Canadian businessman Kevin O’Leary has singled out three states where property owners are reluctant to sell their properties.

Homeowners in Texas, Florida and Tennessee are currently enjoying low mortgage rates and would likely double their payments if they made the decision to move to another state.

Over the past two years, the US Federal Reserve has raised interest rates in an effort to curb inflation.

In the process, mortgage rates have reached their highest levels in four decades.

This means higher housing costs for buyers as home prices continue to skyrocket.

Homeowners in Texas, Florida and Tennessee have been reluctant to sell their properties because they have low mortgage rates and do not want to borrow at current rates, which are much higher. Pictured: South Beach, Miami, Florida

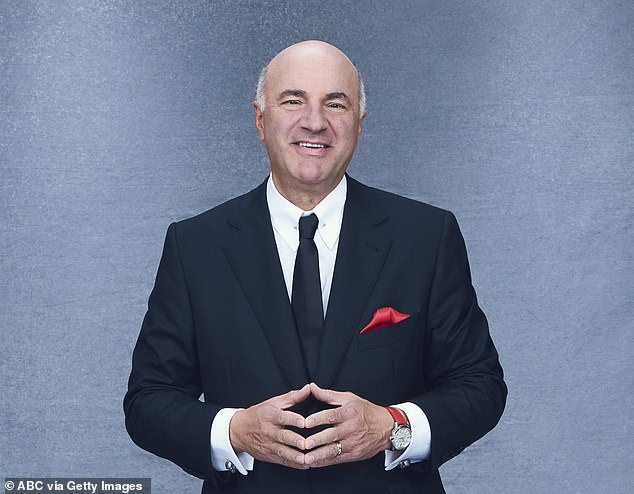

Homeowners who were locked into lower mortgage rates are being deterred from selling and are facing new loans with interest above 7 percent, said investor and Shark Tank personality Kevin O’Leary

Homeowners who were forced to pay lower mortgage rates are essentially deterred from selling and facing new loans with interest rates above 7 percent, said investor and Shark Tank personality Kevin O’Leary.

“That was unprecedented in terms of pace,” O’Leary said. Newsweek Magazine.

O’Leary noted that roughly 90 percent of homes have mortgages with rates below 6 percent.

“If these people were to sell their homes now, they would be faced with a mortgage with an interest rate of 7.5 percent, instead of 3.5 percent. They have no incentive to sell their homes,” O’Leary said.

“So we have an artificially low number of existing housing units not coming onto the market. This is particularly evident in Florida, Texas, Tennessee and other markets.”

Wealthy retirees are moving from high-tax states like California, Massachusetts, New Jersey and New York to places with lower taxes and costs of living like Miami, Florida, and Austin, Texas, increasing demand and driving up prices in these markets.

Wealthy retirees are moving from high-tax states like California, Massachusetts, New Jersey and New York to places with lower taxes and costs of living like Miami, Florida, and Austin, Texas, pictured here.

The shift to remote work, accelerated by the pandemic, has also increased demand in the South and Sun Belt regions. Pictured here, downtown Nashville, Tennessee, with the Cumberland River

The shift to remote work, accelerated by the pandemic, has also increased demand in the South and Sun Belt regions as people seek better living standards away from urban centers.

“If we were looking at a map of… where housing is particularly strong, it coincides or correlates with more attractive fiscal policy,” O’Leary said.

“If you can move a hundred miles out of town or 200 miles from where you work, you live in a better place for many reasons: better housing, better schools, a better lifestyle,” O’Leary continued.

“So smaller cities and jurisdictions that weren’t prepared for a housing boom are finding themselves facing exactly that huge demand. And that’s the nature of the digital economy.”

Miami, along with South Florida in general, has long proven popular with retirees.

O’Leary said he was surprised that high mortgage rates hadn’t dampened demand for housing, attributing that in part to historical norms where rates were in the 6 to 7 percent range.

He stressed that the rapid pace of the Fed’s rate hikes was unprecedented and unexpected, but he was also surprised that it did not affect housing demand.

“I don’t think anyone saw it coming,” he said. “It doubled or tripled the cost of mortgages and had no effect on demand.”

One way to explain that dynamic was that historically rates had been in the 6 percent to 7 percent range.

“A lot of housing booms have happened during periods when rates were higher than that,” O’Leary said. “But for the Fed to raise rates at an unprecedented speed like we saw, that was really unique.”

‘Most housing stocks are in a state of high inflation during an unprecedented period of rate hikes, so for those of us who look at this every day as we try to invest capital, that was a surprise.’