A campaign to ban members of Congress from stock trading is building momentum after investigations revealed that politicians traded more than $1 billion last year – and many significantly outperformed the market.

Lawmakers are accused of “gangster” tactics by critics who have called for legislation to ban members of Congress and their immediate relatives from owning or trading stocks.

The proposed law – known as the ETHICS Act – already has the support of several members, but needs more support before it can be passed.

The campaign to end the trade by America’s top politicians has gained momentum after revelations revealed several had runaway success in the stock market last year.

Nancy Pelosi, the former Speaker of the House, is one of the most prolific traders, making trades totaling about $100 million since 2019. Her return was about 65 percent last year, according to an analysis that significantly outperformed better than the wider market.

Nancy Pelosi, pictured at the 2024 Vanity Fair Oscar party, is one of the most prolific traders in Congress, posting gains of more than 60 percent last year, according to an analysis

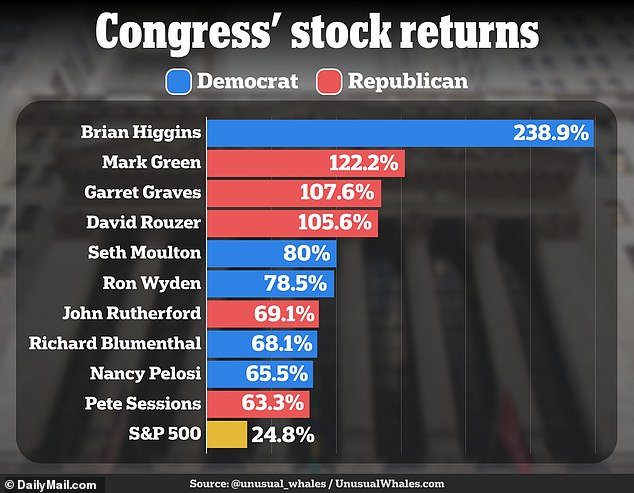

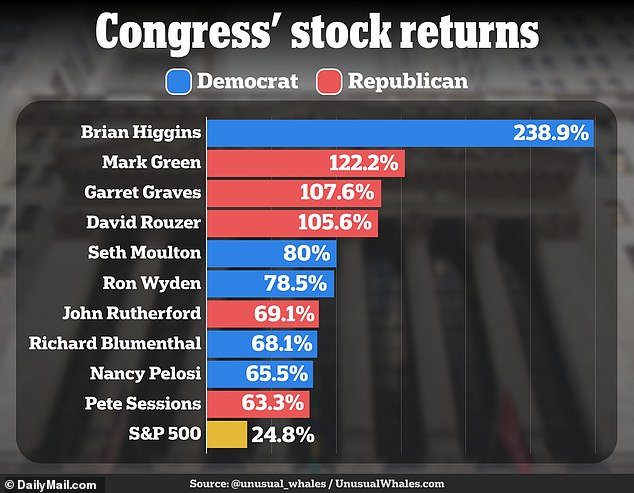

A report on trades by members of Congress reveals that several have significantly outperformed the stock market in recent years

Democratic Representative Brian Higgins of New York was named one of Congress’ top performers after he had a 238 percent return on his investments, placing him number one in terms of percentage gains. Higgins’ gains came from several trades in 2020.

Mark Green, the Republican chairman of the Homeland Security Committee, was found to have gained 122.2 percent.

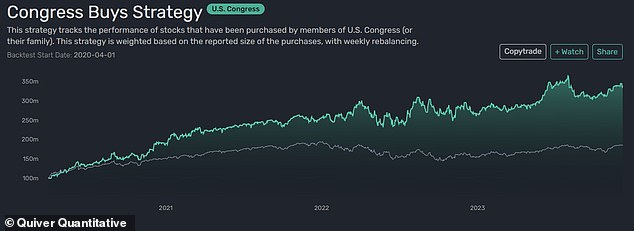

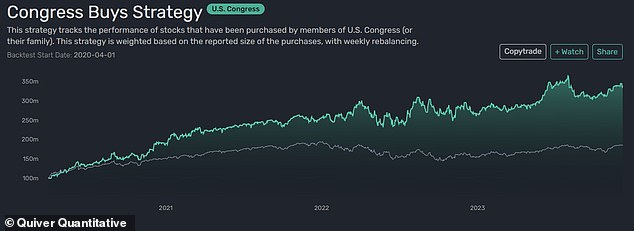

Other studies have found that stocks selected by members of Congress have returned about 273 percent since April 2020.

None of the lawmakers are accused of illegal activity.

Unusual Whales, a trade association that produced a report on the trading activity of members of Congress in 2023, has now partnered with RepresentUs, an anti-corruption organization, to launch a new campaign against the practice.

They say politicians should be banned from owning or trading stocks entirely to prevent them from working with inside information or making decisions based on their own financial interests.

RepresentUs CEO Joshua Graham Lynn said: ‘It is outrageous that members of Congress are playing the stock market while millions of Americans struggle to make ends meet. I’d call it gangster behavior, but that would mean it’s illegal, and unfortunately it’s not.

‘The overwhelming majority of Americans want this to stop. So let’s make it stop’.

Polls have shown that 70 percent of Americans support a ban on the legislature’s trade.

An overwhelming number of politicians from both parties have also signaled their support for a ban – but have yet to pass strict legislation that would end the practice.

Democratic Representative Brian Higgins of New York was named one of Congress’ top performers after he had a 238 percent return on his investments

Mark Green, the Republican chairman of the Homeland Security Committee, was found to have gained 122.2 percent, according to an analysis

Pelosi is among those who have said they would support a ban. In 2020, she backed the idea but said it ‘must be government-wide’ – which some critics saw as simply kicking the can down the road.

Currently, lawmakers are bound by the 2012 STOCK Act, an acronym for Stop Trading on Congressional Knowledge.

The law makes it illegal for politicians and their employees to use private information from their official work for personal gain. Lawmakers must also make their deals public within 45 days.

But the standard penalty for breaking the law is a fine of just $200 — a figure dwarfed by the gains of some politicians. And dozens of lawmakers from both sides have repeatedly flouted the law’s rules.

A review by Business Insider in January 2023 found that 78 members of Congress had failed to report their trades on time. They included Sen. Tommy Tuberville, Republican of Alabama, and Rep. Jamie Raskin, Democrat of Maryland.

The ETHICS Act – Ending Trading and Holdings in Congressional Stock – would ban politicians and their immediate relatives from owning and trading stocks altogether.

Oregon Senator Jeff Merkley, lead sponsor of the bill, has called congressional stock trading ‘deeply corrupt.’

‘We are elected to serve the public, not our portfolios. And no member should vote on bills that are biased by the nature of their holdings,” Merkley said.

In total, members of Congress made about 11,000 transactions in 2023 — down from a high of 17,000 in the Covid year of 2020 and 14,000 in 2022. The trades totaled nearly $1 billion in volume.

A tool that tracks investments by members of Congress and their families is up 20 percent in the 12 months through January. The green shows that the Congress tracker has far outperformed the S&P500, represented by the gray line, since April 2020

A separate tool that focuses exclusively on Nancy Pelosi’s portfolio shows her investments are up about 50 percent over the year through January. Pelosi’s investments are illustrated by the blue line, while the gray line shows the performance of the S&P500 over the same period

Democrats beat Republicans in terms of performance and volume of transactions last year.

In all, 33 percent of traders in Congress beat the S&P500, which tracks the value of America’s largest companies. About a fifth of members traded, a drop of about 33 percent from 2020 to 2022.

House Democrats filed about 7,000 transactions, House Republicans filed 3,000.

The members with the largest number of transactions did not necessarily perform the best.

Rep. Rho Khanna, D-Calif., reported 4,253 transactions, but underperformed the S&P 500, which had a 25 percent return versus his 13 percent return.

Rep. Michael McCaul, R-Texas, chairman of the Foreign Affairs Committee, had 1,826 transactions but only an 11 percent return.

Members of the House Oversight and Accountability Committee bought health care stocks in 435 separate transactions and financial services stocks in 392.

Members of the Defense Committee made 392 transactions in healthcare stocks and 277 in financial services stocks.