Table of Contents

- Shares in London-listed Shoe Zone have fallen more than 46% in the past year

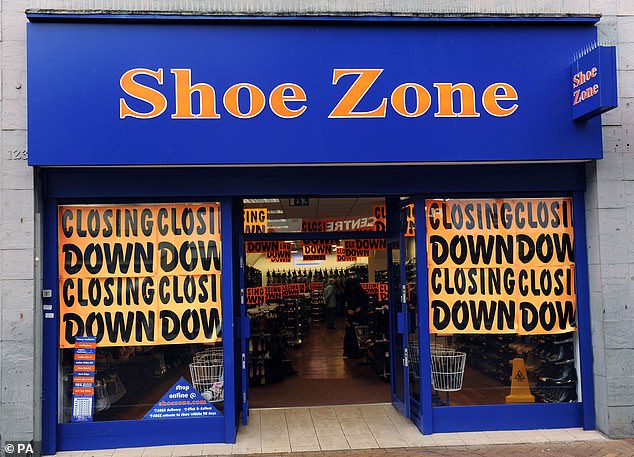

Shoe Zone shares fell sharply on Tuesday after the group issued a profit warning, citing rising shipping costs and bad weather.

The footwear retailer, which says its average retail price for a pair of shoes is £13, now expects its adjusted pre-tax profit for the year to October 2 to be “not less than” £10m.

In its interim results for May, Shoe Zone previously revised its guidance downwards from £15.2m to £13.8m.

Shoe Zone Shares fell 17.38 percent or 26.5 pence to 126 pence on Tuesday, having fallen 46 percent over the past year.

Profit warning: Shoe Zone shares fell sharply on Tuesday after the group issued a profit warning

Shoe Zone said that since its last update it had continued to experience cost pressures associated with container prices due to a reduction in the supply of shipping vessels and the continuation of a diversion away from the Suez Canal.

As a result, container prices have increased significantly over the past six months, he added.

Shoe Zone said in today’s trading update: ‘Along with an increase in shipping costs, the company has experienced weaker than expected spring-summer sales from April to June, due to unseasonal weather conditions.’

In May, Shoe Zone said store revenue fell 2.8 per cent to £59.4m in the 26 weeks to March 30, but digital revenue rose 19.6 per cent to £17.1m.

Shoe Zone said it was operating 27 fewer stores during the half year compared with 12 months earlier.

Russ Mould, investment director at AJ Bell, said: ‘Budget footwear firm Shoe Zone has left investors with cold feet after its latest profit warning.

‘Perhaps the most significant takeaway from the downbeat forecasts was the reported rise in shipping costs, with upward pressure on container prices thanks to diversion from the Red Sea and Suez Canal.’

He added: ‘The Shoe Zone warning also affected LED lighting specialist Luceco, another major importer of products from abroad.

‘It’s a reminder that inflationary pressures persist in the global economic system that may have broader implications than tripping up Shoe Zone.

‘This also means that investors will be closely watching companies with global supply chains to see if they are experiencing a similar impact.

‘Since Shoe Zone’s appeal is based almost exclusively on value, it has limited scope to pass on costs to consumers.

‘Like many retailers, Shoe Zone is also at the mercy of the weather, with unusually wet conditions for much of 2024 meaning its spring/summer offering hasn’t flown off the shelves like it normally would.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you