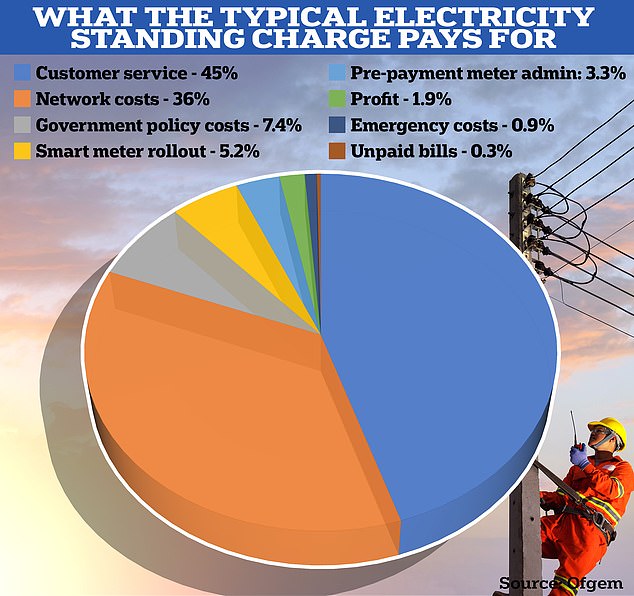

There are also other less financially significant factors, such as the costs of government policies and smart meter implementation. The full breakdown is below:

Where it’s going: According to Ofgem, the majority of standing charges go towards “customer service” and “network costs”.

Why have gas rates increased so much less?

Simply because gas-using households pay for things like failed suppliers and network costs through unit rates and not ongoing charges.

What is the future of permanent positions?

The most reliable predictions for the future of permanent charges come from Cornwall Insight analysts, who accurately predict changes in the maximum price.

Cornwall Insight believes the electricity fixed rate will fall slightly to 58p in July and then rise again to 60p in October.

For gas, Cornwall Insight believes standing charges will fall to 30p in July and then rise slightly to 31p in October.

Ofgem said that while rising network costs have contributed to the rise in permanent charges, it is currently reviewing more than 40,000 responses to its call for views on charges it called for in November 2023.

Why do permanent positions vary?

Permanent charges vary depending on several factors, including where you live and the type of meter you have.

Previous analysis by This is Money found that houses in Liverpool have the highest overhead charges, with a combined total of £362 a year.

Meanwhile, London households pay the lowest, averaging £276 for gas and electricity.

Households with a smart meter pay less than those with prepaid or standard energy meters.

It is even possible to get an energy tariff without any ongoing charges, although this is rare.

These also tend to be as expensive as standard offerings, as unit rates will be higher.