Table of Contents

Decision time is approaching for Keystone Positive Change investors: will they accept Baillie Gifford’s restructuring or will they take the hit and withdraw their money at a discount now?

Keystone Positive Change Investment Trust will merge with the Baillie Gifford Positive Change fund, should investors support the resolutions at the general meetings on January 27 and February 7 next year.

The portfolios are very similar, with almost identical exposure, but the Positive Change fund is an unlisted open-end fund, and investors will be stuck with a small stake in the trust’s portfolio of unlisted companies.

To further complicate matters, Keystone is one of seven investment trusts that activist Saba Capital is targeting for a restructuring.

The trust’s board defended itself yesterday, with Keystone chair Karen Brade saying she was “horrified” by Saba’s “actions and conduct”.

He added: ‘We believe that the proposed resolutions would be very detrimental to the interests of all other shareholders.

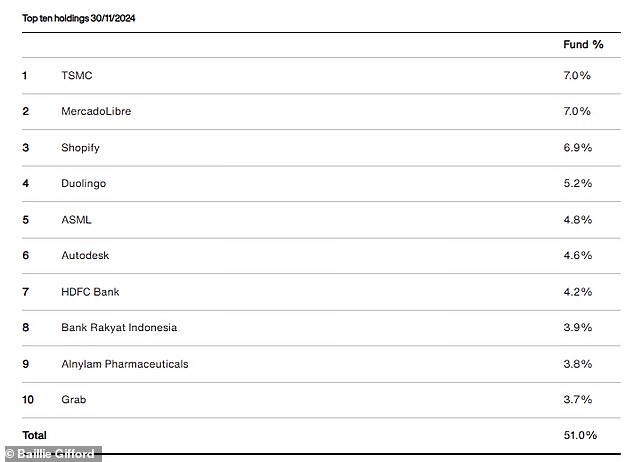

The Keystone Positive Change investment fund invests in companies it believes are helping to improve the world, including language app Duolingo.

What’s happening with Keystone Positive Change?

Keystone, which invests in a portfolio of companies that have a positive social or environmental impact, has struggled to grow its assets after a rough patch for ESG investing.

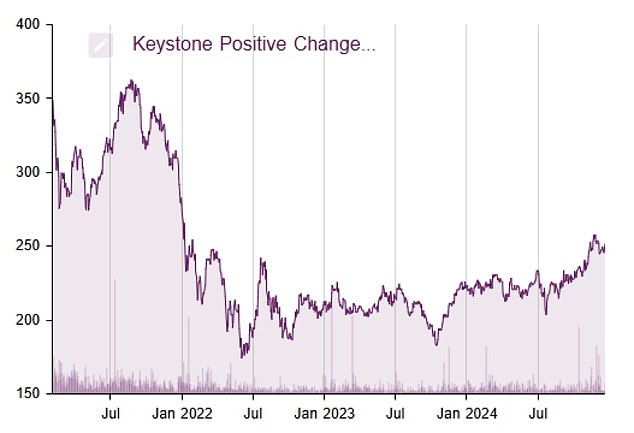

Its shares have been illiquid and traded at a discount to net asset value for the vast majority of recent years.

The discount has narrowed significantly from around 16 percent at the beginning of last year to 5.6 percent today, according to AIC data.

If the resolutions are approved, shareholders who do not want to invest in the Positive Change open-ended fund can sell their holdings at a 1 percent discount to the net asset value. That means, in theory, they would be above where they are now.

Investors will not be able to trade shares after January 27 or trade on the OEIC until February 10. For those who prefer to exit, cash will not be paid until February 17, but there is no exit fee at the OEIC.

But the issue is complicated by Keystone’s unlisted assets.

The trust recently told investors that it has four remaining unlisted investments, representing 2.6 percent of net assets, that cannot be added to the open-ended fund after the merger.

This means that investors will be left with a vehicle that owns these companies, while the rest of their money will go into the fund or be redeemed, and they will have to wait for them to be sold.

Keystone’s remaining holdings include now-bankrupt battery maker Northvolt, which the trust’s board was recently forced to write down, as well as biotech firm Spiber, quantum computing specialist PsiQuantum and carbon removal group Climeworks.

The trust said on December 6: ‘All net proceeds arising from the disposal of illiquid investments during the liquidation period would be returned to ordinary shareholders in due course.

‘However, there can be no guarantee as to the value, if any, and/or timing of the distribution(s) that may result from the realization of the Company’s remaining illiquid investments.

“Both factors will depend, among other things, on prevailing market conditions.”

Baillie Gifford will waive all management fees until February 7 as she attempts to recover value from private assets.

Should investors sell or pick the fund?

James Carthew, head of investment companies at QuotedData, said: “We are not sure why the 1 per cent exit fee is being imposed on shareholders who would prefer to take cash rather than enter the open-end fund and would have preferred the board “I wouldn’t do it.” follow this route.

“I don’t think that’s a fair way to approach this; I really think the cash outflow should be at net asset value.”

Instead, Carthew suggests that investors who want to cash out should consider switching to the open-end fund and “then immediately redeem their units.” This means they will take a little more than cash.

Whether they ultimately make more than if they sell out now at a deeper discount depends on market movements in the coming weeks.

If Keystone shares gain ground, investors will miss out by selling now and face a bigger discount, but if they make a mistake, they may get more now.

Carthew explains how it works for those switching to the fund: ‘You should get the NAV minus the estimated cost of liquidating the portfolio to return your cash, which we think is around NAV -0.15%.

‘I’m not a shareholder, but if I were, the pedant in me would redeem units rather than ring the till, even with the hassle of the extra paperwork involved. However, that leaves you open to market movements for a little longer.”

Keystone Positive Change performance in recent years (Source: AIC as of January 3, 2025)

How will a potentially prolonged sale of private assets affect investors?

Thomas McMahon, head of investment company research at Kepler Partners, said: “The basic way the deal works is that the private investments have to be sold, and that will take time, so whether you invest in the OE fund or accept cash, I always have to wait for that to happen to get anything from them.

‘The discount has currently amounted to 5.5 percent. The unlisted allocation is around 2.6 per cent, and the deal will have costs of around 0.5 per cent. 1 percent of the net asset value will be deducted from the common fund.

“So there really isn’t much value, we just have to decide whether we want about 95 percent of our money in cash or a little more in OE fund shares.”

Should you support a new direction or opt for something new?

Investors moving from the trust to the fund will support the same strategy.

According to the latest figures from Baillie Gifford, the Positive Change fund returned 14.4 per cent over the 12 months to the end of November. It fell 4.7 percent in three years, but rose 13.4 percent in five.

It targets the return of the MSCI AC World Index, in sterling, plus at least 2 per cent per annum over consecutive five-year periods. The benchmark index has soared 28.7 percent over the past year, while adding 11.9 and 14.5 percent in three and five years, respectively.

McMahon said: “The strategy has performed poorly in recent years, but you have to consider what you think it will do in the future and whether you think there are better options.”

‘The positive change approach is distinctive and could appeal to many people.

‘On the other hand, if you want exposure to global stocks with a growth strategy, you can buy Scottish Mortgage at a 13 per cent discount, or take a very different value approach, AVI Global, at an 8 per cent discount.

“So you could take the cash and rotate it into a ‘cheaper’ investment trust in the hope of making a profit at that discount in the future.”

BG Positive Change’s top 10 holdings range from chip companies to language app Duolingo

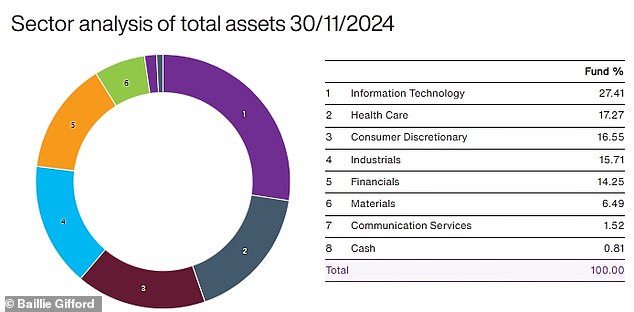

BG Positive Change invests more than a quarter of its portfolio in technology stocks

How does Saba’s intervention change the panorama?

On December 18, activist investor Saba Capital attacked Keystone and six other trusts in an attempt to reform the board and management.

Saba wants shareholders to be able to vote on dismissing the trust’s board and replacing members with “new, highly qualified candidates,” including the hedge fund’s own executives.

The revamped boards would then work to appoint Saba as the trusts’ investment manager.

Keystone has opposed this and Keystone President Karen Brade defended her plan. She said: “Don’t get your hopes up: we believe this American hedge fund manager is acting opportunistically, trying to take control of the board without a majority stake, to pursue his own agenda.”

Kepler’s McMahon said Saba’s intervention has “changed the landscape a little bit.”

He added: They want shareholders to vote for a new board of directors and then appear to also offer a cash outflow or a reinvestment in a portfolio of trusts or former trusts managed by Saba.

“At this time it is unclear how the timeline would work, given that the current proposals are scheduled for a shareholder vote on January 27.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.