Americans generally do not believe Prince Harry should be deported if he is found to have lied about drug use on his visa application, according to an exclusive Dailymail.com poll.

Upon entering the United States, visa applicants must complete a form indicating whether they have used drugs.

Sources close to Harry have indicated that he responded “with sincerity” when he moved to the United States with his wife Meghan Markle in 2020.

But a Washington, DC-based think tank is currently suing the Department of Homeland Security (DHS) for access to its records.

Donald Trump has hinted he could deport royals if they are found not to have provided correct information.

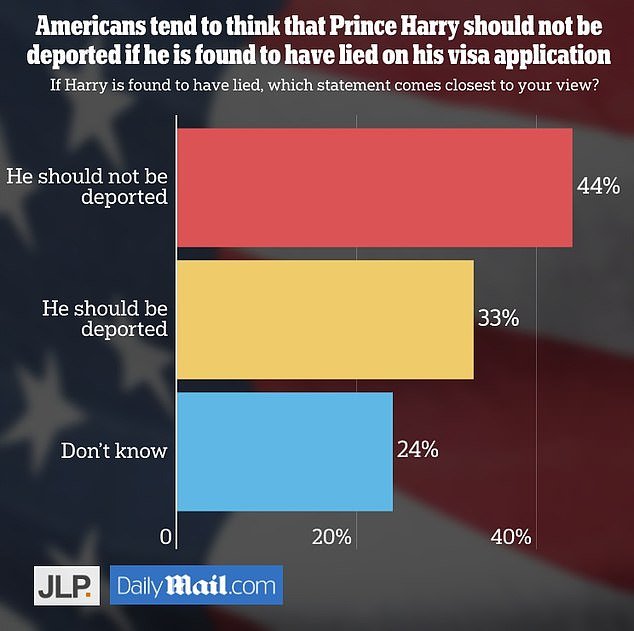

An exclusive Dailymail.com poll found that 44 percent of Americans thought Harry should be allowed to stay in the US even if it is later discovered that he did not fill out the visa form correctly.

A Dailymail.com poll asked Americans what they think about Prince Harry’s visa status

The survey showed that 33 percent said he should be deported under those circumstances, and 24 percent said they did not know.

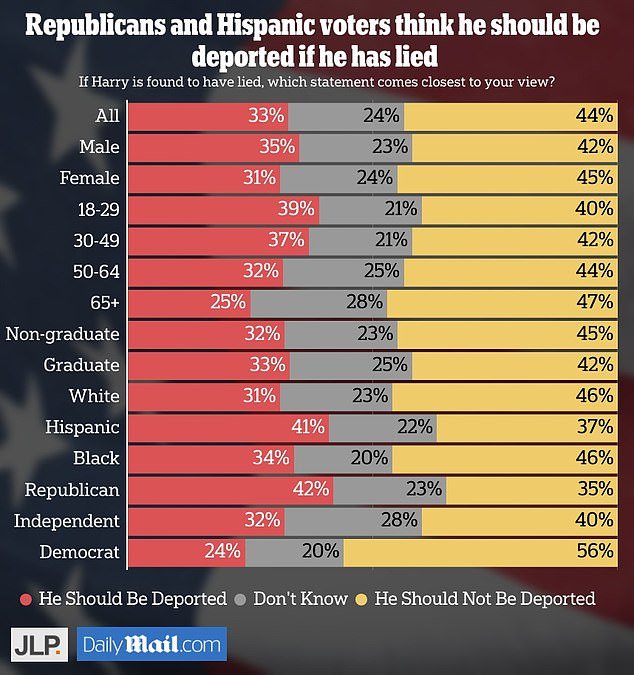

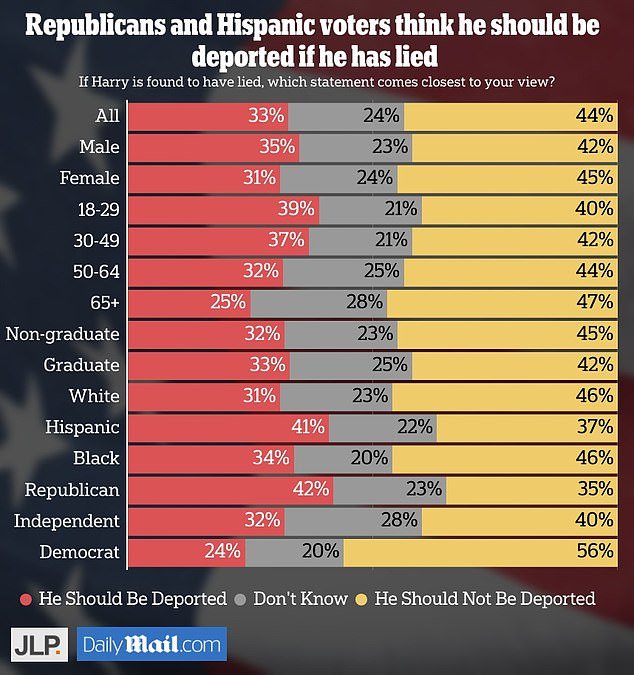

Republicans said Harry should be deported if he lied on the form, with 42 percent saying he should be deported and 35 percent not.

Both Democrats, 56 percent to 24 percent, and independents, 40 percent to 32 percent, said he should be allowed to stay.

Hispanic Americans said he should be deported if he didn’t tell the truth on the form, 41 percent to 37 percent.

White and black Americans said he should be allowed to stay no matter how he answered on the form, the survey showed.

The survey results showed that Republicans and Hispanic Americans are less favorable toward royalty.

James Johnson, co-founder of pollster JL Partners, said: “Some might be furious at Harry’s conduct, but the American public is reacting with a shrug.”

‘Generally speaking, they don’t want to see you deported, even if you lied on your immigration forms. His attitude seems to be live and let live, even if you’re a British prince from across the pond.

Anyone applying for a visa to live and work in the United States must answer “yes” or “no” to the question: “Are you or have you ever been a drug addict or addict?”

Harry lives in a nine-bedroom mansion in Montecito, California, with his wife and two children.

In his autobiography ‘Spare’, published in 2023, he revealed that he previously used drugs.

This may be grounds for rejecting a visa application.

In the book, he admitted to using cocaine, cannabis, and psychedelic mushrooms.

He has said that cannabis helped heal the trauma of his mother’s death.

And he said he used the psychedelic drug ayahuasca, which helped him realize that his late mother wanted him to be ‘happy.’

Prince Harry, Duke of Sussex, speaks on stage during the Invictus Games closing ceremony

Donald Trump spoke about Prince Harry’s visa with Nigel Farage

In a recent interview with TV presenter Nigel Farage on GB News, Trump suggested the royals would get no “special privileges” if they win a second term.

Trump said: “We’ll have to see if they know anything about the drugs, and if he lied, they’ll have to take appropriate action.”

Farage asked: ‘Appropriate action? What it could mean… not staying in the United States?

“Oh, I don’t know,” Trump responded. ‘You’ll have to tell me. You only have to tell me. You would have thought they would have known this a long time ago.

Trump had previously said he “would not protect” Harry because he had “betrayed the Queen.”

In February, Harry was asked on Good Morning America if he would apply for U.S. citizenship.

“American citizenship is a thought that has crossed my mind, but it is certainly not something that is a high priority for me right now,” he said.

The Duke and Duchess of Sussex live in Montecito, California

Recently, Joe Biden’s ambassador to the United Kingdom indicated that the royals can remain in the United States as long as Biden remains president.

Jane Hartley was asked about Trump’s comments and laughed at the suggestion that Harry could be deported, telling Sky News: “That won’t happen in the Biden administration.”

A Washington, D.C.-based think tank, the Heritage Foundation, is currently suing for the release of the royals’ immigration records.

The Biden administration is fighting the case on the grounds that visa applicants have a right to privacy.

But the foundation has responded by insisting that Harry undermined his right to privacy in the book by “selling every aspect of his private life.”

Prince Harry, Duke of Sussex and Meghan, Duchess of Sussex, on November 10, 2021 in New York City

Prince Harry, Duke of Sussex and Meghan, Duchess of Sussex attend the cycling medal ceremony on the cycling track during day six of the Invictus Games on September 15, 2023 in Dusseldorf, Germany.

US immigration authorities routinely ask about drug use on visa applications.

British celebrities such as singer Amy Winehouse and model Kate Moss have had difficulties in the past.

However, acknowledging past drug use does not necessarily result in automatic rejection.

The Heritage Foundation filed a Freedom of Information request last year in an attempt to discover whether Harry received any special treatment.

Nile Gardiner, who is leading the campaign, recently said: ‘Harry has publicly admitted extensive use of illegal drugs.

‘What does this mean? That Harry seems to have received special treatment: DHS turned a blind eye if the Prince answered truthfully, or turned a blind eye if the Prince lied on his visa application.